Join day by day information updates from CleanTechnica on e mail. Or observe us on Google Information!

We’ve already written concerning the high promoting electrical automotive fashions on this planet within the month of Might. Now let’s take a look at the manufacturers and OEMs promoting essentially the most electrical automobiles.

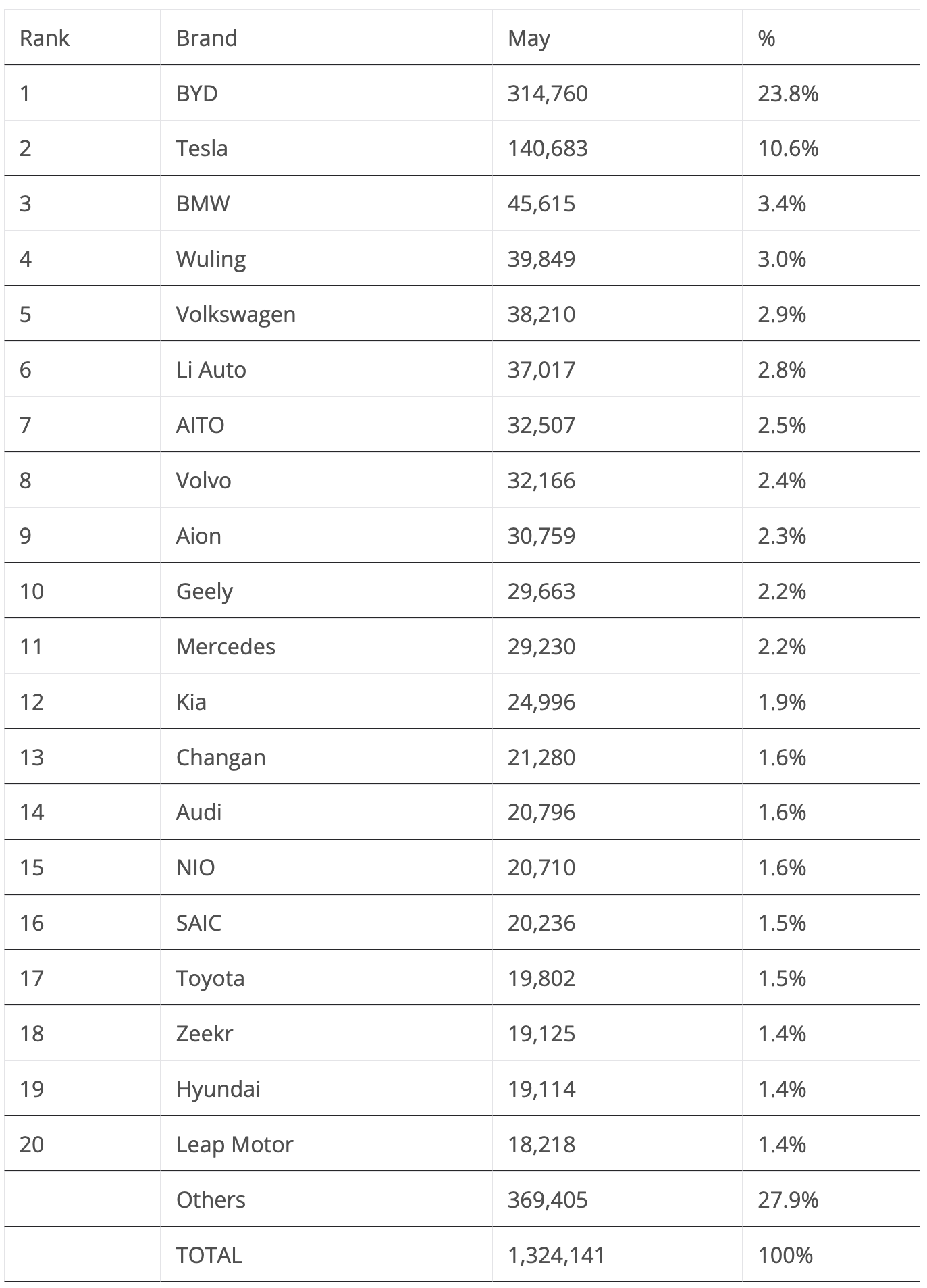

Prime Promoting Manufacturers

In Might, #1 BYD, now deep into pricing out the ICE competitors (and fairly a number of different EVs on the best way…), didn’t disappoint. It scored some 314,000 registrations, its second greatest consequence ever, solely behind final December’s rating. Count on its gross sales to proceed steadily rising all year long.

