Join day by day information updates from CleanTechnica on electronic mail. Or comply with us on Google Information!

The newest World Power Report from the Worldwide Power Company claims the world will spend greater than $3 trillion this 12 months on vitality investments, with $2 trillion of that being spent on clear vitality — principally solar energy — which is double the quantity invested in clear vitality final 12 months. The rest of the vitality investments can be in fossil fuels, the IEA report says.

“Clean energy investment is setting new records even in challenging economic conditions, highlighting the momentum behind the new global energy economy. For every dollar going to fossil fuels today, almost two dollars are invested in clean energy,” stated IEA govt director Fatih Birol. “The rise in clean energy spending is underpinned by strong economics, by continued cost reductions and by considerations of energy security. But there is a strong element of industrial policy, too, as major economies compete for advantage in new clean energy supply chains. More must be done to ensure that investment reaches the places where it is needed most, in particular the developing economies where access to affordable, sustainable and secure energy is severely lacking today.”

When the Paris Settlement was reached in 2015, the mixed funding in renewables and nuclear for electrical energy era was twice the quantity going to fossil fuel-derived energy. In 2024, that is set to rise to 10 occasions as a lot, the report says, with photo voltaic PV main the transformation of the facility sector. Extra money is now going into photo voltaic PV than all different electrical energy era applied sciences mixed. In 2024, funding in photo voltaic PV is about to develop to $500 billion as falling module costs spur new investments.

China is about to account for the most important share of unpolluted vitality funding in 2024, reaching an estimated $675 billion. This outcomes from robust home demand throughout three industries specifically — photo voltaic, lithium batteries, and electrical automobiles. Europe and america comply with, with clear vitality funding of $370 billion and $315 billion respectively. These three main economies alone make up greater than two thirds of worldwide clear vitality funding, underlining the disparities in worldwide capital flows into vitality.

Too A lot Oil & Gasoline Funding

International upstream oil and gasoline funding is anticipated to extend by 7% in 2024 to achieve $570 billion, following the same rise in 2023. The expansion in spending in 2023 and 2024 is predominantly by nationwide oil corporations within the Center East and Asia. The report finds that oil and gasoline funding in 2024 is broadly aligned with the demand ranges implied in 2030 by as we speak’s coverage settings, however far increased than projected in eventualities that hit nationwide or world local weather objectives. Clear vitality funding by oil and gasoline corporations reached $30 billion in 2023, accounting for less than 4% of the business’s general capital spending, in keeping with the report. In the meantime, coal funding continues to rise, with greater than 50 gigawatts of unabated coal-fired energy accepted in 2023, the best since 2015.

Along with financial challenges, grids and electrical energy storage have been a big constraint on clear vitality transitions. However spending on grids is rising and is about to achieve $400 billion in 2024, having been caught at round $300 billion yearly between 2015 and 2021. The rise is basically as a result of new coverage initiatives and funding in Europe, america, China and a few nations in Latin America. In the meantime, investments in battery storage are taking off and set to achieve $54 billion in 2024 as prices fall additional. But once more, this spending is very concentrated. For each greenback invested in battery storage in superior economies and China, just one cent was invested in different rising and growing economies.

US Photo voltaic Energy Faces Tariff Will increase

Solar energy builders within the US will see vital challenges this 12 months. On June 6, 2024, the two-year pause on tariffs for imported photo voltaic panels put in place by President Biden expired. US warehouses are bulging with 35 gigawatts’ price of photo voltaic panels imported because the Biden administration eliminated tariffs on panels from Malaysia, Thailand, Cambodia, and Vietnam in 2022. That motion was meant to hurry up home tasks to struggle local weather change. It has labored a deal with, however now the tariffs can be utilized to these 35 gigawatts of panels if they don’t seem to be put in inside 180 days. Reuters says to count on a frenzy of exercise within the solar energy business within the subsequent six months.

Firms have already dramatically elevated mission constructing, with utility-scale installations hovering 135% to 9.8 GW within the first quarter, in keeping with Wooden Mackenzie. “The temporary tariff moratorium did its job to ensure a sufficient supply of solar modules to support the need for increased clean energy deployment,” stated Stacy Ettinger, senior vp of provide chain and commerce for the Photo voltaic Power Industries Affiliation.

