- Greatest general bank card reader for Android: Sq.

- Greatest for personalisation: Stripe

- Greatest low cost, primary reader: SumUp

- Greatest for accepting a number of fee strategies: PayPal Zettle

- Greatest for ecommerce companies: Shopify

Android gadgets have made important technological developments in recent times. Like iPhones, they will now be used as fee terminals due to NFC expertise and fee apps accessible on the Play Retailer, its app market.

To search out the most effective bank card reader for Android, I thought-about affordability, fee choice flexibility, transaction charges, and, extra importantly, reliability and safety. I evaluated dozens of Android bank card readers in opposition to a 22-point rubric and examined them myself as a payor and payee.

Prime bank card readers for Android comparability

Alongside pricing, some essential options set the cell bank card readers for Android aside. The desk under illustrates which of the highest 5 Android card readers embrace these key options.

| Sq. Reader | |||||

| Stripe M2 | |||||

| SumUp Plus | |||||

| PayPal Zettle Reader 2 | First reader discounted to $29 |

||||

| Shopify Faucet & Chip Card Reader |

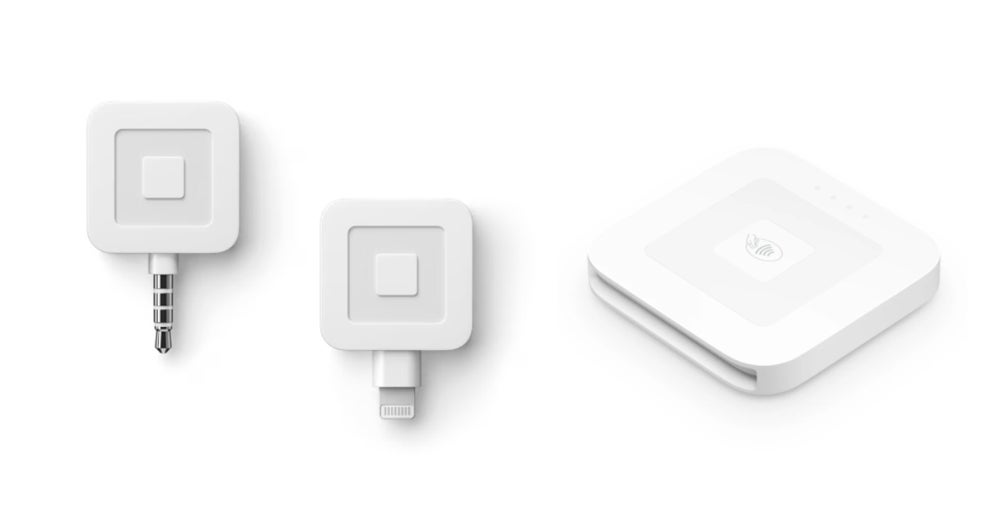

Sq.: Greatest general bank card reader for Android

Our score: 4.63 out of 5

Sq. Readers constantly rank amongst our high picks for bank card readers for Android and iPhone gadgets. They’re extremely rated by customers and consultants alike. Their modern design and useful measurement make them a superb selection for accepting funds anyplace, along with the Sq. POS app.

Sq. allows you to settle for funds totally free — it doesn’t cost month-to-month charges or require month-to-month minimums; you may even get your first magstripe reader totally free, making it appropriate for the informal person. And but, it offers a fully-featured POS system ideally suited for full-time companies.

Why I selected Sq.

I like how Sq. stays inexpensive and nonetheless allows you to settle for a full vary of fee choices. You additionally pay the identical transaction charge regardless of which card a buyer makes use of — even American Categorical, which is notorious for having larger charges.

Among the many card readers I’ve evaluated, it’s one of many card readers that obtained good marks for card reader options (free POS app and reader, nice aesthetics, and a digital receipts function) — SumUp being the opposite one.

Except for the same old faucet, dip, and NFC funds, Sq. allows you to settle for present playing cards and echecks (with an extra cost). You can too settle for worldwide playing cards, however you have to be within the nation the place you activated your Sq. account (no cross-border funds).

However what I like greatest about Sq. is its energetic fraud prevention and dispute administration function. It has a superb chargeback coverage — no chargeback charges aside from the same old processing price that the sale incurred. In actual fact, Sq. and SumUp are the one suppliers on this record that don’t cost dispute charges.

Pricing

- Month-to-month processing price: $0

- Transaction charges:

- Card current: 2.6% + 10 cents

- Keyed-in: 3.5% + 15 cents

- On-line, Recurring, and Invoicing: 2.9% + 30 cents

- Card readers:

- First magstripe reader free; extra orders $10 every

- $49-$59 for Sq. Reader (1st and 2nd era)

- Accepts faucet, dip, Apple Pay, Google Pay, and different NFC funds

- Accepts offline funds; syncing of funds must be performed inside 24 hours

Options

- 4.7 out of 5 cell app score on Google Play primarily based on greater than 230,000 person evaluations.