Wanting nearer on the BYD gross sales breakdown, whereas the BEV aspect of gross sales continues to develop at a gradual tempo (+22% in Might), it’s the PHEV aspect that’s actually shining, leaping 54% YoY. Might was its third document month in a row, with some 172,000 models delivered. BYD’s PHEVs proceed to revenue from pricing out the ICE competitors. Think about that — a PHEV being cheaper than its equal petrol mannequin … now this is disruption!

As for Tesla, after the current gross sales drops, Might’s consequence introduced encouraging numbers. The corporate’s 140,000 registrations characterize a 300-unit enhance in comparison with the identical month final yr. That is partially due to the amount enhance of the Cybertruck, now at over 2,000/month. Might noticed an successfully flat development charge, however that’s welcome information after three straight months of falling gross sales. Nonetheless, YTD, gross sales are nonetheless down by 8% YoY, so June will probably be vital to getting higher perception into Tesla’s gross sales conduct this yr. If June sees a return to development, then it can appear that the worst is over. If not, then Might was a blip and 2024 may properly be the primary yr of dropping gross sales for the US make.

Beneath the highest two galactics, BMW once more gained the final place on the rostrum. Volkswagen, now seeking to recuperate on misplaced time, resulted in fifth with 38,210 registrations, a brand new yr greatest — a lot due to good outcomes from its star gamers, the ID.4 and ID.3.

One other model seeking to be again on observe is Li Auto, with the startup benefitting from the L6 launch to attain a brand new yr greatest efficiency of 37,017 gross sales.

The second half of the desk noticed a stunning NIO carry out a document consequence, getting 20,710 registrations, a lot due to the great outcomes of the ES6 SUV and the ET5 sedan/station wagon (I want all of the luck for NIO’s ET5 wagon — we want extra load luggers like these to assist individuals get off crossovers and SUVs).

Kia ended Might in twelfth, with 24,996 models, its greatest end in 10 months, and with the upcoming EV5 and EV3 touchdown quickly, count on the Korean make to proceed increasing gross sales all year long.

A last point out goes out to Leap Motor, which joined one of the best sellers desk in #20 with 18,218 registrations, a brand new yr greatest. Is that this one other Chinese language model to observe intently?

In April, recognized manufacturers like Ford, Peugeot, and Jeep have been not noted of the highest 20, being changed by extra Chinese language manufacturers. Total, China had 11 manufacturers within the high 20.

