Join every day information updates from CleanTechnica on e mail. Or observe us on Google Information!

Final night time, I mentioned two extremes that could possibly be the way forward for Tesla relying on how the corporate’s present “big bet” seems. It’s been no secret that Tesla’s #1 focus is now AI and robotics, and that’s now the place it’ll both massively succeed or fail. Nevertheless, there have been additionally a number of highlights from the presentation that appeared price pulling out and discussing. Under are 10 key slides and a few quick feedback about them.

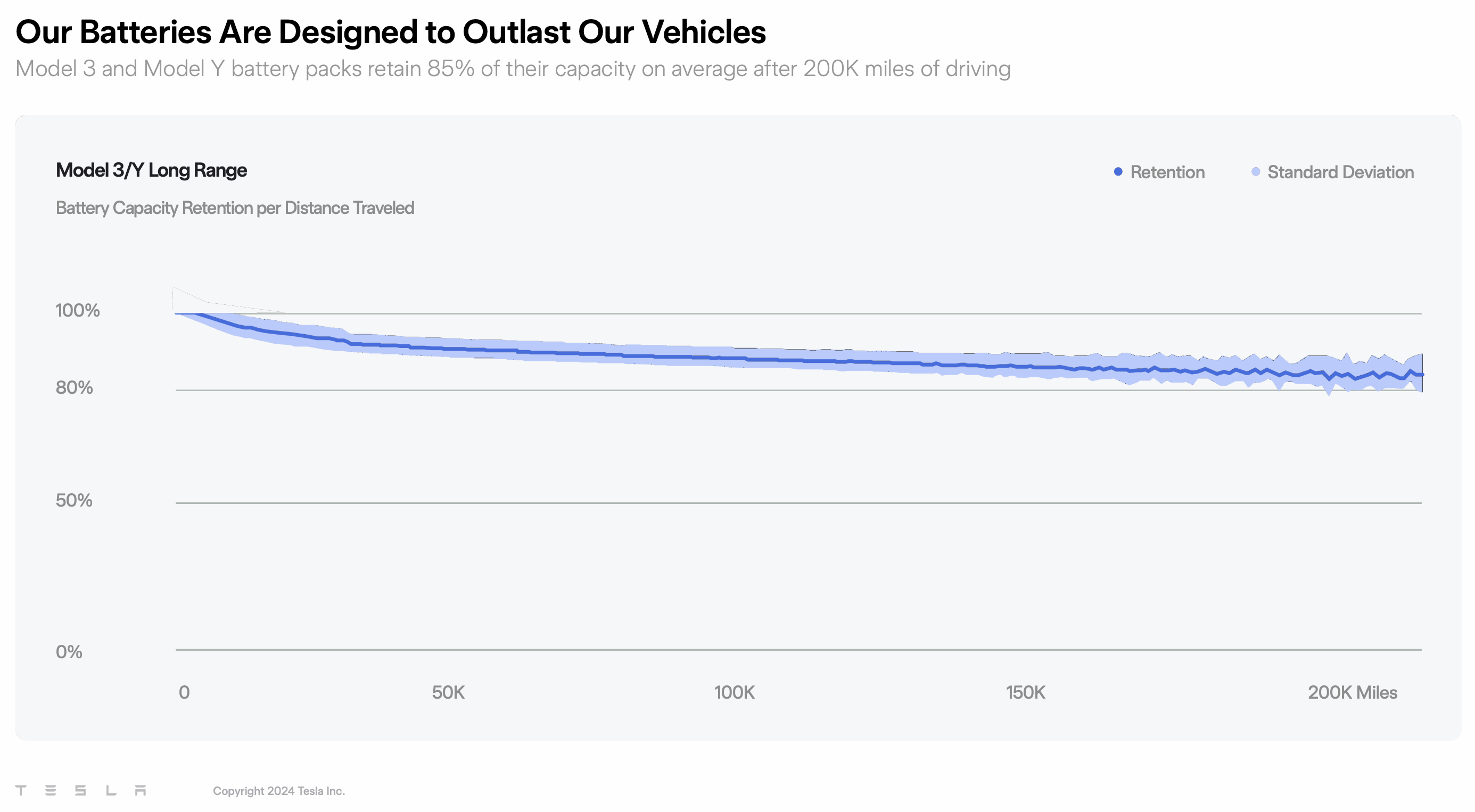

This primary one is one which in all probability deserves its personal article, since battery degradation and substitute prices are such issues for non-EV homeowners. It’s a giant a part of anti-EV hype to say that you just’re going to must spend 1000’s of {dollars} on a brand new battery after a number of years, and persons are accustomed to having to exchange 12V batteries, so it’s simple to consider. Nevertheless, as Tesla factors out, its batteries sometimes last more than its automobiles. Excellent news, and a reality price sharing.

