Cell funds are remodeling how customers and companies work together. As extra prospects desire to pay utilizing their smartphones and different gadgets, small enterprise homeowners want to remain forward of the curve. However what precisely are cell cost companies, and the way do they work?

On this information, we’ll discover key cell cost strategies, how they perform, and why they matter for your enterprise. Whether or not you’re a brand new small enterprise proprietor or seeking to broaden your cost choices, understanding these applied sciences will enable you keep aggressive.

What are cell funds?

Cell funds check with any monetary transaction made through a cell system, akin to a smartphone or pill. These funds can happen in individual, on-line, or by way of an app. They use applied sciences like brief message service (SMS), cell wallets, near-field communication (NFC), and fast response (QR) codes.

This methodology of transacting boasts a sooner, extra handy method for purchasers to finish transactions. Clients don’t should fumble with plastic financial institution playing cards and germ-laden money.

For small companies, accepting cell funds can enhance income, slash wait occasions, and dish out a seamless checkout course of. Plus, it indicators an embrace of the most recent know-how. This issue can lure in individuals pursuing a extra subtle shopping for expertise.

Right here’s a breakdown of six of the preferred cell cost strategies:

1. Textual content to pay funds

The time-honored textual content message doubles as a cash-sending automobile. SMS (brief message service) or textual content to pay funds allow prospects to make purchases through textual content message. These transactions are sometimes accomplished by way of the client’s cell pockets – which we’ll contact on later.

Although handy, textual content to pay is just not ultimate for point-of-sale transactions that have to be accomplished and verified rapidly.

The way it works

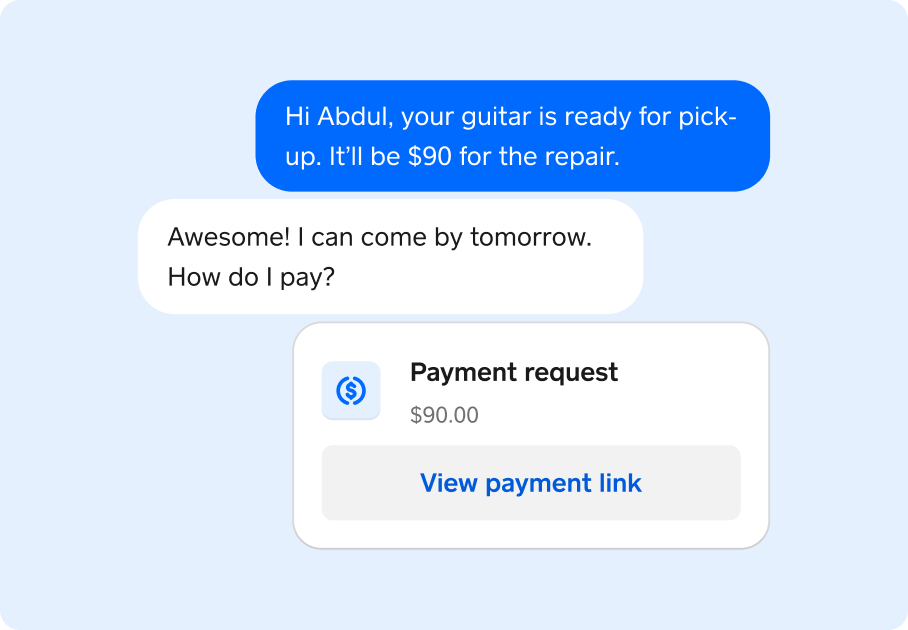

The enterprise sends the client a invoice, bill, or cost request over textual content. The textual content sometimes features a safe cost hyperlink that’s encrypted for further safety.

Why it’s vital for small companies

SMS funds are perfect for companies needing a easy, easy-to-use choice. It’s handy for accumulating payments or recurring funds.

Concerns

The simplicity of SMS funds is interesting from a buyer’s standpoint. Nonetheless, they’re extra susceptible to fraud and chargebacks. Plus, some cell carriers cost per textual content message.

2. Cell wallets

Cell wallets like Apple Pay, Google Pockets, and Samsung Pay are well-known instruments. These apps retailer cost data digitally. This preloaded knowledge permits customers to transact with a easy faucet.

The way it works

Clients enter their credit score or debit card particulars in a cell pockets app. When able to pay, they whip out the app. From there, an individual can faucet their smartphone on a contactless cost terminal or choose their saved card for on-line purchases.

For many smaller purchases, no signatures or safety particulars are crucial. Nonetheless, with bank-grade encryption, one-time safety tokens, and different anti-fraud measures, cell wallets are thought to be very safe instruments.

Why it’s vital for small companies

Cell wallets allow a quick, safe, and contactless method for purchasers to pay. For companies, accepting cell wallets can scale back the friction of checkout, which can enhance buyer satisfaction and gross sales. Moreover, cell wallets use encryption and tokenization for safety, making them a protected choice for companies and prospects alike.

