Quick info about FreshBooksBeginning value: $19/month. Key options:

|

Our star ranking: 4.1 out of 5

FreshBooks is an accounting, invoicing and billing software program program designed for small companies. All pricing plans help limitless invoices, estimates and expense monitoring, in contrast to some opponents that cap the variety of invoices. The software program does supply primary accounting options like receipt scanning and primary reviews, however invoicing and billing are the place it actually shines. Companies with extra complicated accounting wants might have to have a look at FreshBooks opponents comparable to QuickBooks.

On this article, I overview FreshBooks’ execs and cons, discover its most vital options and advocate comparable accounting software program merchandise that would give you the results you want if FreshBooks doesn’t.

FreshBooks’ pricing

FreshBooks provides 4 pricing plans. The primary three plans have clear pricing and are designed to satisfy the wants of freelancers and small and midsize companies. FreshBooks has an enterprise-level plan with customizable pricing and options, so that you’ll should contact the gross sales workforce for a pricing quote.

All FreshBooks plans include a 30-day free trial, which doesn’t require a bank card. FreshBooks runs frequent gross sales that lock in deep reductions in your first six months; nonetheless, you could select between the introductory low cost and the free trial — you’ll be able to’t have each. That being stated, FreshBooks’ 30-day money-back assure ensures you received’t should pay for the complete six months should you determine FreshBooks doesn’t give you the results you want inside that first month.

| Plan particulars are updated as of 6/14/2024. | ||||

FreshBooks Lite

Value: Begins at $19 per 30 days

True to its identify, the FreshBooks Lite plan provides primary options which might be centered on invoicing. With this plan, you’ll be able to ship limitless invoices and estimates to as much as 5 purchasers. You’ll be able to observe limitless estimates, however this plan doesn’t help cellular receipt seize. You will get paid by way of credit score and ACH financial institution transfers and run reviews at tax time, however that’s about it. When you want extra options or wish to invoice extra purchasers, you’ll should improve to the Plus plan.

FreshBooks Plus

Value: Begins at $33 per 30 days

The FreshBooks Plus plan helps you to bill as much as 50 purchasers per 30 days. This plan contains the whole lot in Lite, plus the flexibility to arrange recurring invoices and purchasers, mechanically seize receipts and run monetary and accounting reviews. With this plan, it is possible for you to to ask your accountant to the platform, which will probably be a giant assist come tax time.

FreshBooks Premium

Value: Begins at $60 per 30 days

The FreshBooks Premium plan permits you to ship limitless invoices to limitless purchasers, making it an acceptable selection for midsize companies. This plan contains the whole lot in Plus, along with automated invoice seize, customizable e-mail templates with dynamic fields and challenge profitability monitoring.

FreshBooks Choose

Value: Customized pricing solely

FreshBooks Choose is designed for bigger companies and enterprises. You could contact the gross sales workforce for a customized pricing quote. This plan contains the whole lot in Premium, plus entry to decrease transaction charges, the flexibility to take away FreshBooks branding from emails and a devoted quantity for unique help. This plan contains two workforce seats as an alternative of only one.

Further charges

FreshBooks customers can add the next options for a payment:

- Additional customers for $11 per individual per 30 days.

- Superior fee acceptance for $20 per 30 days (included with Choose plan).