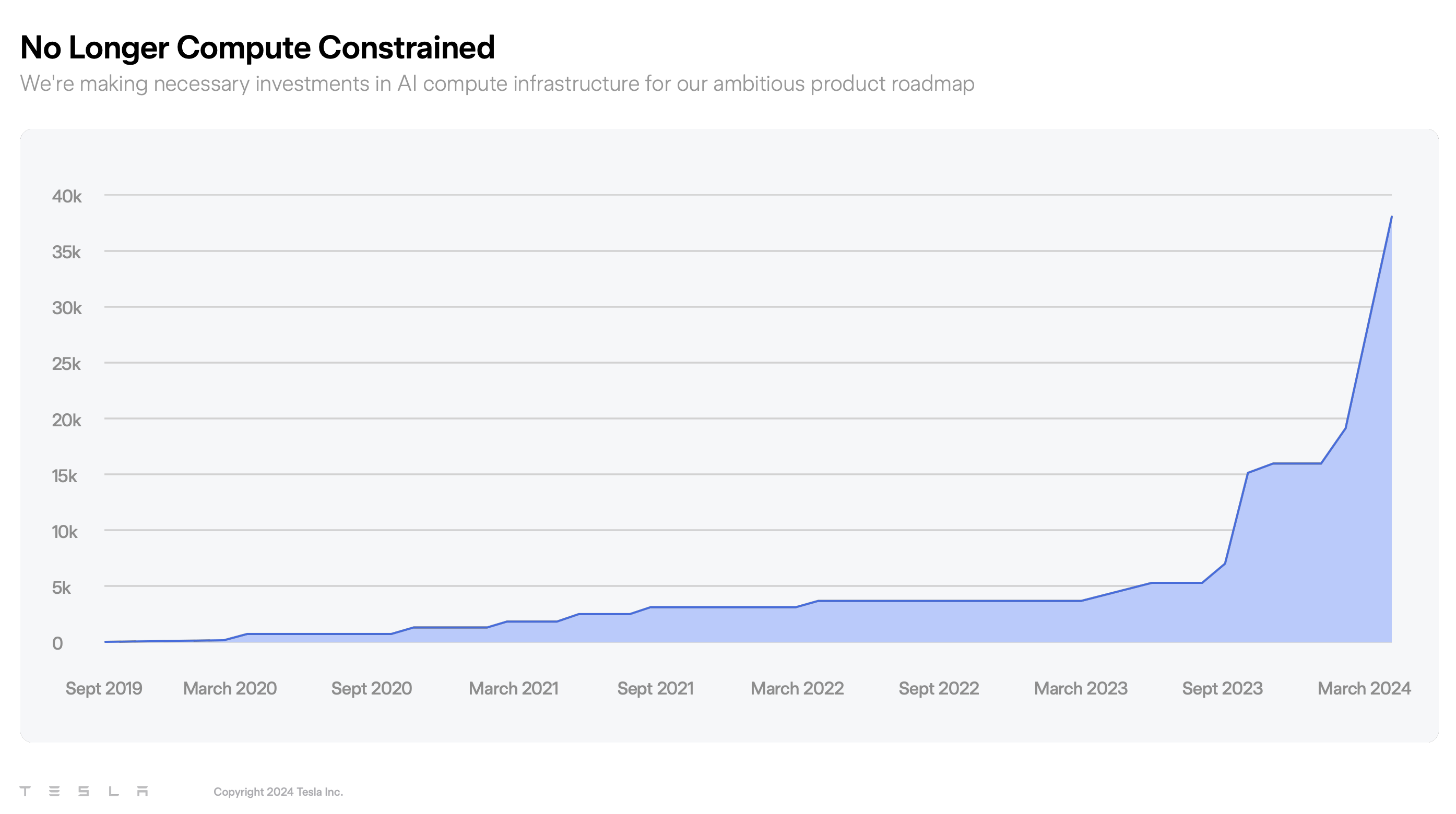

We noticed this shared with the final quarter’s shareholder report, nevertheless it’s price highlighting once more. Tesla’s AI compute infrastructure has skyrocketed. Far more compute energy helps Tesla FSD to drive significantly better. However does the chart proceed spiking upward from there? For a way lengthy? At what price? I’d like to have a extra detailed clarification and dialogue on this. Perhaps on the subsequent Autonomy Day? Are these nonetheless occurring? Effectively, we’ll have the large presentation on August 8 — maybe we’ll be taught rather more about this stuff there.