Concerns

Companies should be sure that their point-of-sale (POS) system is NFC-enabled. Whereas most trendy techniques help cell wallets, some older terminals could require an improve.

3. Peer-to-peer (P2P) cost apps

Peer-to-peer (P2P) cost apps like Venmo, PayPal, and Money App permit people to ship and obtain cash rapidly. Though these apps are designed for person-to-person transactions, many small companies, freelancers, and repair suppliers use them commonly.

The way it works

Clients switch cash instantly from their app account to a enterprise’s account. In contrast to tap-to-pay, this methodology often includes manually trying up a receiver’s account within the app. In consequence, individuals are prompted to create a display screen identify or present their e-mail deal with.

Why it’s vital for small companies

P2P cost apps are perfect for companies with low quantity or pop-up outlets, freelancers, and service-based suppliers. They’re simple to arrange, sometimes have minimal charges, and provide quick cost transfers. However they’re supposed for extra private cases, therefore the usage of display screen names and transaction notes.

Concerns

Whereas P2P apps are handy, they aren’t designed for high-volume enterprise transactions. Many of those platforms restrict the amount of cash that may be despatched or acquired in a given timeframe. Plus, funds are handled like money, which means there are fewer protections towards fraud and errors.

4. Banking apps

Cell banking apps provided by monetary establishments allow prospects to switch cash, pay payments, and generally make purchases instantly from their financial institution accounts. These apps may help funds by way of companies like Zelle.

The way it works

Clients use their financial institution’s cell app to switch cash or full funds. Some banking apps permit companies to arrange a cost hyperlink, letting prospects pay instantly by way of their financial institution.

Why it’s vital for small companies

Banking apps are an economical method for small companies to simply accept funds. Since transactions occur instantly between banks, they usually have decrease charges than bank card processing.

Concerns

Whereas cell banking apps are safe and environment friendly, they don’t present the identical comfort as different cost strategies. Not all prospects use the identical financial institution, and thus the identical app. Plus, the cost course of might be slower in comparison with different cell cost applied sciences.

5. QR code funds

QR code funds are prized for his or her simplicity and low-cost implementation. They’re an excellent mix of comfort and safety. However they rely closely on a buyer’s tech abilities and Web connection.

The way it works

A enterprise generates a QR code that hyperlinks to a cost gateway. The shopper scans the code with their smartphone, which opens a cost interface. From there, the client completes the transaction by choosing their cost methodology.

Why it’s vital for small companies

This cost methodology is straightforward to arrange. You possibly can mission the QR code on something, from a serviette to a pc display screen. This simplicity is nice for all types of conditions, from pop-up occasions to tableside funds in a restaurant.

Concerns

QR code funds require an Web connection and a more moderen mannequin smartphone. So, if cell reception is spotty or a buyer nonetheless makes use of a flip cellphone, this methodology can hit a snag. And even with the appropriate tools, the cryptic look of a code means some individuals could really feel mystified about methods to pay.

You’ll even have to make sure your QR code results in the right place. A lifeless hyperlink is a transaction killer.

6. NFC contactless funds

NFC (near-field communication) know-how permits contactless funds. This idea permits prospects to faucet their cell system or card on a terminal to pay. This methodology is mostly used with cell wallets. However it’s additionally the know-how behind faucet to pay credit score or debit playing cards.

The way it works

Clients carry their NFC-enabled system (akin to a cellphone or wearable) near a cost terminal geared up to help this know-how. The transaction is accomplished wirelessly inside a few seconds. There may be typically no want for signatures or different hands-on steps.

Why it’s vital for small companies

NFC contactless funds are championed for his or her comfort, velocity, and safety. For companies with excessive transaction volumes, this methodology cuts transaction occasions dramatically. It additionally gives a hygienic, touch-free cost choice.

Concerns

Companies will want a POS system that helps NFC know-how. Whereas this buy includes budgeting, the advantages of sooner, safer transactions can quickly recoup prices.

FAQs

What are the advantages of cell funds for small companies?

Cell funds provide small companies sooner checkout processes, decreased reliance on money, decrease transaction prices, and the flexibility to simply accept funds remotely or on the go. All of those components can enhance income and enhance buyer satisfaction. In addition they mission a extra tech-savvy picture of your enterprise, which boosts public notion.

How do cell cost strategies differ from conventional cost strategies?

Cell cost strategies depend on smartphones and apps like Google Pay and Apple Pay. These instruments transfer cash through near-field communication, QR codes, or textual content messages. This dependence on know-how separates it from conventional, tangible types of cost, like money. Plus, cell funds are typically sooner, extra handy, and safe resulting from options like tokenization and biometric authentication.

How do I examine if my cellphone is suitable with cell funds?

To make sure compatibility, examine that your system helps near-field communication (NFC) or Bluetooth for contactless funds. Most trendy smartphones have this know-how built-in. Some cell funds contain a QR code, which solely requires your cellphone’s digital camera app.