Apple broke a string a weak quarters by saying a 5% year-over-year improve in income for the June quarter Thursday, setting a brand new report for the quarter. iPad gross sales skilled an particularly robust quarter, up 24%, and the corporate’s companies sector additionally grew by double digits.

Apple surpassed Wall Avenue analysts’ income expectations, although iPhone gross sales dropped barely when in comparison with the identical quarter a yr in the past.

Apple’s monetary Q3 2024 is a powerful one

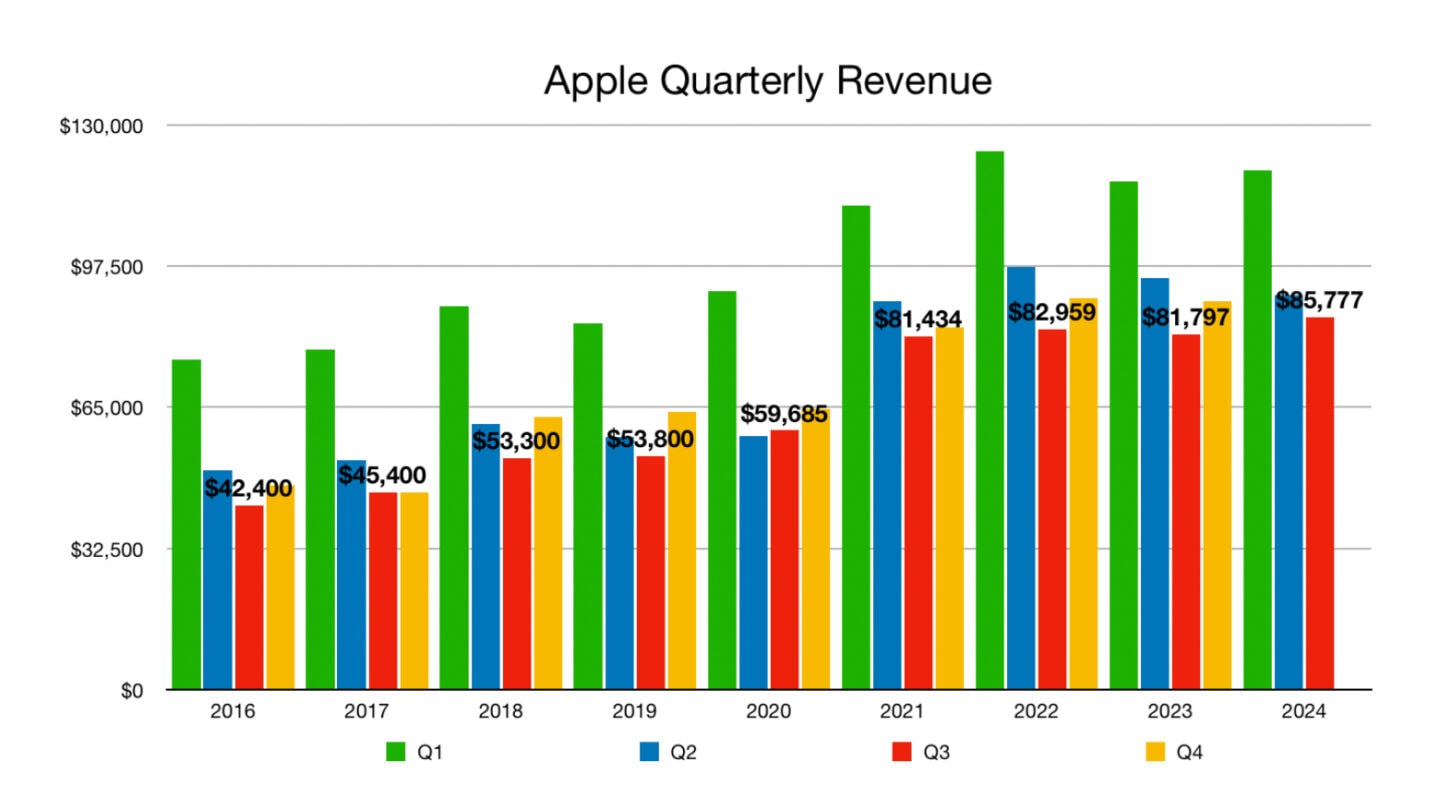

Apart from one quarter, Apple skilled declining income each quarter since September 2022. That’s 5 out of six quarters of declines. So the June 2024 quarter bucks a foul development. Previous to Thursday’s earnings name, analysts predicted that Apple would announce a very good quarter, however Cupertino truly did higher than anticipated.

The consensus was for a 3% annual improve in income. As famous, Apple truly achieved a 5% income improve, as much as $85.8 billion. Quarterly earnings per diluted share within the April-through-June interval got here in at $1.40, up 11% yr over yr.

“During the quarter, our record business performance generated EPS growth of 11 percent and nearly $29 billion in operating cash flow, allowing us to return over $32 billion to shareholders,” mentioned Luca Maestri, Apple’s CFO, in a press launch saying the outcomes Thursday. “We are also very pleased that our installed base of active devices reached a new all-time high in all geographic segments, thanks to very high levels of customer satisfaction and loyalty.”

