CFOs are taking a extra assertive function in IT selections in Australia and New Zealand in 2024.

Analysis from enterprise software program options agency Rimini Road exhibits that CFOs are actually typically those guiding underlying expertise selections — a duty historically held by firm CIO’s.

The analysis, C-Suite Imperatives: Evolving IT and Enterprise Investments, surveyed 250 CFOs and CIOs within the ANZ area. It revealed that nearer collaboration is enhancing CFO and CIO relationships, which might end in larger IT budgets and enterprise return on funding.

As much as 70% of expertise selections contain CFOs in 2024

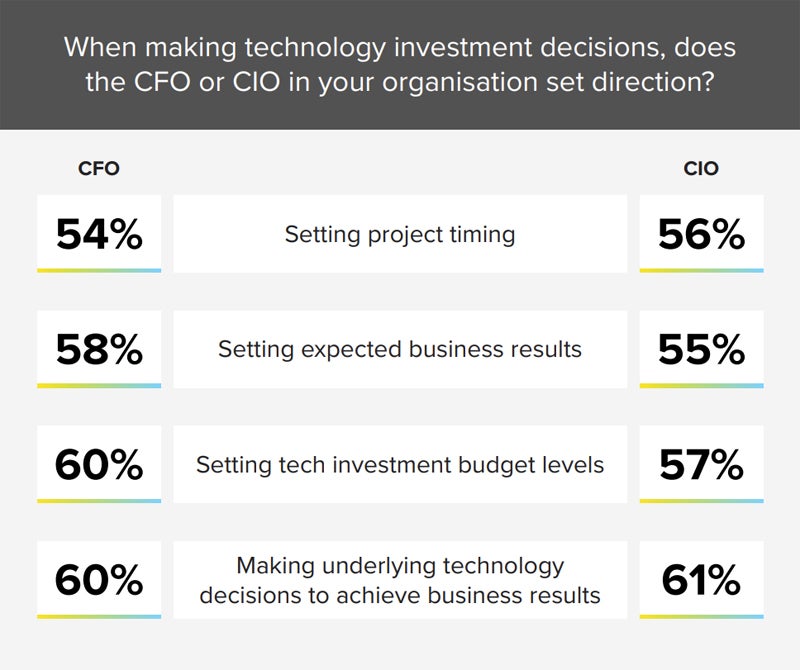

CIOs as soon as had main duty for the tech selections made by enterprises. Nevertheless, Rimini Road’s analysis discovered 60% of CFOs say they’re those accountable for underlying expertise selections to attain enterprise outcomes, marking a shift in how selections are made.

Specialist IT analysis agency ADAPT Analysis has additionally famous this pattern. ADAPT’s strategic analysis director, Matt Boon, estimated at a latest Sydney convention that CFOs are actually concerned in 70% of all IT funding selections. He mentioned this degree was “the highest we’ve ever seen.”

CFOs aren’t the one ones who discover this shift. CIOs agree that their CFO counterparts are those making the underlying expertise selections and taking the lead function in setting expertise funding price range ranges.

Why are CFOs extra concerned in expertise selections?

The elevated give attention to financials in Australia and New Zealand is not any secret. The market has seen rising inflation, larger rates of interest and slower enterprise development. IT leaders within the area have been beneath strain to do extra with the identical or much less or face slower price range will increase.

Useful resource: How CFOs have advanced from quantity crunchers to worth drivers

The atmosphere has drawn CFOs nearer into expertise oversight and decision-making. CFOs have been involved about value, as components like rising cloud prices impression the underside line. They’re additionally within the contribution expertise investments make to enterprise development.

CFOs lament lack of reference to enterprise objectives

The Rimini Road report confirmed that solely 23% of CFOs are proud of the impression tech investments are making on their enterprise objectives — a serious cause why they’re extra concerned in tech selections. That leaves about 3 in 4 CFOs who aren’t utterly happy with the outcomes of their legacy tech investments or who don’t assume that IT investments are tied to enterprise objectives.

In actual fact, many CFOs have scathing suggestions when requested about organisational expertise. Amongst surveyed CFOs:

- 29% have seen solely blended outcomes from tech investments, when measured towards attaining desired enterprise outcomes or gaining adequate long-term worth.

- 19% say they typically see a unfavourable impression from expertise investments, together with ongoing prices, restricted future flexibility or enterprise disruption.

- 17% surveyed by Censuswide for Rimini Road say that a lot of the organisation’s expertise investments are usually not tied to their enterprise objectives.

