Stripe quick detailsOur score: 4.59 out of 5 Beginning value: $0 per person monthly Key options:

|

Stripe is a fee processing platform designed to deal with every little thing from easy on-line transactions to complicated fee flows. It provides highly effective APIs, intensive integration choices, and superior security measures that make it a best choice for builders and tech-savvy companies. I like that it has a complete set of instruments that make it an acceptable processor for small companies, and, on the similar time, present scalability and customizability for mid- to large-sized companies.

In my Stripe overview, I leveraged my years of order and fee processing to check Stripe’s system first-hand, evaluating its instruments and pricing, that will help you resolve whether it is proper for your enterprise.

Stripe pricing

Any enterprise can join a Stripe account and immediately begin accepting funds. It makes use of a flat-rate pricing construction, with potential quantity reductions and/or interchange-plus pricing for companies which have excessive month-to-month transaction quantity. I like that Stripe’s pricing construction is clear, but provides flexibility as you develop.

- Month-to-month price: $0 monthly.

- Card processing price: 2.9% + $0.30 per transaction.

- Manually-entered: +0.5% per transaction.

- Worldwide playing cards: +1.5% per transaction.

- Foreign money conversion: +1% per transaction.

- In-person card processing through Stripe Terminal: 2.7% + $0.05 per transaction.

- Faucet to Pay transactions: + $0.10 per transaction.

- ACH fee processing price: 0.8%, capped at $5 per transaction.

- Instantaneous payout: 1.5%, minimal of $0.50 per payout.

- Chargeback price: $15 per chargeback.

- Stripe Billing: 0.7% of billing quantity.

- Stripe Invoicing: 0.4% per paid bill.

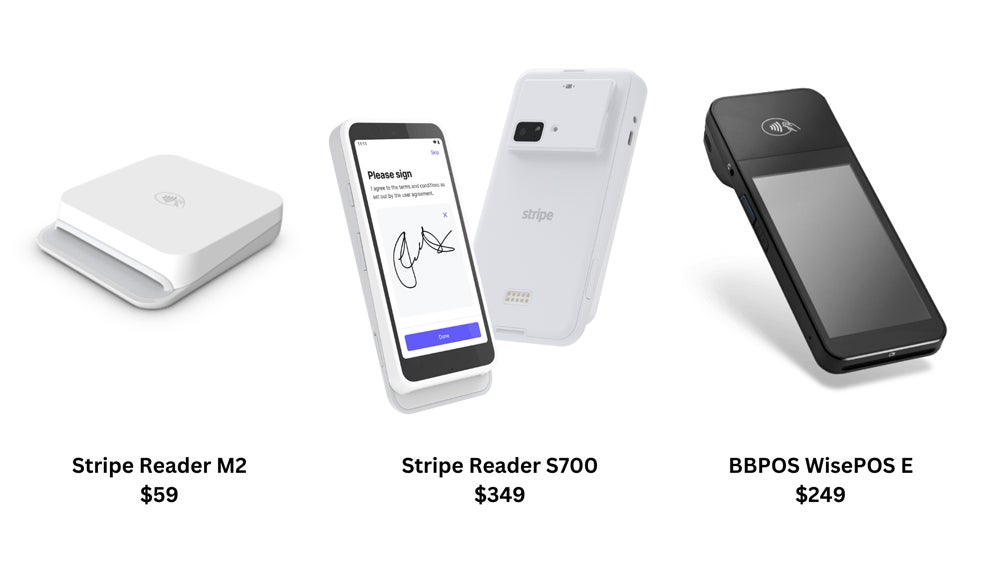

Stripe {hardware}

Though Stripe is greatest recognized for its on-line fee options, it additionally provides in-person fee capabilities. Stripe has card readers companies can buy for in-store transactions, in addition to tap-to-pay performance on cellular units. These choices make it simple for companies to simply accept funds in bodily areas, complementing Stripe’s sturdy on-line platform.

Whereas I feel the easiest way to maximise Stripe’s capabilities remains to be with customized builds, Stripe now has extra choices for no-code point-of-sale options. Since Stripe Terminal’s launch in 2018, it has elevated the variety of no-code off-the-shelf options.

Companies may additionally use Stripe’s Faucet-to-Pay characteristic to simply accept contactless in-person funds via the Stripe Dashboard with none extra {hardware}. The one necessities are a suitable cellular system and Stripe Terminal integration.

