Working your first payroll is thrilling, but it surely can be overwhelming and even a bit of intimidating. How have you learnt in case you’re doing every part accurately? What in case you don’t have all the data you want?

That will help you out, we’ve put collectively the final word step-by-step guidelines on your first payroll run, together with an inventory of all of the important paperwork that you simply’ll want.

3

QuickBooks

QuickBooks

Workers per Firm Dimension

Micro (0-49), Small (50-249), Medium (250-999), Massive (1,000-4,999), Enterprise (5,000+)

Micro (0-49 Workers), Small (50-249 Workers), Medium (250-999 Workers), Massive (1,000-4,999 Workers)

Micro, Small, Medium, Massive

Options

24/7 Buyer Help, API

First payroll run step-by-step guidelines

Step 1: Collect all of your paperwork

You have to a number of paperwork to run your first payroll, together with an Employer Identification Quantity (EIN) and kinds W-4 or W-9 for workers. We’ve put collectively a grasp guidelines of all of the paperwork you’ll want within the subsequent part, so confer with that as you put together to run your first payroll.

Step 2: Open a payroll checking account

To run payroll, you have to a enterprise checking account, not a private one. Most corporations use a devoted checking account for payroll solely so that cash doesn’t get blended in with different funds. Should you don’t at present have a enterprise checking account put aside for payroll, contemplate setting one up.

Step 3: Choose a pay interval

Subsequent, you’ll must resolve how typically you’ll pay staff. Many companies comply with a biweekly fee schedule, whereas others choose twice a month and even as soon as a month. Try our information to pay intervals in case you need assistance figuring out a payroll schedule on your firm. Remember to adjust to all related authorities rules when deciding on a pay interval.

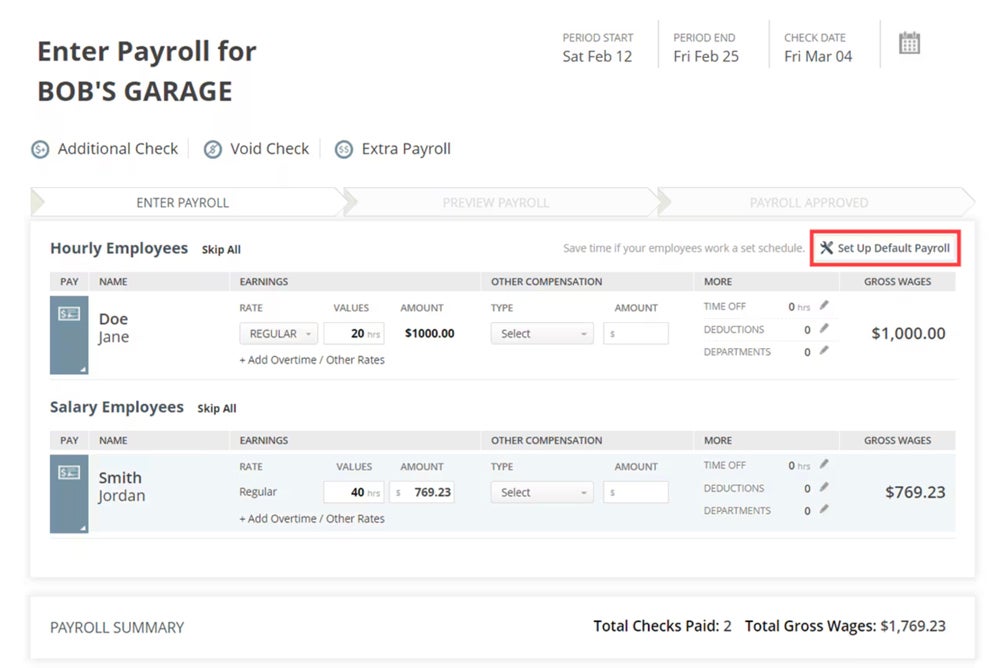

Step 4: Arrange your payroll software program

Should you’re utilizing payroll software program (versus operating payroll manually), you’ll must arrange your payroll software program earlier than operating payroll for the primary time. A user-friendly payroll software program corresponding to SurePayroll will stroll you thru the setup course of to make sure you have every part it’s essential run your first payroll efficiently.

Haven’t selected a payroll software program platform but? See our high picks for the very best payroll software program of 2024.

Step 5: Get employee’s compensation insurance coverage

Out of all 50 states, 49 of them mandate that companies will need to have employee’s compensation insurance coverage to function and pay staff (Texas is the one exception). Some states require it, even when you’ll pay a single worker. Evaluate your state’s necessities and get compliant employee’s compensation insurance coverage so that you’ll be able to run your first payroll.