An lawyer for U.S. photo voltaic producers who’re in search of new tariffs on Southeast Asian imports stated it was unrealistic to count on all of the stock for use within the subsequent six months. “The tariff moratorium led to this surge and glut of inventories that we’re seeing today, that has also contributed to the 50% price collapse in the market that is harming the U.S. industry,” Tim Brightbill, a commerce lawyer with Wiley Rein, stated, referring to home producers of panels. All of which fits to indicate which you can’t please all of the folks on a regular basis.

SEIA Q2 Photo voltaic Energy Report

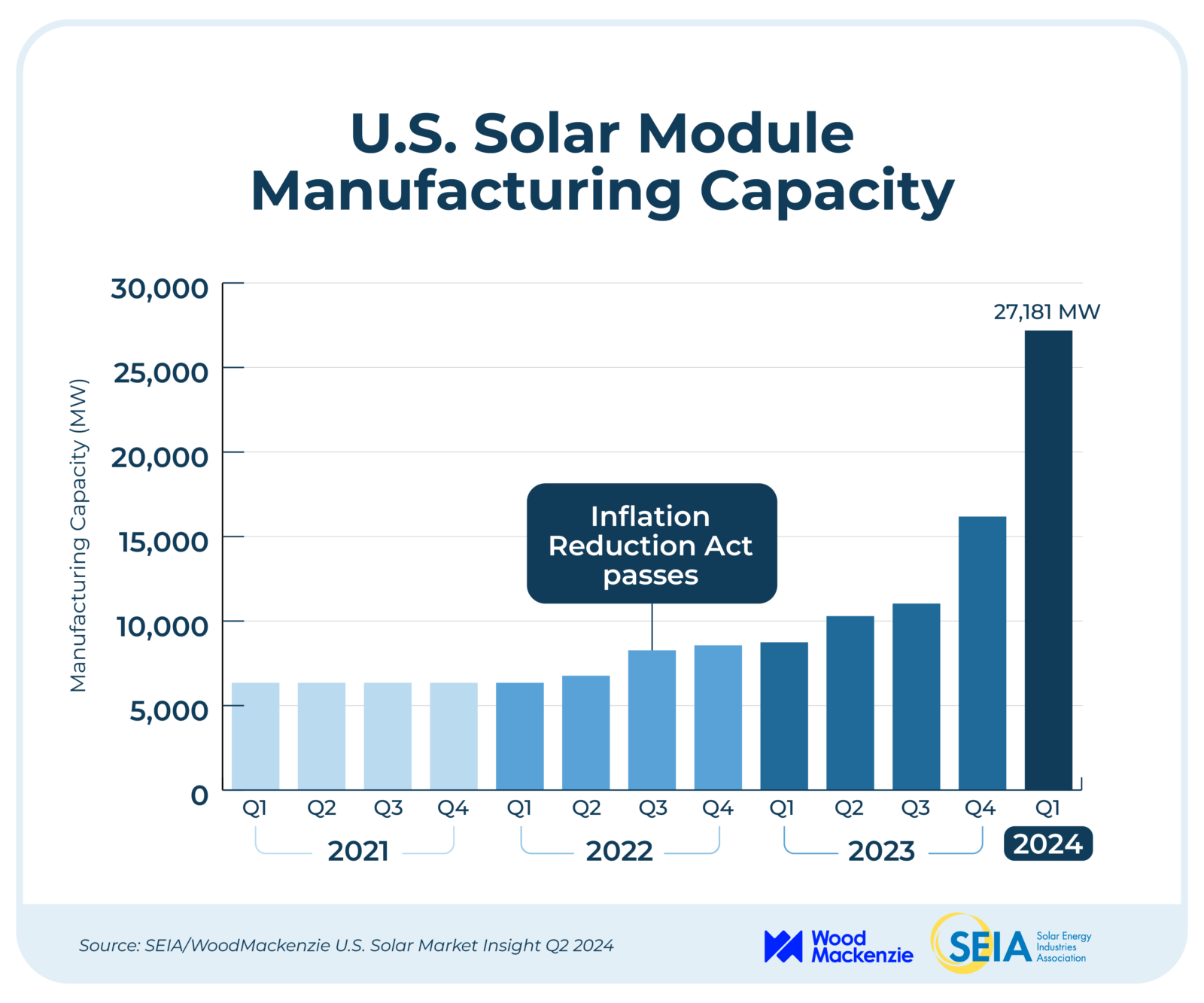

The US Photo voltaic Market Perception Q2 2024 report ready by SEIA and Wooden Mackenzie, says the whole of US photo voltaic module manufacturing capability now exceeds 26 GW yearly. That’s not sufficient to provide of all of America’s wants, however it’s far various years in the past, earlier than the manufacturing incentives within the Inflation Discount Act grew to become out there. Wooden Mackenzie now tasks that the U.S. photo voltaic business will set up 40 GW 0f solar energy in 2024.

“This quarter proves that new federal investments in clean energy are revitalizing American manufacturing and strengthening our nation’s energy economy,” stated SEIA CEO Abigail Ross Hopper. “Whether it’s a billion dollar investment in a nearby solar project or a new manufacturing plant employing hundreds of local workers, the solar and storage industry is uplifting communities in every state across this country.” Large development within the utility-scale market is driving document photo voltaic deployment figures because the section added practically 10 GW of recent capability in Q1. Florida and Texas noticed robust utility-scale development and led all states for brand new photo voltaic capability in Q1. Different markets like New Mexico and Ohio additionally had robust quarters, putting in 686 and 546 megawatts, respectively.

“The U.S. solar industry continues to show strength in terms of deployments,” stated Michelle Davis, head of worldwide photo voltaic at Wooden Mackenzie and lead creator of the report. “At the same time, the solar industry faces a number of challenges to its continued growth including availability of labor, high voltage equipment constraints, and continued trade policy uncertainty.” Whole US photo voltaic capability is anticipated to double over the following 5 years to 438 GW by 2029.