Stripe key options

Stripe is extensively recognized for its versatile fee processing options. Its highly effective API and feature-rich platform make it a go-to for companies and builders seeking to construct customizable and scalable fee methods. Listed below are a few of my favourite key options that set Stripe aside from its rivals:

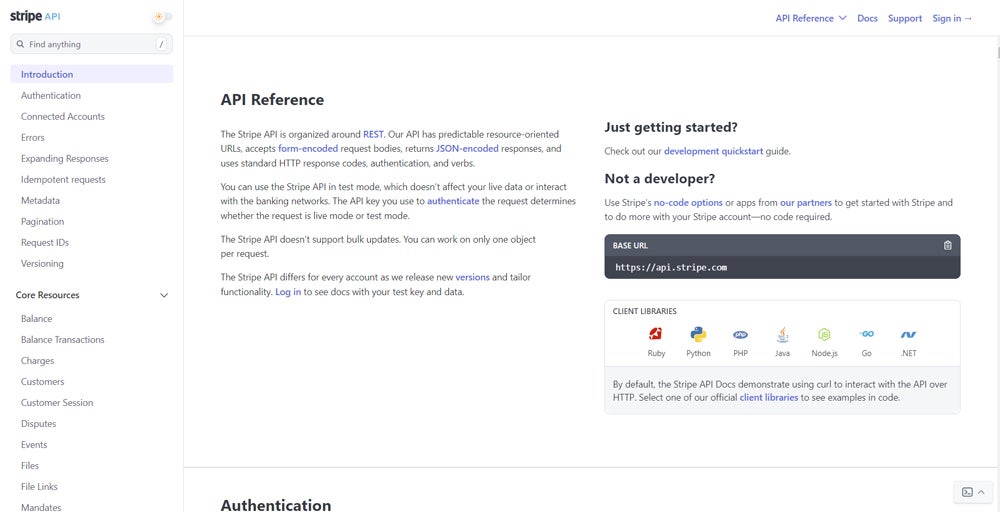

Complete API and developer instruments

Stripe’s API is likely one of the most versatile within the fee business. Though it permits builders to combine fee processing seamlessly into their functions, I discover it may be a bit daunting for companies that lack some technical know-how and like an out-of-the-box resolution. For companies which might be on the lookout for customizability and flexibility, Stripe’s intensive documentation and developer assist make it simple to construct customized fee options to swimsuit particular wants.

World fee assist

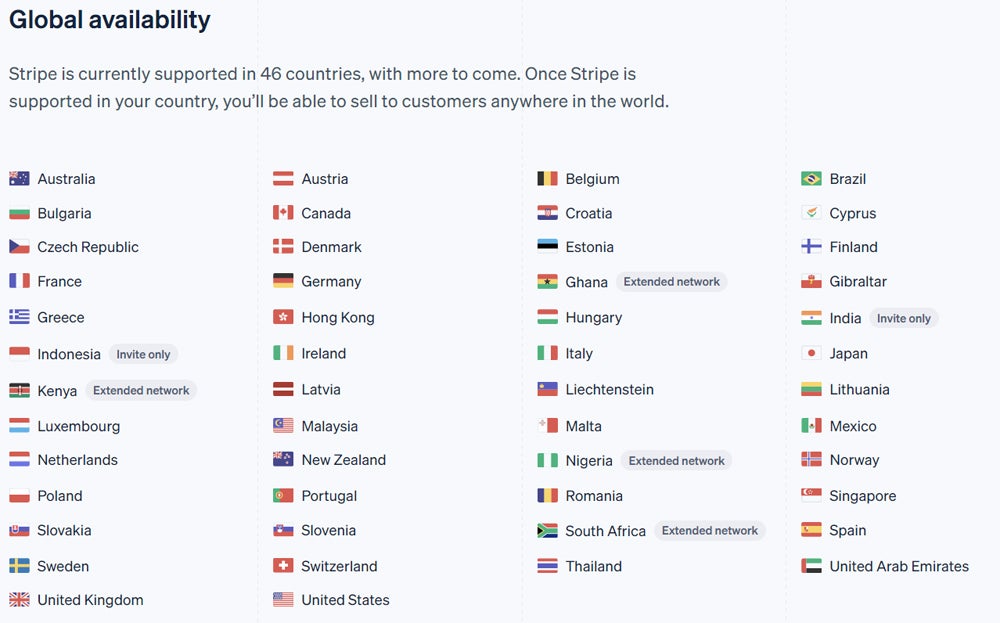

Stripe helps funds in over 135 currencies, 46 international locations, and numerous fee strategies, together with bank cards, ACH, and even cryptocurrencies. This makes it ideally suited for companies with a global buyer base, offering a seamless fee expertise throughout borders.