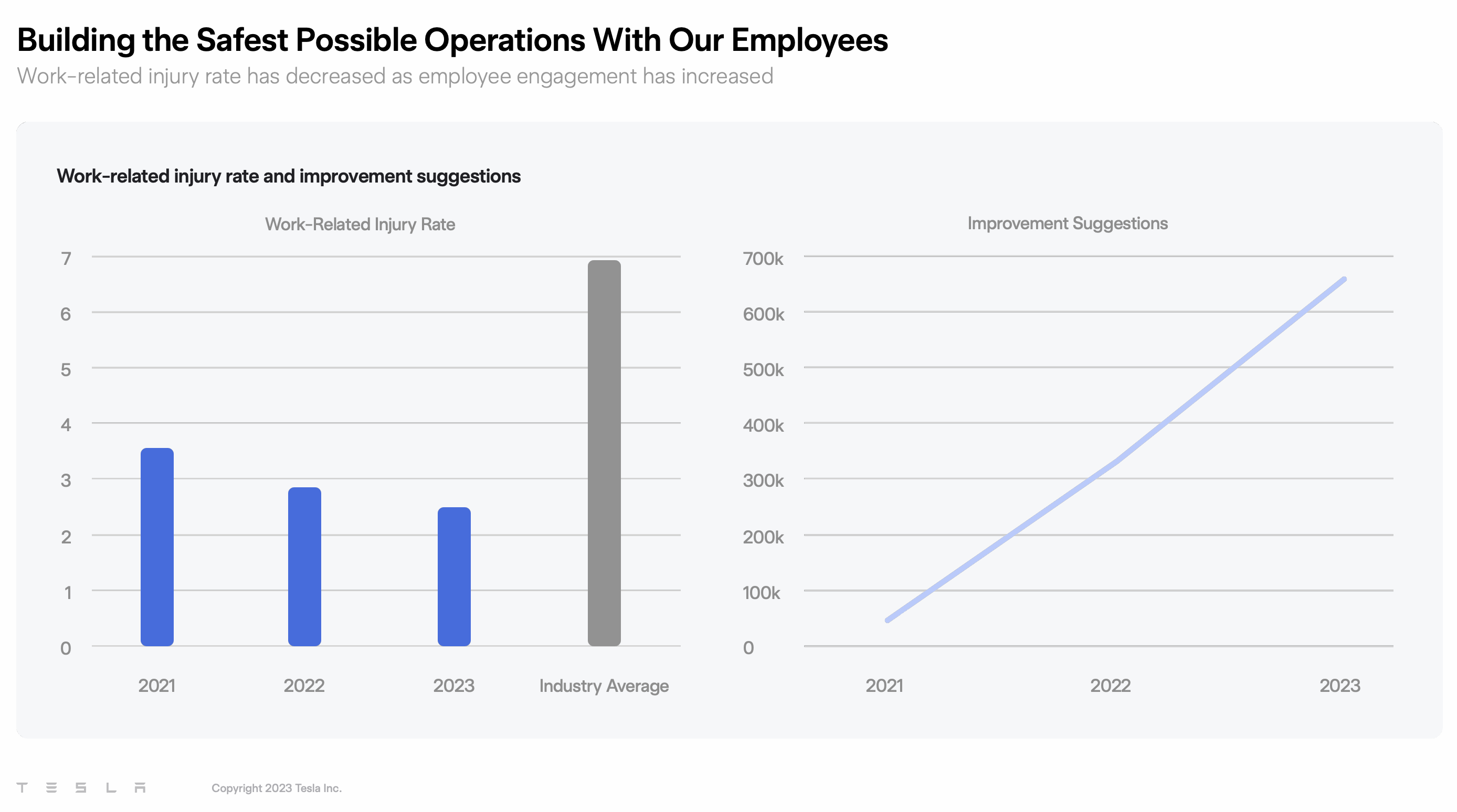

That is one I feel Tesla may have mentioned rather more, particularly contemplating the historical past of claims that Tesla factories are usually not secure. Clearly, Tesla has been making good progress in regard to employee security, and far of that might be from employee-provided enchancment solutions. Nevertheless, Musk shortly skipped previous this slide and it’s minimalist within the particulars supplied. It might be very nice to see extra of the underlying particulars and information. It might even be good to get some perception into how a lot enchancment solutions have elevated manufacturing facility effectivity, in addition to security.