- Card reader options:

- Free magstripe reader is offered with lightning or audio jack enter; can settle for funds through magstripe (swiped).

- Sq. Reader connects through Bluetooth, can work with out Web connectivity, and might settle for funds through EMV (chip) or NFC (Apple Pay, Google Pay).

- Clear and flat-rate processing charges.

- Offline fee processing.

- Free, highly effective POS app.

- No chargeback or dispute charges.

Professionals and cons

| Professionals | Cons |

|---|---|

|

|

Associated: Greatest Free Credit score Card Readers for iPhone & Low-cost Alternate options

Stripe: Greatest for personalisation

Our score: 4.41 out of 5

Stripe is greatest identified for its extremely customizable checkout pages, and that extends to its fee terminals, too. In case you have the means to rent a developer (or have the know-how your self!), you’ll actually recognize Stripe’s versatile terminal instruments — you may actually customise in-person fee experiences.

Furthermore, you need to use the Stripe M2 reader with your individual POS app or combine it with different apps for stock or buyer relationship administration.

Why I selected Stripe

Given all of the excessive degree customization choices you get with Stripe, I like that it nonetheless gives a low-cost card reader choice, permitting you to promote in-person. Stripe is generally identified for on-line funds, and whereas its in-person gross sales options will not be as nicely often called that of Sq. — it scored above common on most classes throughout my analysis.

Stripe and SumUp are the one card readers on this record that settle for magstripe (swipe) funds, together with chip and faucet. Whereas this expertise isn’t usually used anymore, it could actually come in useful when the connection (NFC or Bluetooth) turns into spotty. Resulting from its top-notch safety and fraud detection, Stripe is the most effective bank card swiper for Android.

Additionally price mentioning is the app’s excessive person evaluate scores, 4.50 out of 5 — one of many highest scores among the many apps I function on this record. I seen Stripe actively listens to person suggestions — the newest evaluate as of this writing requested a function and Stripe added the performance within the app instantly.

Pricing

- Month-to-month processing price: $0

- Transaction charges:

- Card current: 2.7% + 5 cents

- On-line: 2.9% + 30 cents

- Keyed-in (Handbook): 3.4% + 30 cents

- Touchless: 2.9% + 30 cents

- Faucet-to-pay on cell: +10 cents per authorization

- Invoicing: + 0.4%–0.5%

- Recurring Billing: + 0.5%–0.8%

- Worldwide funds: + 1.5% price, 1% unfold for forex conversion

- ACH: 0.8%, $5 cap

- Card readers:

- $59.00 for Stripe Reader M2

- $249.00 for BBPOS WisePOS E (sensible reader with a touchscreen show)

- $349.00 for Stripe Reader S700 (Android-based sensible reader)

- Accepts EMV chip playing cards, contactless playing cards, magstripe playing cards, and digital wallets.

- Chargeback price: $15 per dispute.

Options

- 4.50 out of 5 cell app score in PlayStore primarily based on almost 25,000 person evaluations.

- Card reader options:

- Bluetooth connectivity.

- Offline mode.

- Battery—2 hours charging time, 28 hours energetic use, 42 hours standby.

- Customizable checkout course of.

- Customizable danger administration and fraud detection instruments.

- Multi forex fee processing.

- Finish-to-end encryption (E2EE) and point-to-point encryption (P2PE).

- Seamless integration with Stripe Terminal software program growth package (SDK).

Professionals and cons

| Professionals | Cons |

|---|---|

|

|

SumUp: Greatest low cost, primary reader

Our score: 4.35 out of 5

SumUp is primarily designed to be an end-to-end cell fee processing resolution. Except for inexpensive card readers, you may settle for funds through invoicing and digital terminals. There are not any month-to-month minimums and contract charges. And in contrast to the Sq. Reader, SumUp Plus accepts magstripe funds (swipe playing cards) and features a display screen to point out transaction particulars.

In comparison with different feature-rich POS methods like Stripe and Sq., SumUp’s functionalities are primary at greatest. Nonetheless, for companies on a price range and solely have simple fee wants, SumUp is a superb choice.

Why I selected SumUp

If we’re speaking completely about card readers for cell app funds, SumUp’s readers are top-notch. Its entry-level card reader (accessible in black and white variations) is among the many most cost-effective readers I’ve reviewed.