FreshBooks’s key options

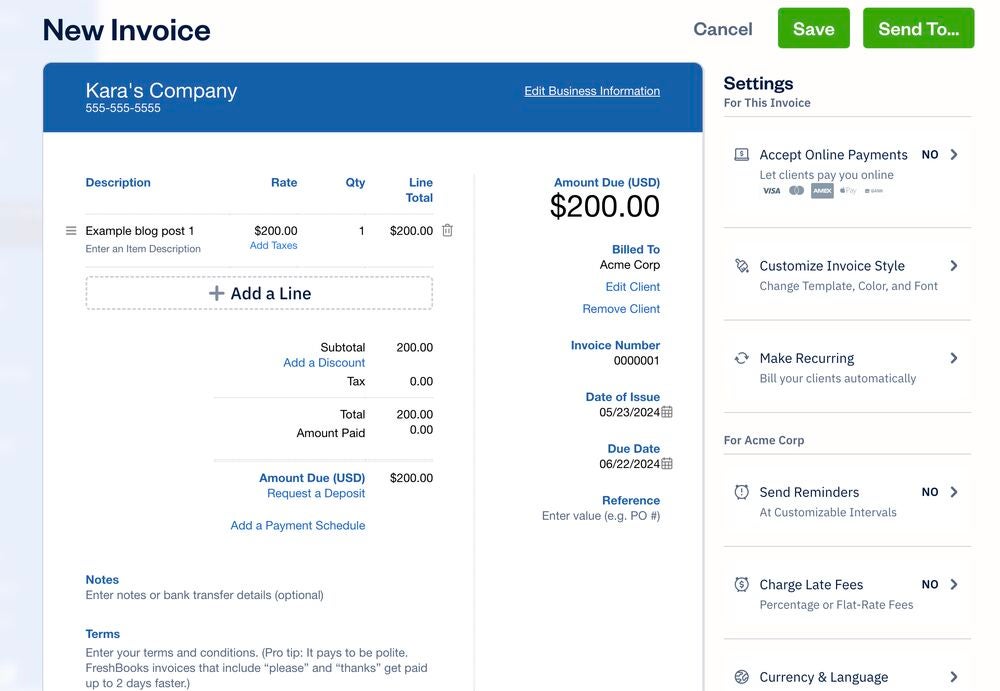

Limitless invoicing and estimates

Each FreshBooks plan contains limitless invoices — this units it aside from Xero’s most cost-effective plan, which limits customers to sending solely 20 invoices a month. There are two templates to select from, two fonts and a handful of colours. Personally, I’d like to see extra choices than this restricted choice to permit for better customization, however it’ll suffice for many small companies.

The method to create and ship an estimate is equally easy, and you’ll convert it to an bill with a single click on after the consumer approves it. Further invoicing options embrace automated recurring invoices, automated late charges for overdue invoices and automatic upcoming-payment reminders.

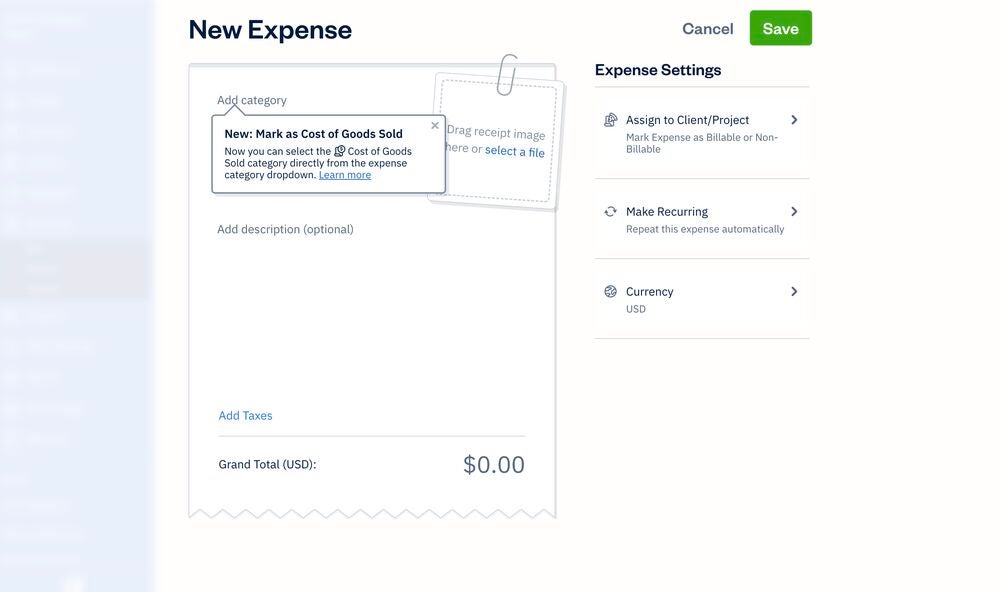

Expense monitoring and categorization

FreshBooks syncs with greater than 14,000 monetary establishments and mechanically imports your information by means of a safe 128-bit SSL encryption. You add your bills or seize them utilizing the cellular app, then assign them to purchasers and connect them to invoices for reimbursement. The software program will mechanically categorize bills to easily tax write-offs.

FreshBooks just lately launched a brand new function known as Journal Entries, which lets you observe transactions exterior of Invoices and Bills, comparable to depreciation or loans. You could allow Superior Accounting so as to have the ability to entry the Journal Entries function, so I solely advocate utilizing it should you’re aware of barely extra complicated accounting options.