- 12% have seen little or no enterprise enchancment from their expertise investments, and/or the price of the funding outweighed the worth of the advance.

Stronger CFO and CIOs relationships are benefiting companies

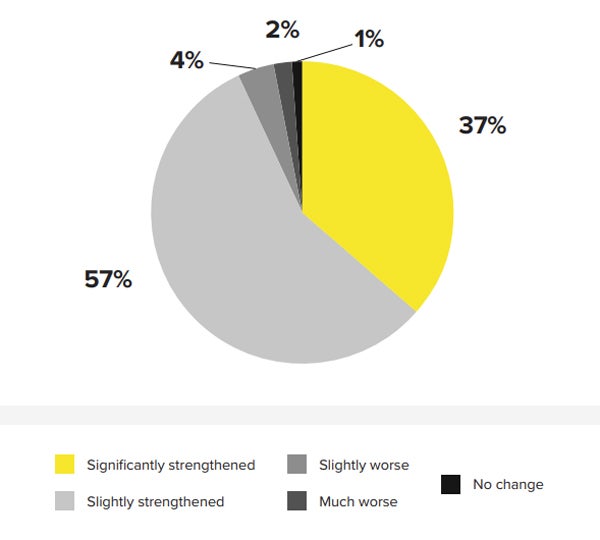

Regardless of some CFO dissatisfaction, 94% of respondents mentioned the CFO and CIO relationship has strengthened considerably or barely. This can be a massive share contemplating the CFO is more and more encroaching on a few of a CIO’s conventional duties.

CFOs seeing CIOs in a extra optimistic gentle

Nearer collaboration is tipping CFO notion of CIOs towards the optimistic. The survey discovered:

- 39% of CFOs thought-about their CIO as an “innovative change-agent who drives business strategy.”

- 33% see their CIOs as companions who assist join the dots between tech and enterprise selections.

Rimini Road mentioned these ability units transcend the core expertise power of most IT execs.

“It speaks to leadership and collaboration more so than technology proficiency, indicating at least on the CIO side, they are learning the CFO’s language,” in response to the report.

Why the CFO-CIO bond is rising stronger

An unsure enterprise atmosphere has been an element within the strengthening relationship between CFOs and CIOs, as they’ve been required to work carefully collectively. Based on the Rimini report, a number of the causes nominated by CIOs and CFOs for the stronger bond have been:

- The opposite chief proactively partaking (39%).

- A give attention to safety, compliance and danger (38%).

- The pressing have to collaborate to make nimble expertise selections (37%).

- The necessity to shortly lower IT prices in a wise manner (35%).

Rimini Road mentioned CFOs stay depending on CIOs due to the complexity of IT selections and wish CIO steerage with priorities rooted in expertise, reminiscent of safety and rising applied sciences. CIOs want to CFOs to help them with price range and govt advocacy.

CFOs imagine nearer collaboration with CIO is sweet for enterprise

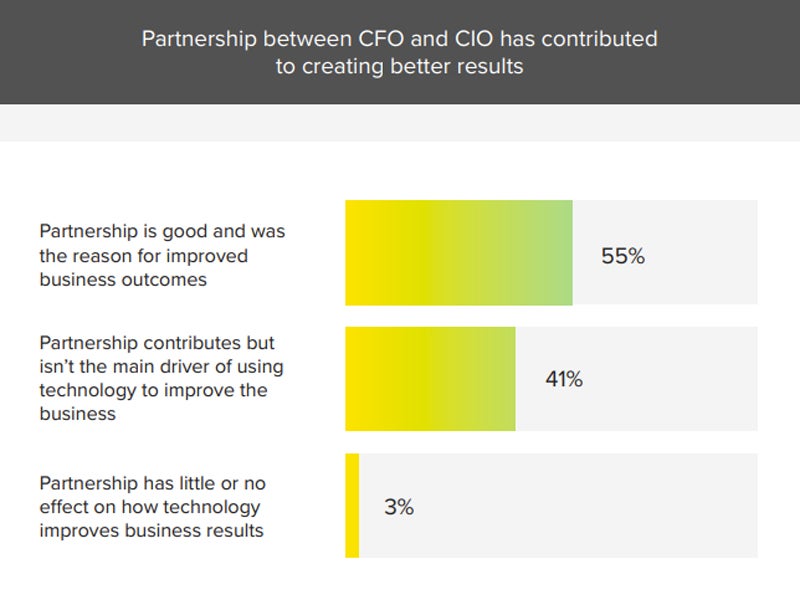

Greater than half of CFOs within the ANZ area (55%) imagine a optimistic CFO-CIO relationship has been instrumental to raised enterprise outcomes. A major 41% assume the partnership contributes, even when it’s not the principle driver of enhancing enterprise outcomes.

