Join each day information updates from CleanTechnica on e-mail. Or observe us on Google Information!

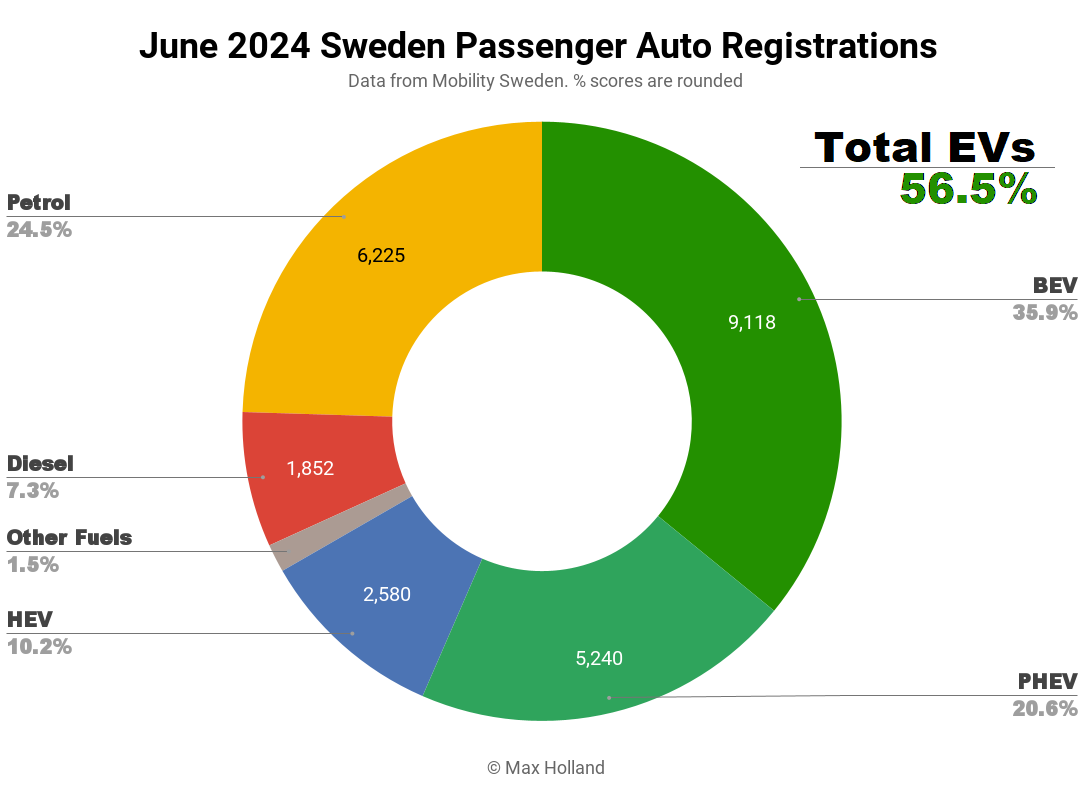

June noticed plugin EVs take 56.5% share in Sweden, down YoY from 59.2% in June 2023. BEV share fell YoY, whereas PHEV share was flat, and each misplaced quantity. General auto quantity was 25,401 items, down 10% YoY. The Tesla Mannequin Y was the most effective promoting BEV.

June’s end result noticed mixed plugin EVs take 56.5% share in Sweden, with full battery-electrics (BEVs) at 35.9% and plugin hybrids (PHEVs) at 20.6%. These shares evaluate YoY in opposition to 59.2% mixed, 38.7% BEV and 20.5% PHEV.