SumUp is the one card reader, apart from PayPal Zettle, that includes a display screen to point out transactions on its gadget and has a PIN function. Additionally it is tied with Sq. for scoring good marks on card options. Nonetheless, SumUp is the highest card reader on the subject of fee choices — Zettle doesn’t have an offline mode, and Sq. Reader can’t do swipe funds. SumUp Plus can do each.

Nonetheless, SumUp is kind of limiting for those who want a full-featured POS system and ecommerce integrations. In contrast to others on this record, It solely gives primary stories like transaction and income summaries.

Pricing

- Month-to-month processing price: $0

- Transaction charges:

- Card current: 2.6% + 10 cents

- On-line and keyed-in: 3.5% + 15 cents

- Invoicing (fee hyperlink): 2.9% + 15 cents

- Card readers:

- $54 for SumUp Plus (Connects through Bluetooth to your smartphone or pill)

- $99 for SumUp Solo (Standalone gadget with a modern touchscreen)

- $169 for SumUp Solo printer bundle (Standalone gadget with printer)

- Accepts swipe, faucet, dip, Apple Pay, Google Pay, and different NFC funds

Options

- 3.70 out of 5 cell app score in PlayStore primarily based on greater than 105,000 person evaluations.

- Card reader options:

- 8 hour battery life lets you settle for funds on the go.

- Course of over 500 transactions on a single cost.

- Connects through Bluetooth (SumUp Plus).

- Join through WiFi and with free, limitless cell information with the built-in SIM card (SumUp Solo and printer bundle).

- Cellular-first fee processor.

- No add-on charges for worldwide bank cards.

- No additional value for e-check funds with invoicing.

- No chargeback charges.

Professionals and cons

| Professionals | Cons |

|---|---|

|

|

PayPal Zettle: Greatest for accepting a number of fee strategies

Our score: 4.10 out of 5

PayPal Zettle is the best choice if it’s worthwhile to settle for a wide range of funds in individual at a low value and with no commitments. Except for faucet and dip (EMV chip, contactless, and digital wallets), Zettle can settle for Venmo and PayPal funds. QR funds are potential with the assistance of the POS app, too.

In case you have a seasonal enterprise or a aspect hustle, the Zettle Reader is a terrific choice. It gives very inexpensive transaction charges: 2.29% + 9 cents.

Why I selected PayPal Zettle

Except for the added fee choices PayPal Zettle can settle for, I like that it offers an added safety function to transactions, having a PIN function when processing funds. It additionally has a show display screen. Amongst these on this record, solely Zettle Reader and SumUp Plus have these options.

PayPal Zettle additionally has the bottom card-present (in-person) transaction charge among the many card readers featured on this information. Nonetheless, notice that PayPal Zettle is greatest for accepting funds on the go and nothing extra. It doesn’t provide plan upgrades or integrations for on-line promoting.

Pricing

- Month-to-month price: $0

- Transaction charges:

- Card current and QR codes: 2.29% + 9 cents

- Keyed-in: 3.49% + 9 cents

- Invoicing (PayPal funds): 3.49% + 49 cents

- Invoicing (playing cards and various fee strategies): 2.99% + 49 cents

- Card reader: $79 (first one, $29)

- Accepts debit and credit score EMV playing cards, NFC funds, present playing cards, and Venmo funds

- Chargeback price: $20

Options

- 3.20 out of 5 cell app score within the Play Retailer primarily based on greater than 43,000 evaluations.

- Card reader options:

- 8-hour battery life (100 transactions)

- PIN card function

- Scan QR codes via smartphone

- No long-term contract or termination charges.

- Accepts a wide range of fee varieties — chip and contactless fee strategies, together with Venmo and PayPal funds.

- Subsequent-day funding, similar day with price.

Professionals and cons

| Professionals | Cons |

|---|---|

|

|

Shopify: Greatest for ecommerce companies

Our score: 3.99 out of 5

The Shopify Faucet & Chip Card Reader is essentially the most appropriate and handy choice for accepting funds in individual if in case you have an internet enterprise and, extra so, use Shopify as your ecommerce platform. You don’t must pay an extra month-to-month price.

Just like the Sq. Reader, the Shopify Faucet & Chip Card Reader is unique to Shopify’s funds and ecommerce ecosystem. Shopify’s related ecosystem permits gross sales and stock to sync seamlessly throughout your gross sales channels.

Why I selected Shopify

I’ve over a decade of expertise working with primarily online-first companies, and Shopify has been my constant decide for ecommerce platforms. Despite the fact that Shopify is thought for ecommerce, I’ve skilled its equally sturdy POS platform for cell and in-store gross sales — additional cementing Shopify as the most effective resolution for multichannel sellers.