CFO and CIO enterprise relationships nonetheless have room to enhance

The CFO and CIO relationship can nonetheless enhance. For instance, each CFOs and CIOs assume the opposite ought to higher perceive their self-discipline:

- A big share of CFOs (91%) indicated that their CIO counterpart must be extra business-savvy to raised talk with them.

- A mixed 96% of CIO respondents indicated their CFO counterpart must be extra technology-savvy to enhance communication with them.

Why CFO and CIO relationships go unhealthy

A small share (6%) of CFOs report having a worse relationship with their CIO. Amongst these CFOs, 38% attributed the difficulty to a lack of understanding in addressing safety, compliance and danger points, whereas one other 38% cited the CIO’s inflexibility in figuring out methods to chop IT prices.

Different causes for CFO dissatisfaction included CIOs demonstrating a irritating lack of urgency (23%), presenting plans that didn’t show ample return on funding (23%), or not welcoming extra proactive engagement (23%). These points point out that each expertise and dealing kinds might each be relationship flashpoints.

How IT leaders can higher interact with their CFOs

Savvy IT leaders have the potential to raised leverage blossoming CFO relationships to advance the pursuits of IT throughout the organisation — significantly in terms of budgets and funding.

Get used to working extra carefully with CFOs

IT budgets are increasing as a share of general income, with 79% of respondents to Rimini Road’s report saying they’re rising. As IT balloons in significance, each by way of value and as a business-value driver, CIOs ought to anticipate elevated involvement and scrutiny from CFOs.

SEE: 4 confirmed methods to broaden your worth as a CIO in 2024

Rimini Road added that CFO dissatisfaction with tech investments might result in elevated involvement.

“This [CFO dissatisfaction] is a clear signal for CIOs to expect a heightened level of collaboration with their business counterparts, as well as to prepare for increased oversight to ensure that their tech choices are driving business value,” the report mentioned.

Examine how CFOs assess expertise selections

CIOs can profit from higher understanding how CFOs assess the benefit of recent expertise investments. As anticipated, Rimini Road discovered CFOs are extra targeted on the monetary impression of investments. The highest 5 components thought-about by CFOs in tech investments are:

- The strategic worth to the enterprise.

- The sustainability of the expertise answer.

- Anticipated return on funding.

- Ease of upkeep and assist.

- CAPEX and OPEX issues.

What CFOs need CIOs to give attention to

CFOs might have completely different concepts about what CIOs ought to give attention to. For instance, the analysis discovered CFOs need CIO priorities to incorporate danger administration and compliance, buyer success and engagement, main ERP reimplementation and migration, and revenue-generating expertise.

CIOs might have a special opinion from their CFO when discussing technology-related selections — particularly given the significance of danger administration and compliance for CFOs. However Rimini Road mentioned CIOs may be assured that, on the entire, CFOs are pushed extra by outcomes and return on funding than they’re by the expertise itself.

Go straightforward on ‘shiny toys’ and rising applied sciences

CIOs are largely concerned with rising applied sciences: 64% of CIOs surveyed are already investing in synthetic intelligence, whereas an extra 28% plan to take a position this yr. Nevertheless, they do perceive the have to be cautious, with 34% saying they’re solely supplementing current enterprise expertise quite than investing in new improvements.

SEE: 3 finest practices for CIOs utilizing rising expertise for enterprise outcomes

This warning might additional assist the CFO-CIO relationship. Rimini Road discovered that CFOs weren’t essentially against the introduction of rising applied sciences, however they indicated they need to guarantee they get the utmost worth from new expertise.

CFOs keen to assist CIOs with future IT budgets

CIOs stand to learn from the rising collaboration with CFOs. The report discovered that, if a CIO was to strategy a CFO with an affordable IT funding proposal that might show ROI, 23% of CFOs could be keen to strategy the board to safe the required funding.

This bodes effectively for CIOs into the long run. With a necessity to stay agile and spend money on new applied sciences like AI to maintain companies aggressive, assist from CFOs and a powerful relationship basis may very well be the fulcrum for future enterprise success.