There’s the slide displaying the three Tesla fashions underneath growth. I really feel like we’ve seen nearly the identical slide earlier than. Ready for the small print, nevertheless it’s not less than proof that Tesla remains to be engaged on different fashions (suppose everybody knew that, although).

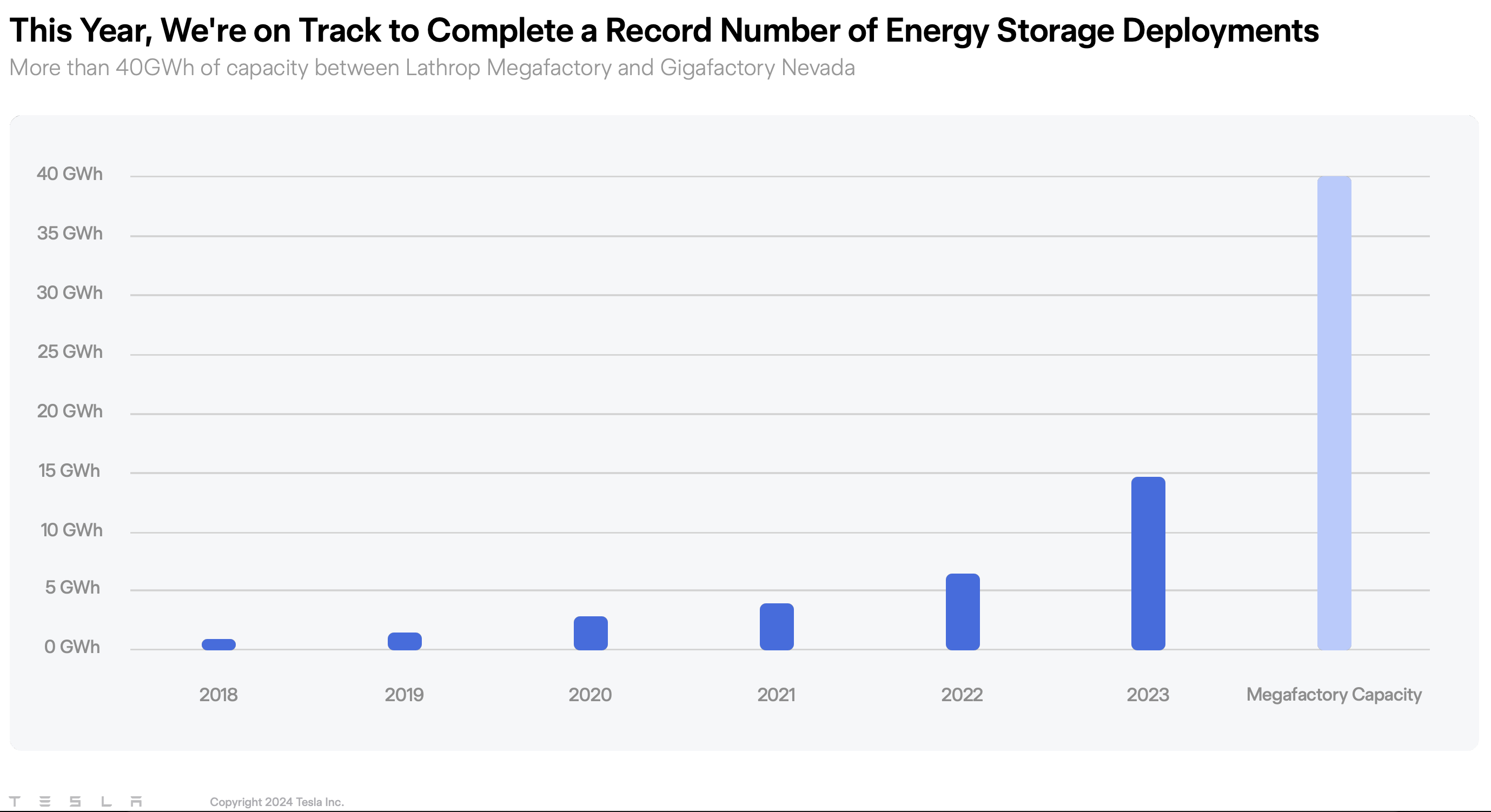

This is without doubt one of the extra thrilling slides. It exhibits speedy development of Tesla’s power storage deployments previously few years, and it exhibits the Megafactory the place these storage programs are produced has sufficient capability to supply about 2.5× extra of them annually.