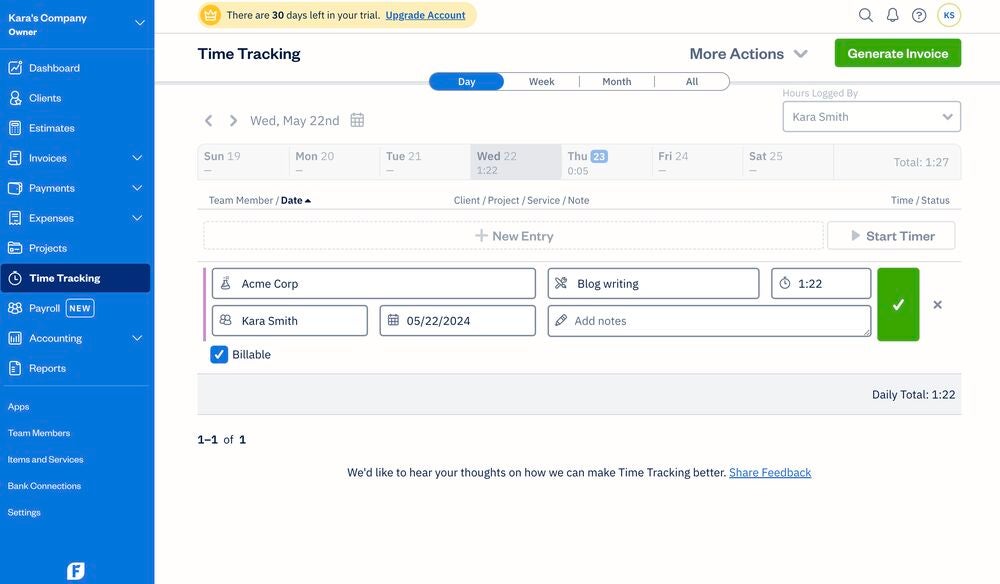

Time monitoring

FreshBooks provides a local time-tracking function so you’ll be able to observe billable hours and add line gadgets to invoices. I discovered the timer very simple and intuitive to function, and including a time entry after the actual fact was tremendous fast. All I needed to do was select the consumer, choose the date and add the service I used to be engaged on and the date I carried out the work.

If you’re able to invoice your consumer, hit the massive inexperienced Generate Bill, and FreshBooks will stroll you thru the method. You’ll be able to add time entries as line gadgets proper from the invoicing device. As an employer, you’ll be able to type hours labored by consumer, workforce member, date and challenge to see how work time is being spent.

I like that FreshBooks provides this native time-tracking function, in contrast to many opponents that depend on third-party integrations. Nevertheless, the timer is fairly easy and doesn’t help superior time monitoring like getting into specific billing codes for particular person jobs.

Cost acceptance

When you’ve despatched the bill, purchasers will pay you one among 3 ways: FreshBooks funds, Stripe and PayPal. All of those strategies cost an ordinary payment of two.9% + $0.30 per transaction for many playing cards and 1% for direct financial institution ACH transfers. Subscribers to the FreshBooks Choose plan will get even decrease transaction charges, however FreshBooks doesn’t disclose what that lowered charge is.

The non-obligatory Superior Funds add-ons let your corporation settle for bank card funds over the cellphone. It prices $20 per 30 days for the three most cost-effective plans and is included on the Choose plan. This function additionally helps you to arrange recurring billing profiles for purchasers you’re employed with repeatedly.

FreshBooks execs

- Constructed-in time and challenge monitoring: All FreshBooks plans include native time and challenge monitoring, so you’ll be able to sync the info straight to your invoices.

- Extremely rated cellular accounting apps: With FreshBooks’ iOS and Android apps, customers can create invoices, scan receipts and observe mileage on the go. The iOS app scores 4.7/5 on the App Retailer, whereas the Android app charges 4.5/5 on Google Play.

- Person-friendly interface: Each the cellular and net apps are user-friendly and intuitive, with setup solely taking a couple of minutes.

- Payroll integration: FreshBooks provides an non-obligatory payroll add-on that’s powered by Gusto, probably the most widespread software program choices on the market. You could contact the gross sales workforce for pricing info.

FreshBooks cons

- Most cost-effective plan limitations: FreshBooks Lite doesn’t embrace free accountant entry, double-entry accounting or financial institution reconciliation, in contrast to many shut opponents.

- Price for extra customers: Further customers for FreshBooks price an additional $11 per individual per 30 days. For context, Zoho Books costs simply $3 per additional person per 30 days.