The Shopify cell card reader isn’t any exception. Whereas it has restricted offline performance, I like that it accepts many fee choices — bank card, contactless, digital wallets, on-line funds, present playing cards, worldwide/cross-border, and even cryptocurrency — rivaling PayPal Zettle.

Pricing

- Month-to-month price: $0–$89 (plus Shopify ecommerce plan starting from $5-$399 — required)

- Transaction charges:

- In-person: 2.4%–2.7%

- On-line: 2.4%–2.9% + 30 cents

- Card reader: $29–$49

- One-year restricted guarantee (minimal)

- Accepts each chip and contactless funds.

- Chargeback price: $15

Options

- 3.30 out of 5 cell app score within the Play Retailer primarily based on almost 2,300 evaluations.

- Card reader options:

- Accepts chip and contactless funds

- Customary 1-year guarantee or an prolonged 2-year guarantee on POS Professional

- Accepts bank cards (through EMV chip), contactless (through NFC and QR), digital wallets, on-line funds, present card, worldwide/cross-border, and cryptocurrency.

- Native fee strategies will be accepted for an add-on price.

- No long-term contract or termination charges.

- Sync on-line and in-person gross sales and stock.

- In depth integrations for scalability.

- A number of gross sales channels, together with social channels and on-line marketplaces like Amazon and Walmart.

- 24/7 buyer assist.

Professionals and cons

| Professionals | Cons |

|---|---|

|

|

Associated: The 6 Greatest Cellular POS Programs for 2024

How do I select the most effective Android bank card reader for my enterprise?

The perfect Android bank card reader for what you are promoting is one which matches what you are promoting wants and is suitable along with your Android gadget’s working software program. Prioritize cell card readers with excessive safety and minimal stories of downtimes or failed transactions. Connectivity must also not be an issue. It must be simple to attach along with your cell fee app.

Particularly, it’s best to contemplate:

- Reliability, compatibility, and connectivity: Most card readers join through Bluetooth to your Android gadget. There are card readers that embrace a SIM card to get their very own WiFi connection.

- Accepted fee strategies: EMV (chip) and NFC (contactless) funds are the commonest fee strategies for card readers. Your card reader ought to have the ability to settle for these on the minimal — faucet and dip readers are what they’re referred to as. In order for you to have the ability to settle for different fee strategies like QR, invoicing, and Venmo, make sure that to examine the cardboard reader first earlier than buying.

- Straightforward-to-use cell app with sturdy options: Cellular card readers work collectively along with your fee processor’s cell fee app. Their cell apps are often free, so examine their options in the event that they match what you are promoting wants earlier than buying.

- {Hardware} pricing: Cellular bank card readers are typically very inexpensive. Most provide card readers between $50 and $100, and a few subject your first reader totally free or at a reduced worth. In order for you a tool that gives extra subtle capabilities, comparable to a built-in printer or scanner, put together to shell out greater than $100 per gadget.

Methodology

Based mostly on my expertise serving to retail companies launch their ecommerce shops and streamline their in-store and on-line gross sales operations, I seemed on the high fee suppliers and service provider providers which have cell apps and supply card readers for Android.

From my preliminary record, I graded them utilizing an in-house rubric of twenty-two information factors primarily based on pricing, fee varieties, card options, safety and stability, and person evaluations. I prioritized Android card readers with excessive evaluations on safety and reliability — minimal failed transactions and downtimes.

This text and methodology had been reviewed by our retail professional, Meaghan Brophy.

Steadily requested questions (FAQs)

What are the variations between cell bank card readers for Android?

The principle variations between Android bank card readers are the fee strategies they settle for and their transaction charges.

How do you settle for bank card funds in your Android cellphone?

You may settle for bank card funds in your Android cellphone via Faucet to Pay. Your gadget will function a fee terminal via a cell fee app. You can too settle for bank card funds in your Android gadget with the assistance of a suitable card reader.

Are there any bank card readers for Android that work offline?

Sure, there are Android bank card readers that work offline. Sq., Stripe, and SumUp are a couple of nice examples.

Are there any free bank card readers for Android?

Sure, there are free Android card readers. Sq. offers your first magnetic stripe reader totally free, and PayPal Zettle additionally gives a reduced charge on your first card reader.

What card readers work with Google Pay?

Most Android card readers can settle for NFC funds and cell wallets comparable to Google Pay. Sq., SumUp, Stripe, PayPal Zettle, and Shopify have nice card readers that course of Google Pay funds.

Does Samsung Pay nonetheless work with any card reader?

Sq., PayPal Zettle, and Stripe cell card readers settle for Samsung Pay.