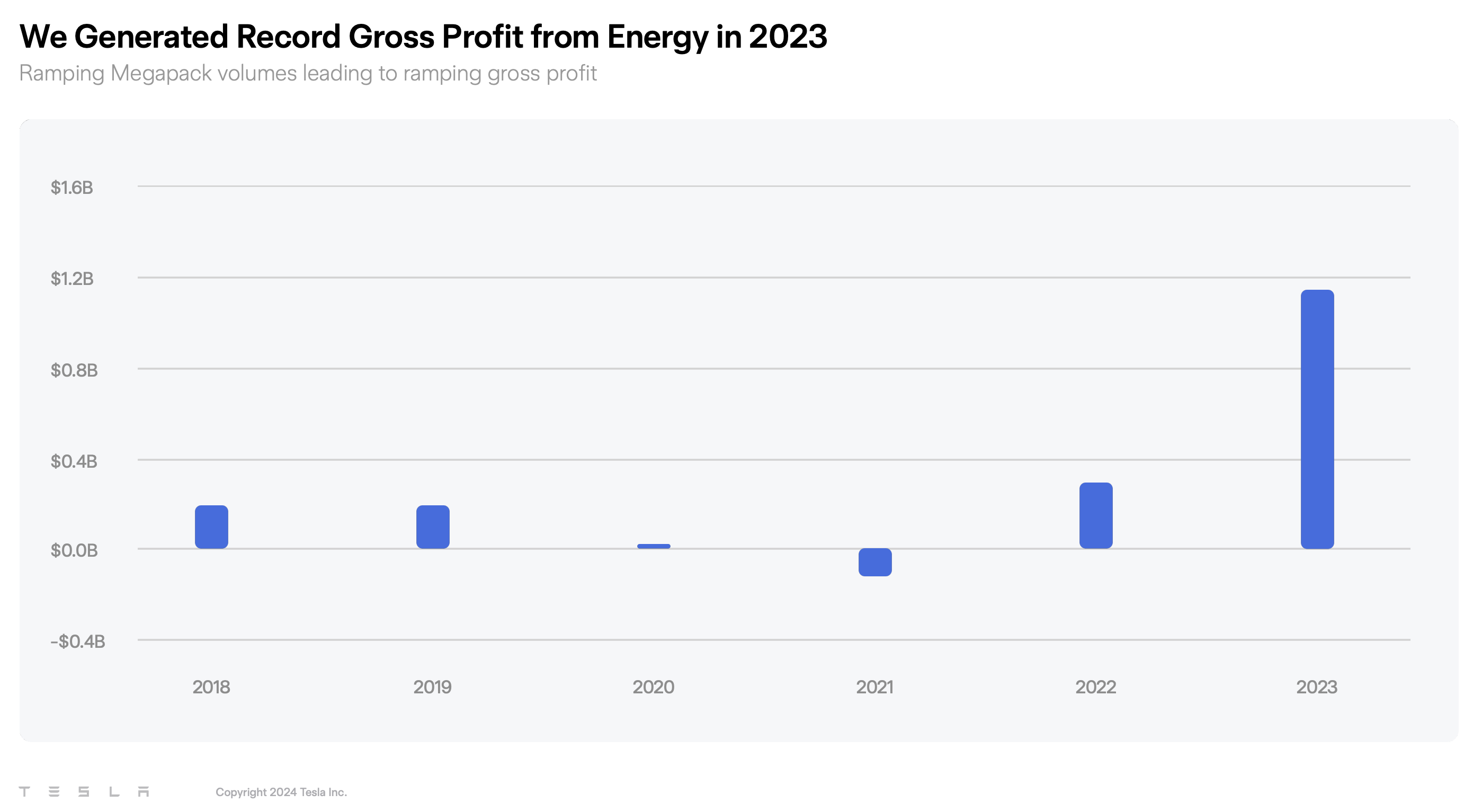

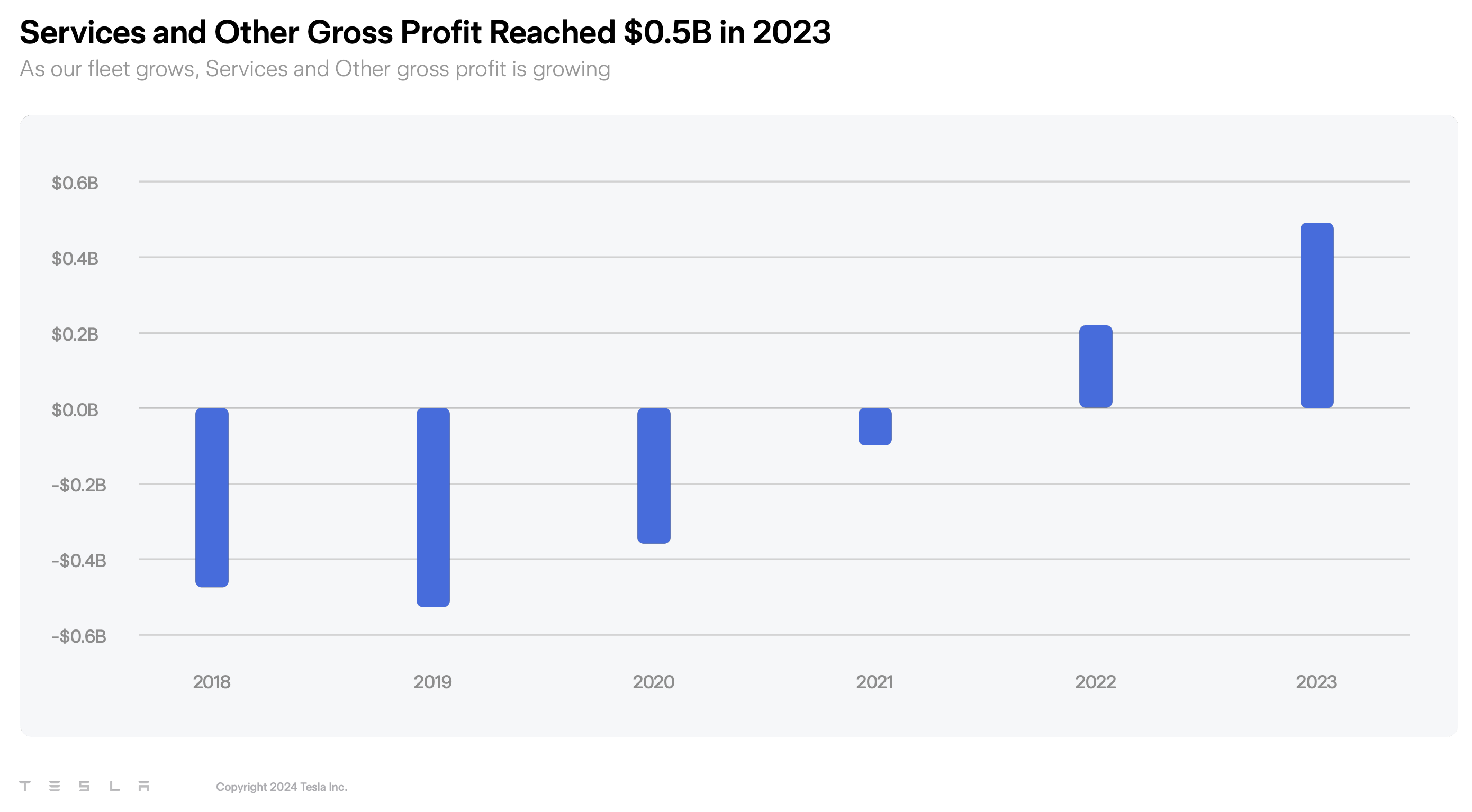

And, unsurprisingly, these power storage programs are bringing in additional gross revenue!

