Join day by day information updates from CleanTechnica on e mail. Or comply with us on Google Information!

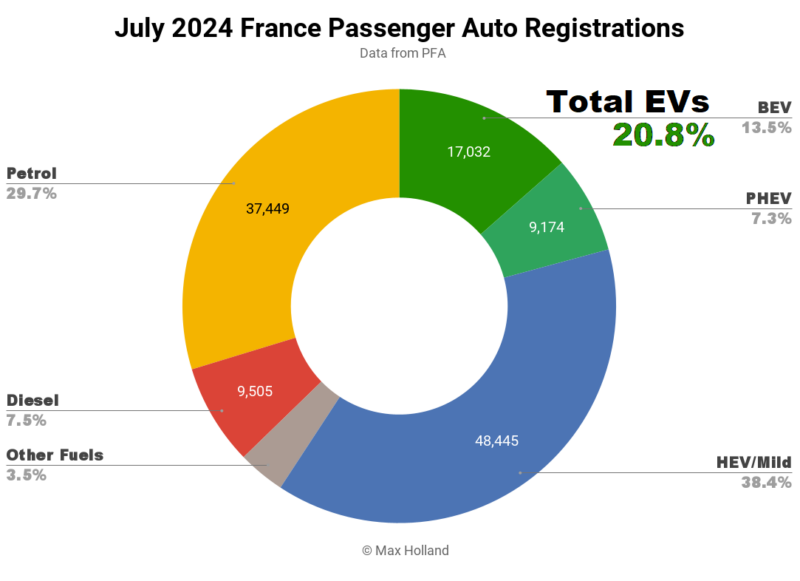

July’s auto gross sales noticed plugin EVs take 20.8% share in France, a drop from 23.3% year-on-year. BEV share was roughly flat YoY, whereas PHEV share fell. Total auto quantity was 126,037 items, down by some 2% YoY. The Renault Megane took the lead within the BEV rankings.

July’s market tally noticed mixed plugin EVs take 20.8% share in France, comprising 13.5% full battery-electrics (BEVs), and seven.3% plugin hybrids (PHEVs). These examine with YoY figures of 23.3% mixed, with 13.1% BEV, and 10.3% PHEV.

In quantity phrases, BEVs have been basically flat YoY, rising gross sales by lower than one %. This was sufficient to marginally enhance BEV market share, given the general market’s 2% quantity shrinkage. PHEV volumes fell 31% YoY to 9,174 items (the bottom quantity in virtually 2 years), and thus noticed a loss in market share.

Some BEV puritans could also be tempted to have fun the decline in PHEV gross sales, however this isn’t Norway, a rustic close to the top level of the transition, the place the choice for an averted PHEV sale is sort of all the time a BEV sale.

In France, the de facto various to a PHEV sale is usually both a combustion automobile or extra possible a plugless hybrid (or delicate hybrid). Hybrids grew quantity by virtually 50% YoY to 48,445 items, overtaking mixed combustion-only gross sales for the primary time.

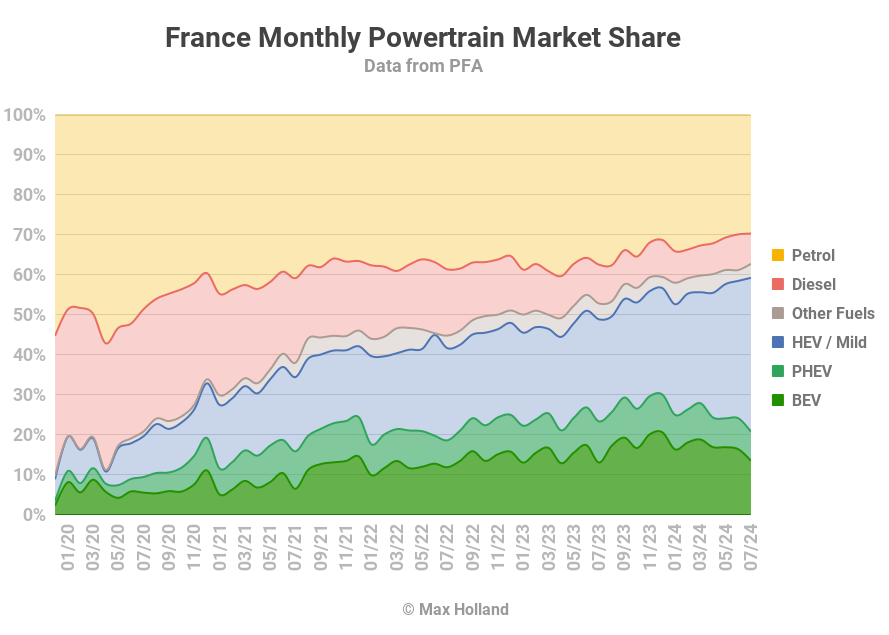

Why are France’s BEV gross sales now lacklustre by way of YoY progress? European BEVs stay far overpriced in comparison with the place they need to be, given the unconventional price declines in BEV powertrains. Recall that BEVs in China are actually competing on value with ICE autos in virtually all market segments.