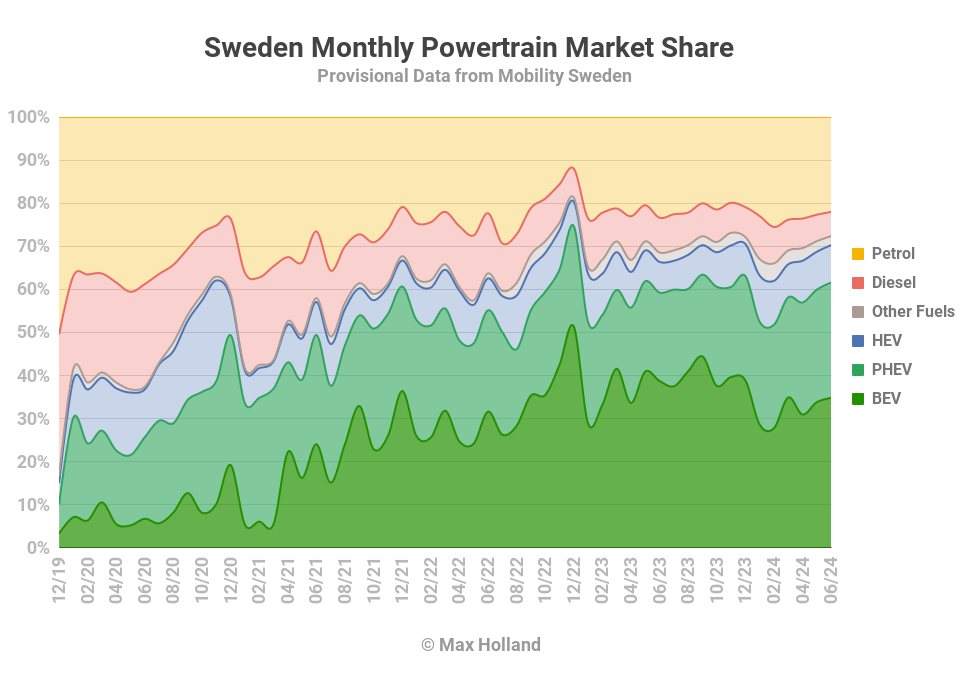

The 2024 development of BEV decline continues — after incentives dried up all through 2023, the economic system is in a squeeze, and lots of legacy producers refuse to market their half-hearted BEV choices at something apart from grossly over-inflated costs whereas pushing (and in some instances rising) their ICE gross sales. you, Stellantis.

June’s quantity noticed BEVs down 14% YoY (underperforming the general market) and PHEVs down virtually 10% (on par with the market).

Stepping again to take a look at 2024 12 months to this point, BEV share has fallen to 32.4% share, from 37.3% final June, resulting from BEV volumes underperforming the general market decline. H1 2024 noticed BEV quantity greater than 20% down YoY, at 42,757 items. Certainly, the general market is down in quantity (by 6% YoY) largely due to the drop in BEV volumes.

The one shiny(ish) spot is that PHEVs have taken up a few of the slack, and grown in quantity YoY throughout H1, by 8.4%. Even this isn’t sufficient to forestall mixed plugins from shedding share YoY, nevertheless. Cumulative 2024 mixed plugin share stands at 56.3%, from 58.0% YoY.

None of that is spectacular. In the meantime, the Chinese language market’s home EV penetration price is catching up with Sweden, and has elevated plugin share to 47% as of Could, even while incentives have decreased YoY. How is that this doable? The choice, the price, and the pricing of BEVs (and EREVs, and PHEVs) continues to enhance in China, greater than compensating for the trimming of incentives.

This pricing enchancment — the traditional sample within the ramp up of any new expertise — will not be the case in Europe, together with Sweden. As a substitute, European EV costs have elevated over the previous few years (even while batteries and different EV elements have grow to be cheaper)! This needs to be a serious scandal, however the legacy auto trade (and its earnings, and vested pursuits) are highly effective, and the political class seems to be complicit. #neoliberalcapitalism.

On account of Sweden’s weakening efficiency of plugin EVs, petrol-only powertrains truly elevated their share in June YoY, from 23.4% to 24.5%, since their quantity shrinkage was higher than the market common. One small piece of excellent information is that diesel share continues to steadily drop, right down to 7.3% in June, from 8.1% YoY.

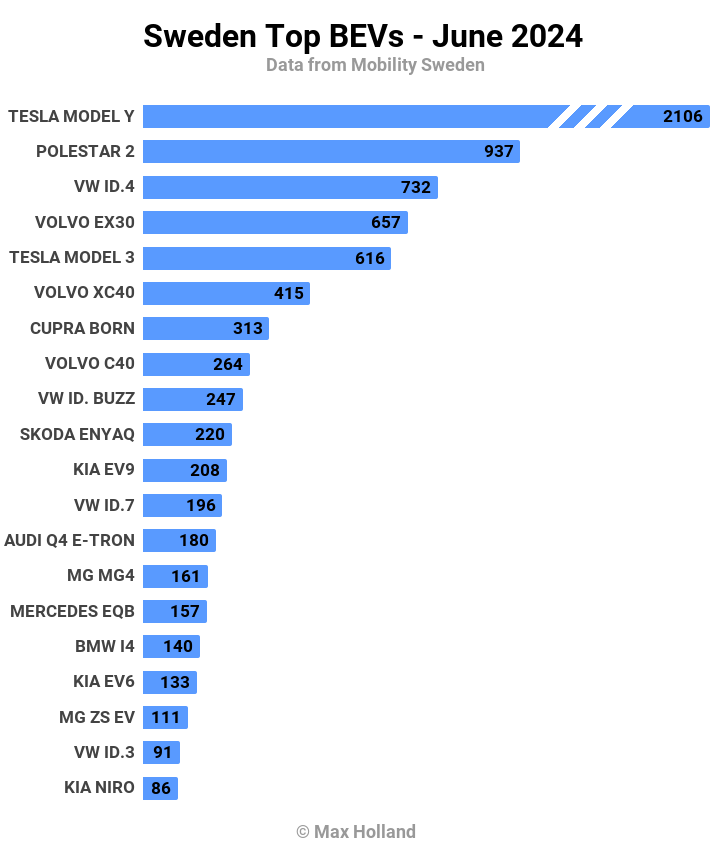

Finest Promoting BEVs

Again to its normal place, the Tesla Mannequin Y was the most effective promoting BEV in June, with 2,106 registrations.