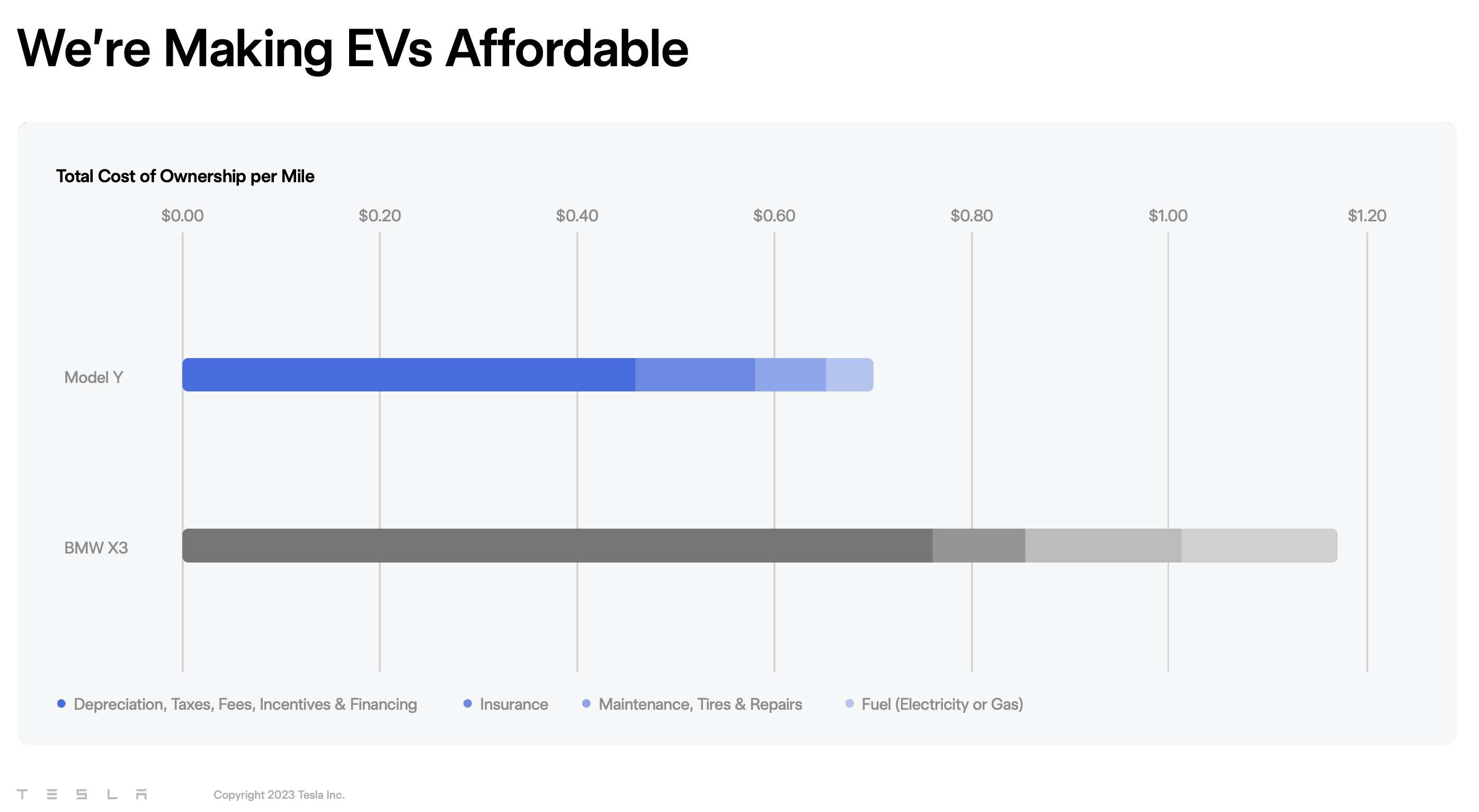

One other thrilling and interesting chart was this one evaluating “total cost of ownership” of a Tesla Mannequin Y and a BMW X3. Although, once more, I’d like to see particulars someplace. I’ve finished dozens of complete price of possession analyses, and so they rely closely on quite a lot of assumptions, together with some very customized assumptions. So, it’s exhilarating to see how less expensive a Mannequin Y could be than certainly one of its closest opponents. However let’s see the info and assumptions!