The EU guidelines have successfully frozen the requirement for auto emissions enhancements in 2024 in comparison with 2023 — and lots of legacy auto makers are solely shifting to BEV as a result of they need to, not as a result of they need to decrease emissions. Don’t anticipate them to do greater than legally obligated.

The EU guidelines will solely see the subsequent step of tightening in 2025, so we are able to’t anticipate EV progress in Europe till then. The largest European legacy gamers really diminished their BEV gross sales in Q1 2024, over Q1 2023 (see Sweden report). Protecting out inexpensive EVs made in China, to guard European legacy auto’s report income (within the brief time period), can also be a part of this image — sturdy competitors is outwardly dangerous for shareholder income and govt salaries.

Well being, local weather, and client pocket books, are all paying the value for legacy auto’s report income.

The brief time period increase to YoY BEV gross sales in France firstly of the yr — which got here from the momentary “social leasing” programme — is now firmly prior to now. We are able to anticipate, at greatest, a flat BEV YoY market till 2025, until the Citroen e-C3 has a record-breaking manufacturing ramp up, and funnels virtually all its output into the French market.

The e-C3 was initially scheduled to launch in Q2, however none have delivered but (as of early August 2024), with the rationale given for the delay — “software issues”. However after all. Now the primary supply timing is guided vaguely as “after the summer break” — does that successfully imply October and onwards? My recommendation — don’t maintain your breath for this promised wave of inexpensive BEVs from European legacy auto. Most of them stay unashamed foot-draggers on the EVs transition. Respectable quantity in all probability received’t seem till nicely into 2025.

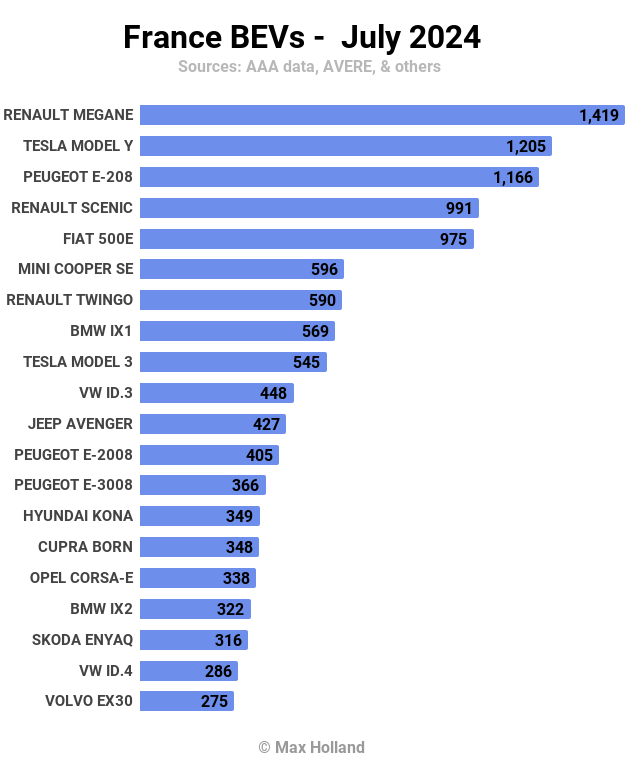

Greatest Promoting BEV Fashions

The Renault Megane was the very best promoting BEV — for the second consecutive month — in July, with 1,419 items delivered.

In runner-up spot was the Tesla Mannequin Y, with 1,205 items. The Peugeot e-208 took third, with 1,166 items.

The brand new Renault Scenic (in 4th) has damaged into the highest 5 for the primary time since its January debut. Let’s see if it may grow to be a daily, and even climb greater.

The one shock within the prime 20 was the BMW iX2, coming into for the primary time (seventeenth place) after its French debut in February. The stunning side is that the iX2 is basically a barely lowered and coupe-backed variant of the iX1, which is already a prime 10 common in France.

Each these BMW SUVs are fairly inexpensive, given the premium positioning. Each might be had for costs ranging from €46,900. The iX1 is extra boxy and sensible for households, the iX2 is extra sporty wanting.

One level to notice is that — whereas the iX1 MSRP is about 7.5% costlier than its combustion “X1” variants — the BEV iX2 undercuts its combustion variants (the “X2”), even when solely by ~€1,000.