Chart: Ed Hardy/Cult of Mac

iPad and companies revenues grew sharply

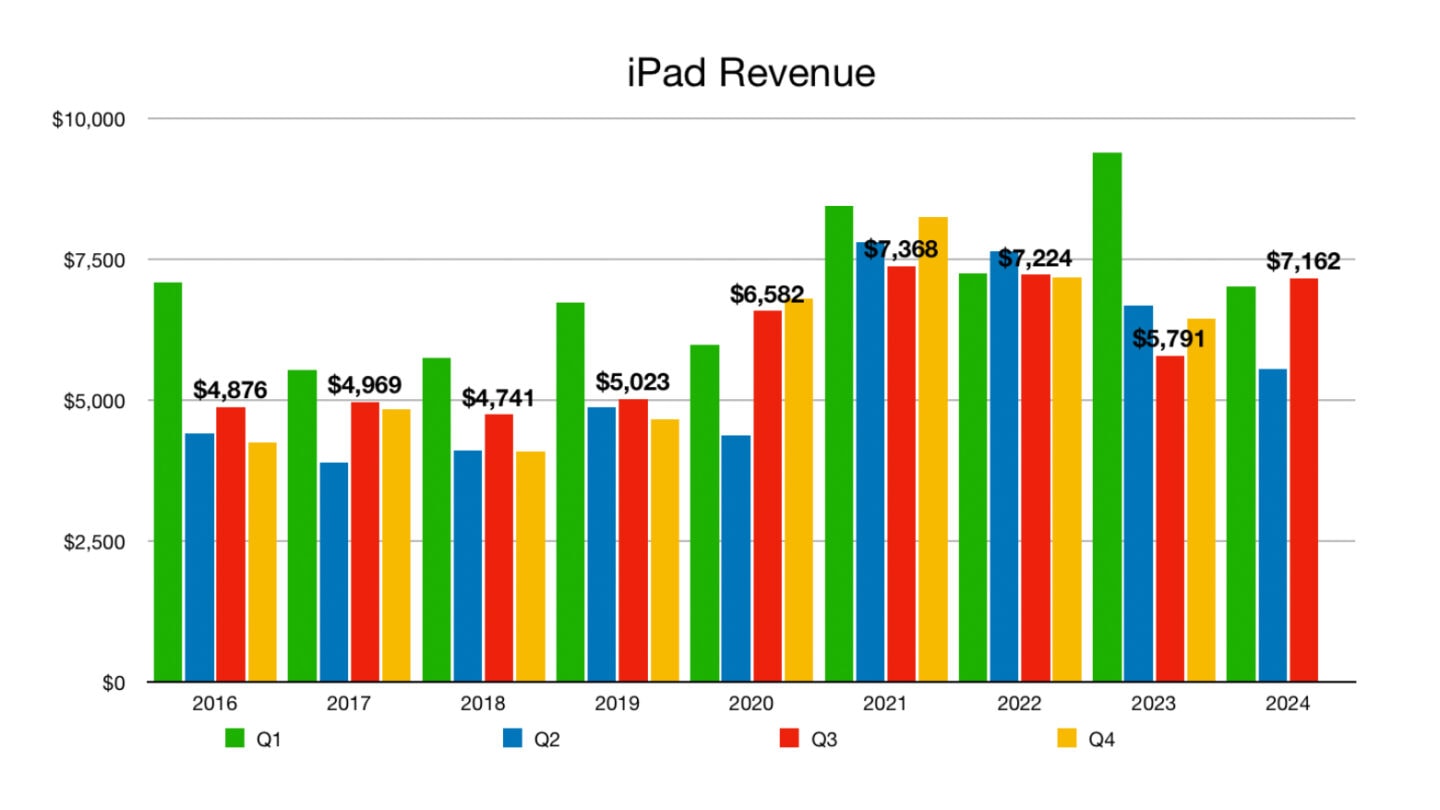

Chart: Ed Hardy/Cult of Mac

A part of the income development got here from iPad. This didn’t come as a shock — the 2024 iPad Professional and iPad Air launched throughout the quarter, and new high-end tablets often carry a rush of income for Apple. The pill complete final quarter was $7.2 billion.

“The iPad installed base continues to grow and is an all-time high as half of the customers who purchased iPads during the quarter where new to the product,” mentioned Maestri throughout a convention name with traders after the earnings announcement.

As well as, income from the corporate’s intently watched companies section (the App Retailer, Apple Music, and so on.) grew 14%, beating analysts’ expectations.

“We’re constantly focused on improving the breadth and quality of our services, from critically acclaimed new content on Apple TV+ to new games on Apple Arcade,” Maestri instructed traders on Thursday. It totaled $24.2 billion.

Mac income climbed 2% YOY to $7.0 billion.

iPhone gross sales stood out as a weak spot in Apple’s Q3 2024 monetary outcomes, with revenues down 1%. Nonetheless, that’s much less of a drop than analysts feared.

The AAPL share worth climbed 0.59% in after-hours buying and selling … and after Apple’s incomes’s announcement. That’s after taking place 1.68% in common buying and selling.

Supply: Apple

// stack social info fbq('init', '309115492766084'); fbq('track', 'EditorialView');