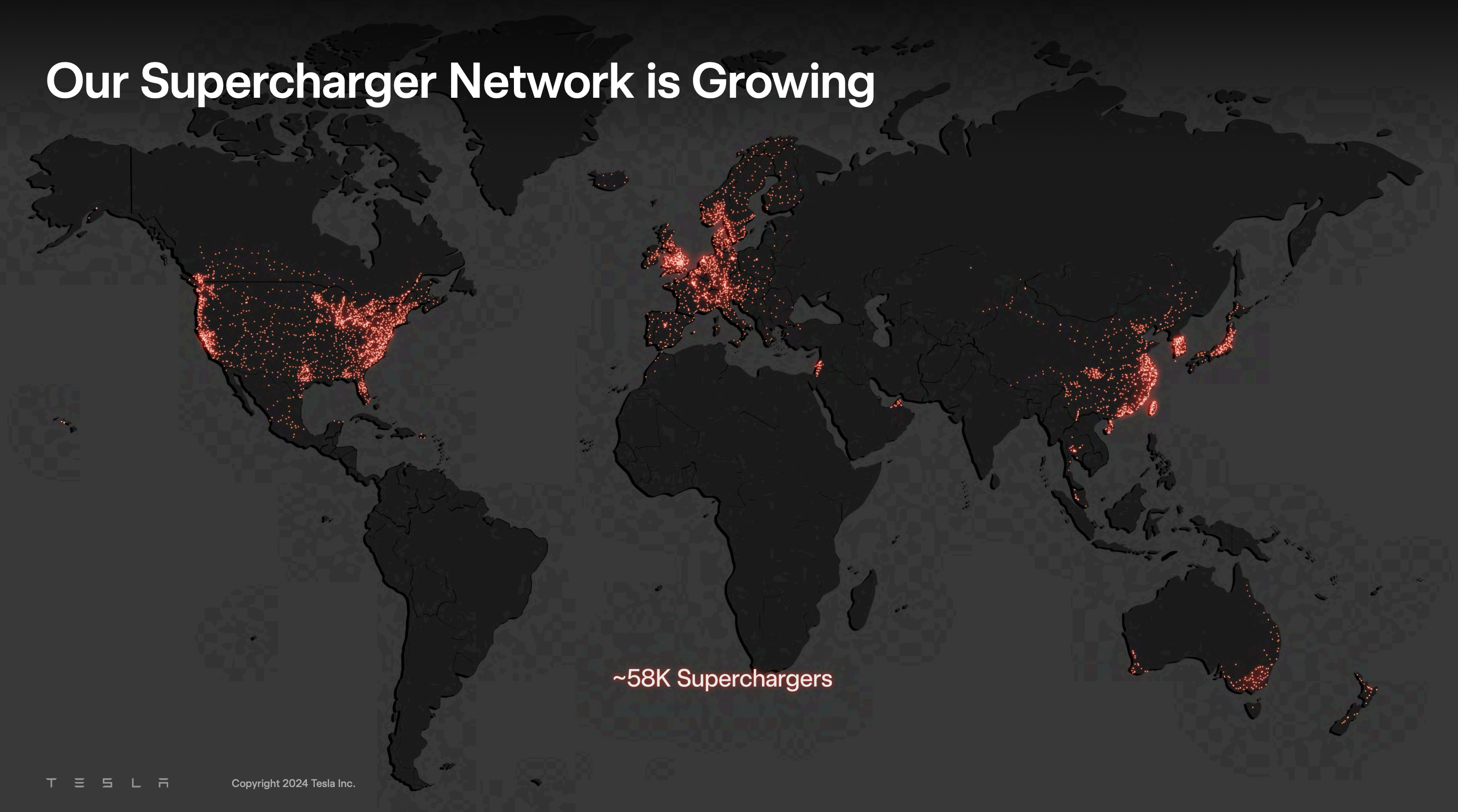

I really like the look of this new Tesla Supercharger map. It’s no doubt spectacular how a lot Tesla has constructed out these networks world wide. After all, the dots for the Superchargers listed below are in all probability bigger than cities, nevertheless it’s an ideal visualization nonetheless!

It’s clearly spectacular how a lot Tesla’s gross revenue from “services and other” have risen.

This one will get its personal article, as a result of Elon Musk’s phrases about Tesla’s lithium refining, vertical integration, and battery manufacturing prices had been actually attention-grabbing. Simply think about this slide a placeholder for a enjoyable article to return. Let’s simply say that the story seems rather more promising and optimistic listening to Musk’s statements on this within the annual shareholder assembly than within the Q1 shareholder assembly.

Have a tip for CleanTechnica? Wish to promote? Wish to recommend a visitor for our CleanTech Speak podcast? Contact us right here.

Newest CleanTechnica.TV Movies

CleanTechnica makes use of affiliate hyperlinks. See our coverage right here.