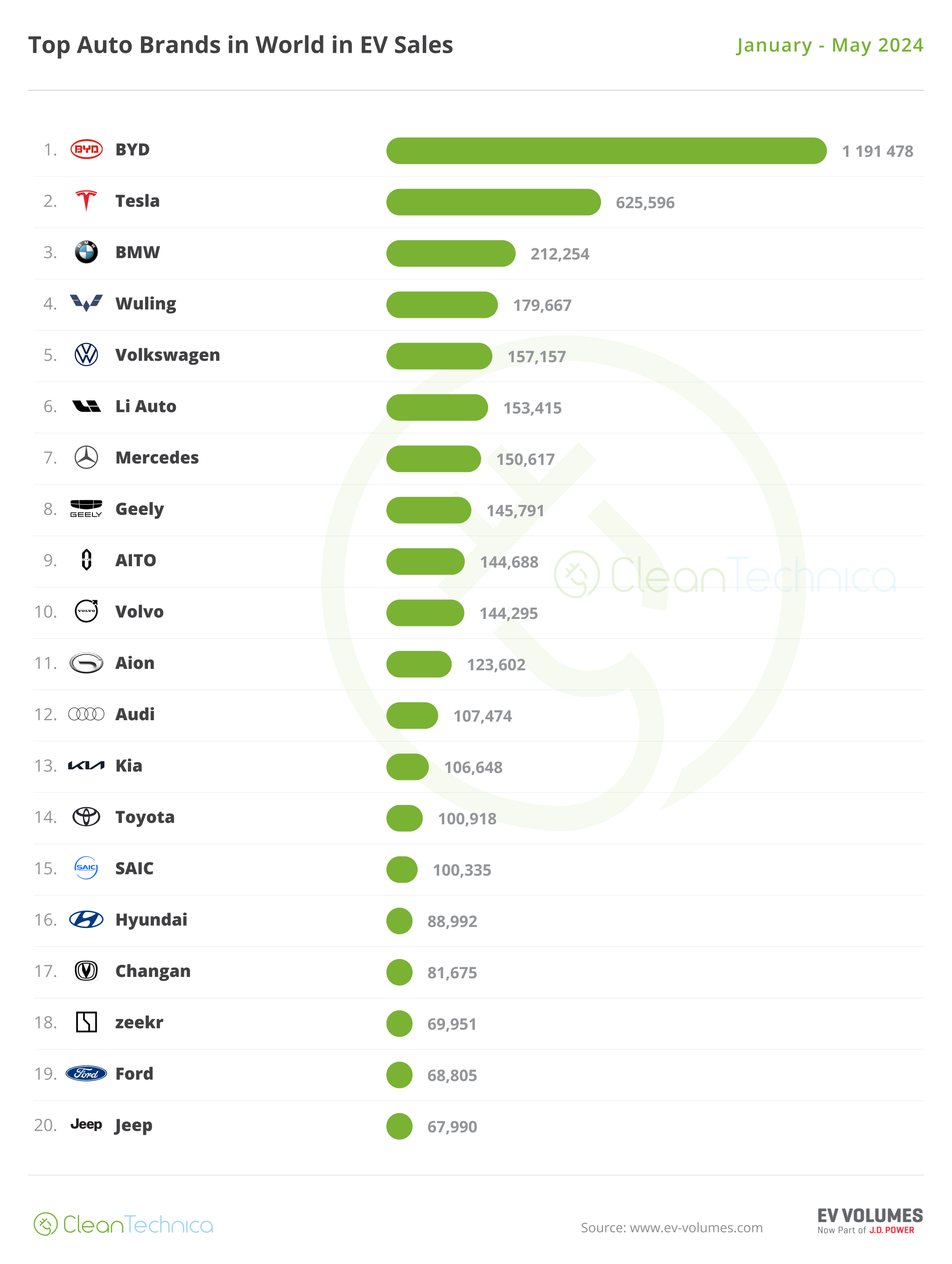

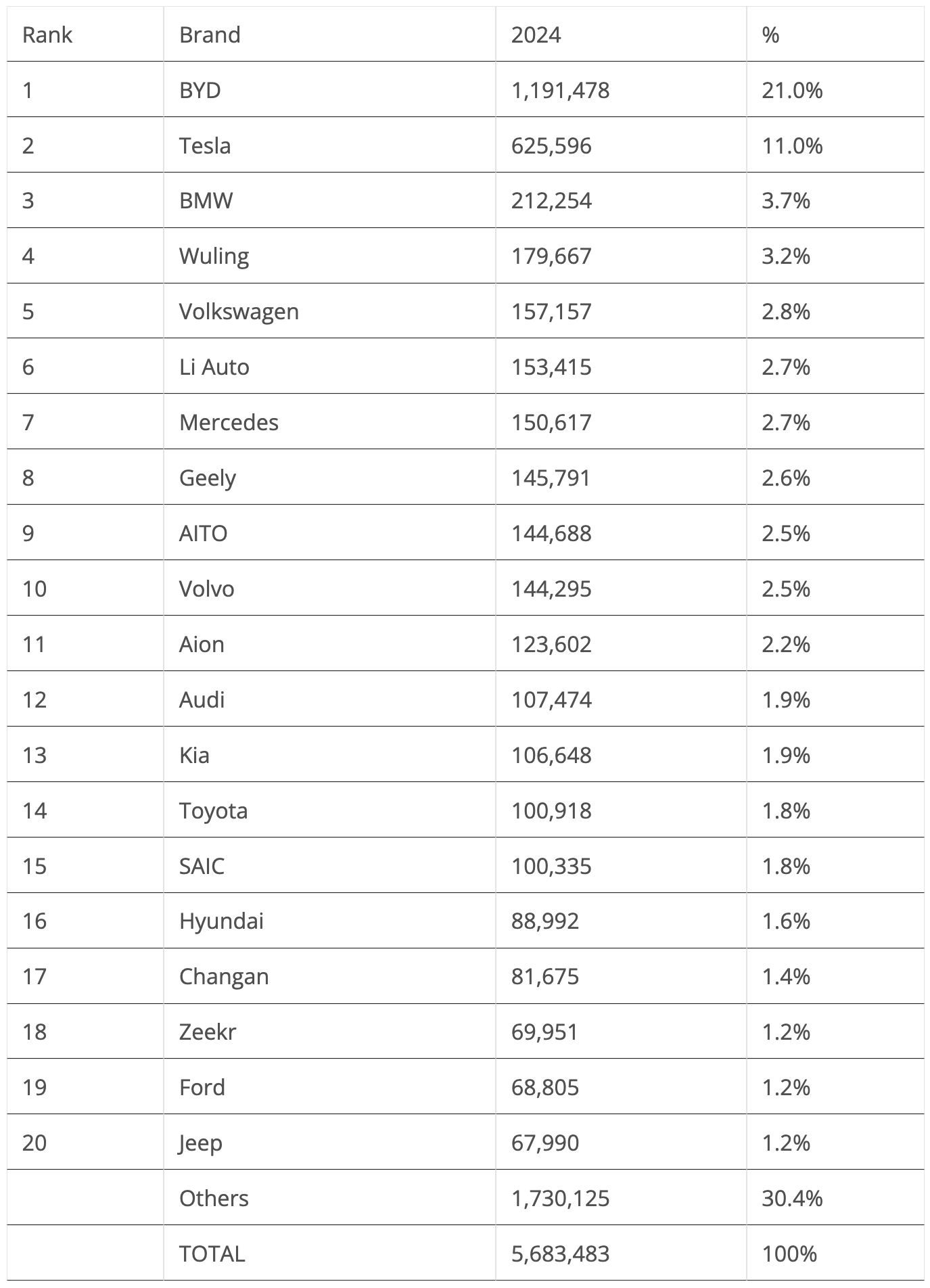

Within the YTD desk, there wasn’t a lot to report on the high. BYD is forward of Tesla, and the US model has virtually thrice as many registrations as #3 BMW. However whereas BYD continues to develop by double digits, Tesla’s gross sales are down 8% in 2024….

Far beneath these two, that are actually in a league of their very own, BMW and Wuling stayed of their positions, whereas Volkswagen benefitted from a powerful month of Might to leap one other place, this time to fifth. Now, will the German make have the ability to recuperate floor on the #4 Wuling and threaten the Chinese language model? Please place your bets.

Li Auto and its rival AITO each gained one place in Might, with the previous climbing to #6 and the latter to #9. A significant factor serving to Li Auto to beat AITO on the worldwide stage is that whereas AITO is mainly promoting solely in China, Li Auto has arrange a profitable enterprise in Russia, with the startup model promoting a median of over 2,000 models per thirty days within the Eurasian nation, satisfying that market’s thirst for giant SUVs. The truth that they’re plugin hybrids is only a secondary impact….

With Li Auto touchdown quickly within the Center East, count on the startup model to be one other Chinese language EV automaker leaving China’s Jurassic EV Park and spreading panic among the many established competitors.

Within the second half of the desk, Kia benefitted from month in Might, and jumped two positions, to thirteenth, thus compensating for a poor month from stablemate Hyundai.