An Earthquake In The Photo voltaic Energy Business In California

All that excellent news makes you surprise what on this planet is occurring in California, the place current coverage adjustments by the state’s public utilities fee have eviscerated the rooftop photo voltaic business. The CPUC has all types of excuses for its actions, however the backside line appears to be a powerful choice for utility-scale photo voltaic quite than photo voltaic methods that profit particular person owners. It’s true that — per panel put in — utility-scale photo voltaic is cheaper than rooftop photo voltaic, however that solely tells a part of the story.

Native energy era provides people management over their vitality utilization. Name it the democratization of vitality, if you’ll. By and enormous, massive investor-owned utility corporations detest the idea of an vitality democracy. They’re steeped in a protracted custom of getting an absolute monopoly over electrical energy and are proof against something that challenges that monopoly. Their place is mainly, “It’s our electricity and we will control how it is generated and how much you will pay for it!” That perspective might induce some to construct their very own photo voltaic methods and battery storage, and break free from reliance on the grid solely.

They could not get the advantage of no matter paltry compensation their utility firm is keen to present them, however the federal tax credit out there coupled with the power to by no means pay a utility invoice ever once more might attraction to a sure section of society. If sufficient folks select that route, the businesses can be in the same state of affairs as oil corporations are in as we speak as they watch electrical automobiles and vehicles lower into the demand for gasoline and diesel gas. Few would really feel a lot sympathy for these utility corporations if that occurred.

Have a tip for CleanTechnica? Need to promote? Need to counsel a visitor for our CleanTech Discuss podcast? Contact us right here.

Newest CleanTechnica.TV Movies

CleanTechnica makes use of affiliate hyperlinks. See our coverage right here.

FB.AppEvents.logPageView();

};

(function(d, s, id){ var js, fjs = d.getElementsByTagName(s)[0]; if (d.getElementById(id)) {return;} js = d.createElement(s); js.id = id; js.src = "https://connect.facebook.net/en_US/sdk.js"; fjs.parentNode.insertBefore(js, fjs); }(document, 'script', 'facebook-jssdk'));