This possible makes many potential BMW SUV patrons take a look at the iX2 BEV as comparatively “great value”, and helps its gross sales. The primary instance of a BEV priced beneath its ICE siblings that I’m conscious of in Europe (leap within the feedback if you understand of others) — although not too stunning to see it in a premium phase. In any case, it’s a lot simpler and more cost effective to supply “power and refinement” by way of an EV powertrain, than by way of an ICE powertrain.

We don’t have sufficient information decision to determine France’s July debutants, however see our different stories to verify regional debutants rising in neighbouring markets.

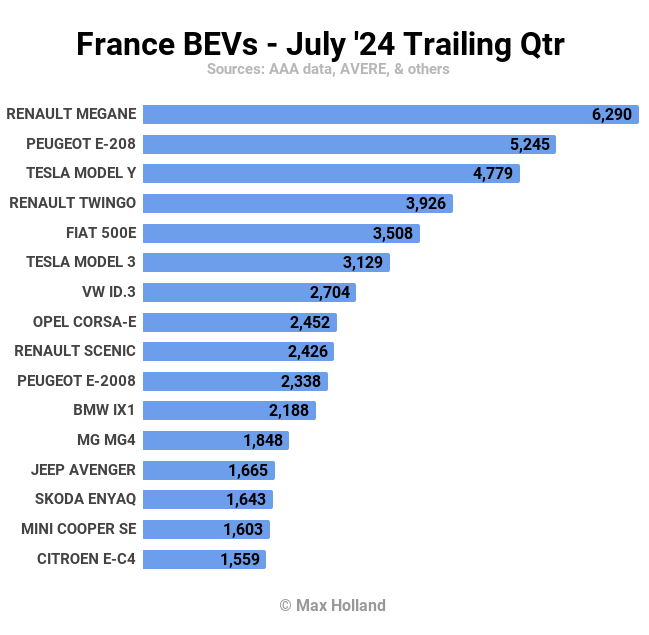

Let’s verify in on the trailing 3-month rankings:

There are few huge surprises right here, besides to notice that the Renault Megane has climbed steadily over the previous couple of months to now take the highest spot. The Peugeot e-208 nonetheless has an enormous lead within the full yr race, nevertheless.

Be aware additionally the rise of the Megane’s youthful sibling, the Renault Scenic, now inside the highest 10 for the primary time, and more likely to climb greater.

When the Citroen e-C3 lastly does arrive in good quantity (once more, possible not earlier than 2025), it would shake up this chart a bit. Renault and Volkswagen must reply by providing higher worth on their very own small BEVs, which can enhance their respective gross sales volumes. This relative enhance will possible push a number of the extra premium and costly BEVs (BMW iX1, maybe the Tesla Mannequin 3) a number of steps down the rankings, even when their unit gross sales stay largely unchanged.

Outlook

France’s BEVs noticed wholesome YoY development for the primary 4 months of 2024, however have since stagnated for the explanations we mentioned above. The general auto market has additionally been barely down YoY for the previous 3 months. The broader financial system remains to be above water YoY, however solely weakly so, with Q2 2024 GDP up 1.1% YoY, from 1.5% in Q1. That is however higher than the Netherlands, Germany, Denmark, and Sweden, that are all in unfavourable territory as of newest information.

France’s inflation price remained comparatively regular at 2.3% in June (newest), and rates of interest are flat at 4.25%. Manufacturing PMI took a downturn in July to 44 factors, from 45.4 in June.

The outlook for the BEV transition in France is more likely to proceed to be uninspiring for the remainder of this yr. The momentary social leasing programme is now largely performed out, 2024 EU rules don’t require emissions progress over 2023, and the “affordable” home-grown European BEVs received’t arrive in quantity till 2025. Actually, they are going to arrive simply in time for the tighter emissions rules — not a coincidence.

What are your ideas on France’s EV transition? Please leap into the dialogue beneath to share your perspective.

Have a tip for CleanTechnica? Need to promote? Need to recommend a visitor for our CleanTech Speak podcast? Contact us right here.

Newest CleanTechnica.TV Movies

CleanTechnica makes use of affiliate hyperlinks. See our coverage right here.

CleanTechnica’s Remark Coverage

FB.AppEvents.logPageView();

};

(function(d, s, id){ var js, fjs = d.getElementsByTagName(s)[0]; if (d.getElementById(id)) {return;} js = d.createElement(s); js.id = id; js.src = "https://connect.facebook.net/en_US/sdk.js"; fjs.parentNode.insertBefore(js, fjs); }(document, 'script', 'facebook-jssdk'));