The remaining spotlight got here from Zeekr, which joined the desk in 18th. As it’s, Geely is the one OEM with greater than two manufacturers within the desk — the namesake model is eighth, Volvo is tenth, and now Zeekr is 18th.

Ford and Jeep have been relegated to #19 and #20, respectively, and with #21 Leap Motor (66,674 models) and #22 NIO (66,236), trying dangerously shut, we may see each US manufacturers being kicked out of the desk in alternate for the 2 Chinese language startups, which might elevate the variety of Chinese language manufacturers within the high 20 to 11 representatives.

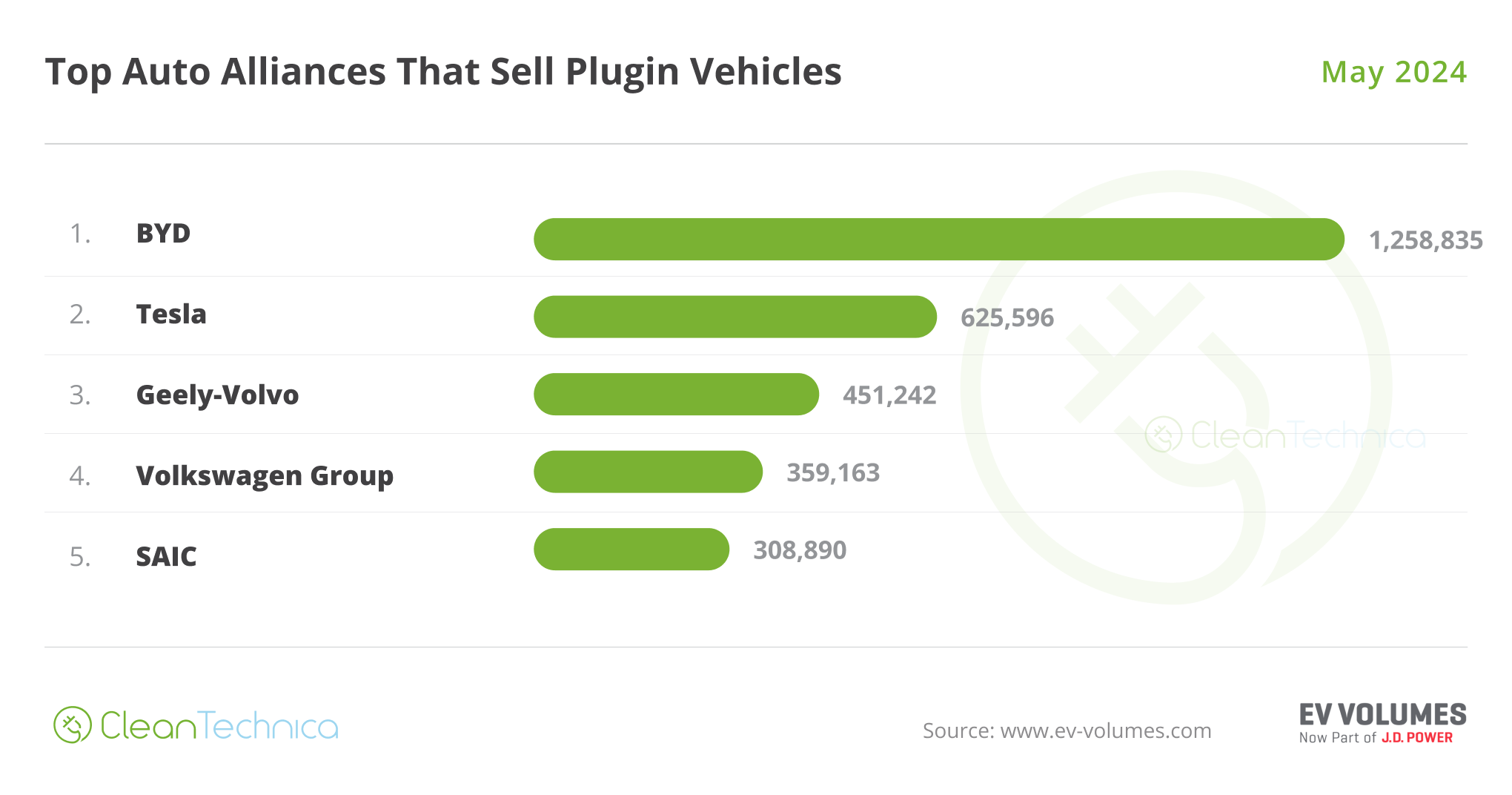

Prime Promoting OEMs for EV Gross sales

registrations by OEM, #1 BYD gained share due to its current value cuts, going from 20.8% to its present 22.1% (it had 21.9% a yr in the past), whereas Tesla ended Might with 11% share (it had 14.8% in the identical interval of 2023).

third place is within the fingers of Geely–Volvo, with the OEM climbing from 7.8% in April to 7.9% in Might. The Chinese language OEM is the one that almost all progressed within the high 5, going from 6.2% in Might 2023 to its present 7.9%.

Contemplating Tesla’s current share drop and Geely’s important development, will we see the Chinese language juggernaut threaten Tesla’s silver medal by yr finish?

In the meantime, #4 Volkswagen Group (6.3%) remained secure, gaining a ways over #5 SAIC (5.4%, down from 5.6%). Though, evaluating outcomes with the identical interval of 2023, the German OEM is faring a lot worse, as it’s down by 1% share, whereas SAIC has remained comparatively secure (5.4% now vs. 5.6% then).

Beneath SAIC, a free-falling Stellantis (3.9%, down from 4%) dropped two positions in a single month, to eighth. It was surpassed by each BMW Group and Changan, and has misplaced important share in comparison with Might 2023, when it had 4.8%.