The Polestar 2 has returned to type in current months, now taking second place with 937 items. The Volkswagen ID.4 took third place, with 732 items.

The Polestar 2 has returned to nice well being (4th general 12 months to this point), from a mean rank of tenth in H2 2023.

The brand new Volvo EX30 stepped again barely to 4th in June (from 2nd in Could), however nonetheless maintains regular numbers not removed from its 700 unit current month-to-month common.

Aside from the standard jostling for place, there have been no huge surprises within the prime 20 (and even within the prime 30).

We noticed one debutant BEV come onto the Swedish market in June, the brand new Audi Q6 e-tron, with an preliminary 3 items. That is an costly midsized premium SUV, with size of 4,771 mm and pricing from SEK 885,000 (€77,930). It’s rated for as much as 625 km (WLTP) vary, and DC charging 10–80% in 21 minutes. On the upside, the Q6 e-tron relies on Volkswagen Group’s new BEV platform, the PPE (shared with the brand new Porsche Macan and the upcoming Audi A6 e-tron), which is pretty revolutionary in each technical means and in general effectivity.

On the draw back, clearly, this lofty value level is already saturated with BEV choices, and gained’t translate to sufficient quantity by itself to maneuver the needle on the transition. But, the innovation and certain success of this Volkswagen Group platform within the higher segments will maintain the strain on competing premium manufacturers (BMW, Mercedes, Volvo, Jaguar Land Rover, Alfa Romeo, Maserati, Lexus, and many others.) to up their very own recreation. The ensuing R&D and expertise (and price) enhancements will finally make it right down to extra inexpensive segments.

When it comes to lately launched fashions, the Peugeot e-3008 (9 items) and the BYD Seal-U (7 items) had quieter months after their Could debut. The Mini Countryman (14 items) and Good #1 (4 items) had been additionally quieter following their April launch, and the Polestar 4 was silent (0 items). It’s nonetheless early days for all of those fashions, with uneven delivery, so we’ll regulate them.

Let’s flip to the longer-term image:

The Tesla Mannequin Y remains to be dominant, with quantity not removed from that of the following two fashions mixed. Its robust June efficiency truly led it to barely improve the hole over the runner-up, the Volvo EX30.

While there have been a number of small rating adjustments, and a few effectively established fashions waxed or waned (e.g., the Cupra Born is again to volumes it final noticed on the finish of 2022), there aren’t any nice surprises, past the quick ascent of the Volvo EX30.

One other comparatively first rate performer is the Volkswagen ID.7, which had a sluggish begin after its Swedish debut in November however has seen good volumes over the previous two months. It climbed to the fifteenth place. An identical sample, at a decrease magnitude, is current for the BMW i5 (September debut), which just about made this listing. It was in twenty fourth place. Plainly massive sedans nonetheless have followers in Sweden.

For a current have a look at Sweden’s fleet transition trajectory, examine my February report.

Outlook

The auto market drop of 10% YoY echoes the weak state of the broader economic system. The most recent accessible macroeconomic information from Q1 2024 was revised from a provisional GDP calculation of unfavourable 1.1% to a constructive 0.7%. This was a constructive flip from the earlier 3 quarters (all unfavourable), however let’s see if that’s sustained in Q2.

The inflation price cooled additional to three.7% in Could (newest information), from 3.9% in April. Rates of interest remained at 3.75% all through June, unchanged since early Could. Manufacturing PMI fell again barely to 53.6 factors in June, from 54.0 factors in Could.

The auto trade affiliation Mobility Sweden notes that the EV market has “stagnated” and urges authorities motion, however — actual discuss — past asking for extra handouts subsidies, shouldn’t additionally they examine their very own behaviour, and urge their very own members to cease overpricing their BEVs? In spite of everything, the UK BEV market has saved rising EV share regardless of cancelling subsidies two years in the past.

At what level does persevering with the tradition of subsidies counter-productively assist the false narrative that BEVs “are [inherently] more expensive” than ICE vehicles, and grow to be an excuse for foot-dragging? The Chinese language auto market exhibits that BEVs are now not dearer.

What are your ideas on Sweden’s EV market and trajectory of transition? Please leap into the dialogue beneath.

Have a tip for CleanTechnica? Wish to promote? Wish to recommend a visitor for our CleanTech Discuss podcast? Contact us right here.

Newest CleanTechnica.TV Movies

CleanTechnica makes use of affiliate hyperlinks. See our coverage right here.

CleanTechnica’s Remark Coverage

FB.AppEvents.logPageView();

};

(function(d, s, id){ var js, fjs = d.getElementsByTagName(s)[0]; if (d.getElementById(id)) {return;} js = d.createElement(s); js.id = id; js.src = "https://connect.facebook.net/en_US/sdk.js"; fjs.parentNode.insertBefore(js, fjs); }(document, 'script', 'facebook-jssdk'));