Step 6: Calculate gross pay

Now it’s time to really begin determining how a lot to pay staff. To start out, it’s essential calculate gross pay for every worker (a.ok.a., wages earlier than taxes, advantages and different deductions are taken out).

For hourly staff, you’ll must evaluate their timecards for accuracy and calculate any mandatory time beyond regulation and paid break day. For salaried staff, you don’t have to fret about time beyond regulation, however you have to to calculate any paid break day.

You’ll additionally must account for any further pay, corresponding to commissions, bonuses and retroactive pay, for all staff. Payroll software program like SurePayroll will routinely do these calculations for you, rushing up the method and rising accuracy.

Step 7: Calculate web pay

Subsequent, it’s essential calculate all deductions and subtract them from the gross pay to get every worker’s web pay. First, calculate pre-tax or tax-exempt changes, which embody profit premiums, retirement fund contributions, HSA contributions and expense reimbursements.

Then calculate taxes and withhold federal earnings tax, Medicare tax, Social Safety tax, state earnings tax, native taxes and wage garnishments. Lastly, account for after-tax withholdings, corresponding to Roth IRA contributions. Once more, utilizing payroll software program will automate these calculations in your behalf.

Step 8: Evaluate the maths

Whether or not you calculate payroll manually or use payroll software program, it is best to evaluate the maths earlier than processing payroll to make sure all calculations are appropriate. It will provide help to to keep away from pricey errors, disgruntled staff and even authorities penalties for incorrect taxes.

Step 9: Distribute funds and pay stubs

When you’ve double-checked every part, it’s time to really pay your staff. Most staff can be paid by way of direct deposits, however you can even pay them by way of bodily paper checks or pay playing cards. You also needs to generate a pay stub for every worker and ship it to them so that you each have a file of the payroll run.

Paperwork wanted to run your first payroll

Beneath, we’ve put collectively a guidelines of all of the paperwork you have to to run your first payroll. For a extra in-depth rationalization of those paperwork, see our devoted information that explains the paperwork you’ll want for payroll in additional element.

Firm tax info

- Employer Identification Quantity: That is utilized by the U.S. federal authorities to trace your tax deposits. You may get an EIN without spending a dime in a couple of minutes by way of the IRS web site. See our information that explains what an EIN is for extra info.

- State Company ID Quantity: That is much like an EIN and is used to trace your tax deposits to the state authorities.

- State unemployment insurance coverage contribution fee: All 50 states and D.C. have an unemployment tax that’s levied on corporations, however each prices a distinct fee and constructions their UI program in a different way.

- Payroll tax deposit schedule: Largely federal and state taxes are due quarterly, but it surely’s all the time a good suggestion to double-check the dates.

Worker paperwork

- Private info: You’ll want every worker’s full authorized title, date of beginning and present tackle to be able to pay them.

- Employment begin or termination date: Since that is your first payroll run, you’ll in all probability be utilizing the worker’s begin date.

- Tax submitting quantity: This can be both the worker’s Social Safety quantity or their Taxpayer Identification Quantity (TIN), which is analogous to an EIN for people.

- Pay fee and compensation particulars: This contains not simply the hourly fee or salaried wages however all mandatory compensation info, corresponding to fee charges and bonuses.

- Withholding info: This specifies how a lot cash must be withheld from every paycheck to cowl the worker’s contributions to advantages and taxes.

- Kind I-9: This kind verifies every worker’s eligibility for employment within the U.S.

- Kind W-4: This kind summarizes all of this info for every worker.

- Kind W-9: This kind summarizes all of this info for every unbiased contractor.

Firm info

- Firm checking account: You have to an organization checking account to pay staff and taxes.

- Firm contributions: As an employer, you need to contribute to sure advantages, corresponding to medical health insurance.

Often requested questions

When establishing payroll, what do you have to do first?

When establishing payroll for the primary time in the USA, it is best to receive an Employer Identification Quantity (EIN) and collect different mandatory paperwork. Within the U.S., you can’t run payroll except you’ve got an EIN, so that you want it to maneuver ahead.

Why is a payroll guidelines vital?

A payroll guidelines is crucial in order that your calculations are as correct as attainable. Should you don’t have a payroll guidelines, you then would possibly neglect to incorporate time beyond regulation, miscalculate deductions or neglect to withhold taxes — all of that are pricey errors to repair.

How lengthy does payroll take to be processed?

From begin to end, it may possibly take as much as every week for payroll to be processed. Relying on how huge your organization is, it might take a number of days to really run payroll and get all the mandatory approvals. As soon as payroll is finalized and submitted, it usually takes one to 4 days for direct deposits to really be made to staff’ financial institution accounts.