The multinational conglomerate must react quick — its low-cost EVs (Citroen e-C3 EV, e-C3 Airscross EV, Opel Frontera EV, Fiat Grande Panda EV, and so forth.) must land as quickly as doable, and in important volumes (a refresh on the Fiat 500e wouldn’t damage both…). This yr, Stellantis not solely misplaced contact with the highest 5 OEMs, however it’s vulnerable to being swallowed by the competitors.

With BMW, Changan, and Stellantis separated by fewer than 600 models, loads can occur within the race for sixth, however for now, BMW Group (3.9%) is following the pack, with #9 Hyundai–Kia (3.5%) not too far behind, both.

Chip in a number of {dollars} a month to assist assist unbiased cleantech protection that helps to speed up the cleantech revolution!

Wanting simply at BEVs, Tesla remained within the lead with 17.2%, but it surely has misplaced 4% share in comparison with the identical interval final yr. With this, the US make continues to be forward of BYD (16%, down 0.2%). With Tesla dropping share at a speedy tempo, although, we would see BYD surpass it round This fall.

Geely–Volvo (7.5%, up 0.3%) continues to rise, due to good outcomes throughout its lengthy lineup of manufacturers. It gained extra of a bonus over #4 SAIC (7%, down from 7.1%), permitting it to maintain the bronze medal.

In fifth we have now Volkswagen Group with 6.9%, up 0.1%. The German OEM is seeking to attain the 2 firms forward of it, and SAIC will not be that far now. With #6 BMW Group (4.3%, up from 4.1% in April) at a protected distance, the German conglomerate may attempt to recuperate misplaced time within the coming months.

Have a tip for CleanTechnica? Need to promote? Need to recommend a visitor for our CleanTech Discuss podcast? Contact us right here.

Newest CleanTechnica.TV Movies

CleanTechnica makes use of affiliate hyperlinks. See our coverage right here.

CleanTechnica’s Remark Coverage

FB.AppEvents.logPageView();

};

(function(d, s, id){ var js, fjs = d.getElementsByTagName(s)[0]; if (d.getElementById(id)) {return;} js = d.createElement(s); js.id = id; js.src = "https://connect.facebook.net/en_US/sdk.js"; fjs.parentNode.insertBefore(js, fjs); }(document, 'script', 'facebook-jssdk'));