- Primary stock monitoring solely: FreshBooks has solely primary built-in stock administration options, although you’ll be able to combine it with some third-party integration monitoring software program.

- Restricted scalability: Though FreshBooks provides a customizable plan for greater companies, its streamlined options work a lot better for small and midsize companies. Its comparatively restricted collection of third-party integrations provides much less flexibility for greater corporations.

Options to FreshBooks

Xero: Greatest for product-based companies

Our star ranking: 4.4 out of 5

Beginning value: $15 per 30 days

Xero’s key options

Xero accounting software program is designed for freelancers and small and midsize enterprise house owners. It provides easy instruments for sending invoices, accepting funds and monitoring funds. It really works with Hubdoc, so you’ll be able to add payments and receipts for simpler monetary administration.

In contrast to FreshBooks, Xero contains stock monitoring with each plan. It helps you to add as many customers as you need at no further price, although every subscription is restricted to 1 group, so it’s not the only option for enterprise house owners with a number of corporations.

Xero’s execs

- Integration with greater than 1,000 third-party apps.

- Person-friendly software program interface and cellular app.

- Automated recurring invoicing.

- Financial institution reconciliation, accountant entry and limitless purchasers in all plans.

Xero’s cons

- Most cost-effective plan limits you to twenty invoices and 5 payments per 30 days.

- Expense and challenge monitoring solely accessible in the costliest plan.

- 24/7 help solely accessible by way of dwell chat — no phone quantity.

Be taught extra about how FreshBooks and Xero evaluate in our complete evaluation of FreshBooks vs. Xero, and browse our Xero overview.

QuickBooks On-line: Greatest for rising companies

Our star ranking: 4.6 out of 5

Beginning value: $30 per 30 days

QuickBooks On-line’s key options

Intuit QuickBooks On-line is without doubt one of the hottest accounting software program of all time. Its plans help companies of all sizes, from self-employed freelancers and contractors to enterprises. With QuickBooks, you’ll be able to observe bills, ship a vast variety of invoices per 30 days, settle for funds on-line and generate estimates.

QuickBooks On-line has extra bookkeeping and accounting options than FreshBooks, particularly on the upper tier plans. When you’re keen to pay for them, QuickBooks’ dearer plans supply superior options like invoice administration, challenge profitability monitoring and stock administration.

QuickBooks On-line’s execs

- Accountant entry, financial institution reconciliation and double-entry accounting.

- Mileage monitoring, earnings monitoring and tax categorization.

- Extraordinarily scalable plans.

- Superior accounting options accessible.

QuickBooks On-line’s cons

- A lot increased beginning value than most opponents.

- Variety of customers restricted on every plan.

- Poor customer support popularity.

Be taught extra about how QuickBooks On-line and FreshBooks evaluate in our complete evaluation of QuickBooks vs. FreshBooks, and browse our QuickBooks On-line overview.

Wave Accounting: Greatest free accounting software program

Our star ranking: 4 out of 5

Beginning value: $0 per 30 days

Wave’s key options

Wave Accounting is without doubt one of the solely accounting software program that provides a very free plan. Nevertheless, a number of the most useful options, comparable to automated financial institution transaction import and cellular receipt seize, are restricted to the Professional paid plan, which prices $16 a month.

A lot of Wave’s options overlap with FreshBooks’, together with its customizable invoicing device, expense monitoring and on-line fee bills. In contrast to FreshBooks, Wave makes use of double-entry accounting. With Wave’s paid plan, you’ll be able to add a vast variety of customers and extra completely automate your earnings monitoring.

Wave’s execs

- Free without end plan accessible.

- Useful accounting app for each iOS and Android.

- Seamless integration with Wave Payroll.

Wave’s cons

- No stock administration, time monitoring or challenge monitoring.

- Restricted third-party integrations.

- Much less scalable than opponents.

Be taught extra about how Wave Accounting and FreshBooks evaluate in our complete evaluation of Wave Accounting vs. FreshBooks and take a look at our Wave Accounting overview.

Evaluation methodology

To guage FreshBooks, I arrange a free account, seen a demo and created invoices throughout the software program as a part of our hands-on take a look at challenge. I fastidiously thought-about person evaluations from trusted third-party websites. Options that I prioritized included invoicing, billing, costly monitoring, time monitoring and fee acceptance. I thought-about pricing, ease of use and customer support in the course of the writing of this overview.