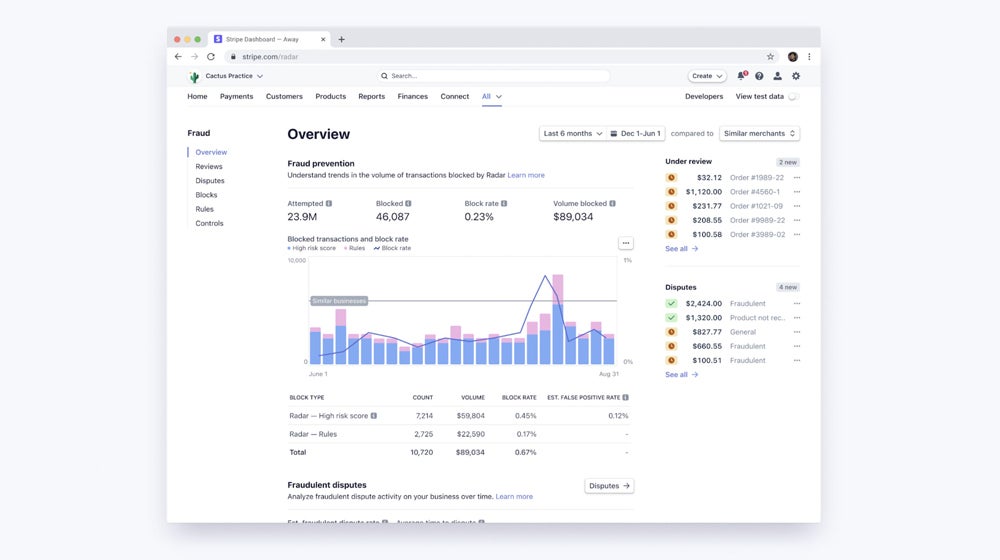

Superior fraud detection

Stripe has a machine learning-based fraud detection and prevention system known as Radar, which adapts to evolving threats in real-time. It helps scale back chargebacks and unauthorized transactions. This ensures companies can function securely with much less guide intervention for fraud administration.

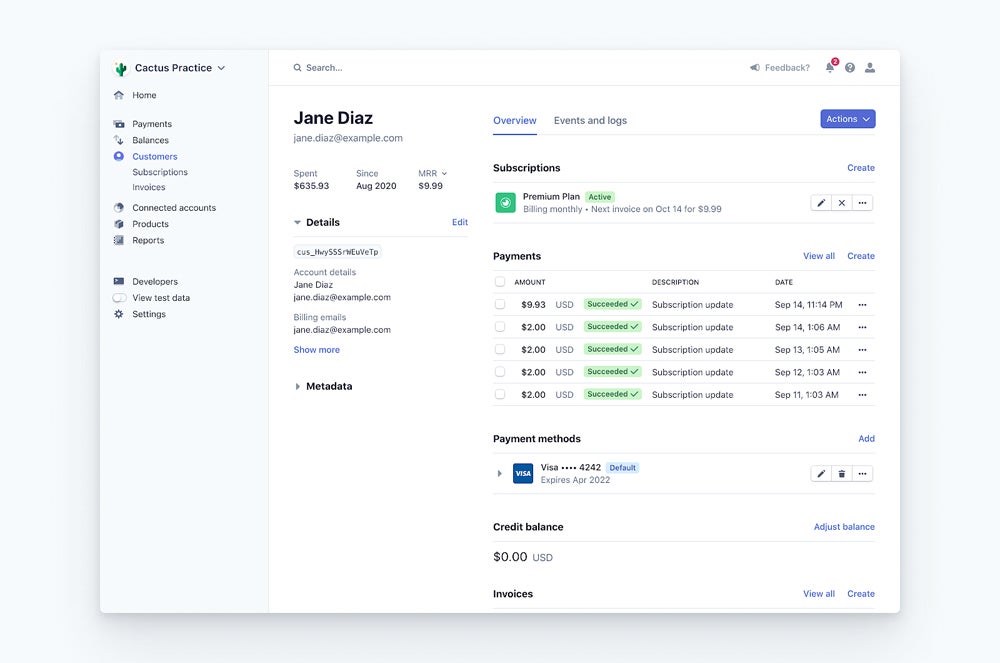

Subscription administration and recurring billing

Stripe provides a whole suite of instruments for managing recurring funds, together with assist for subscriptions, computerized invoicing, and versatile billing intervals. These options are important for SaaS companies and firms with recurring income fashions. Nevertheless, it’s necessary to notice that Stripe fees extra charges for utilizing Stripe Billing to handle these recurring funds.

Third-party integrations

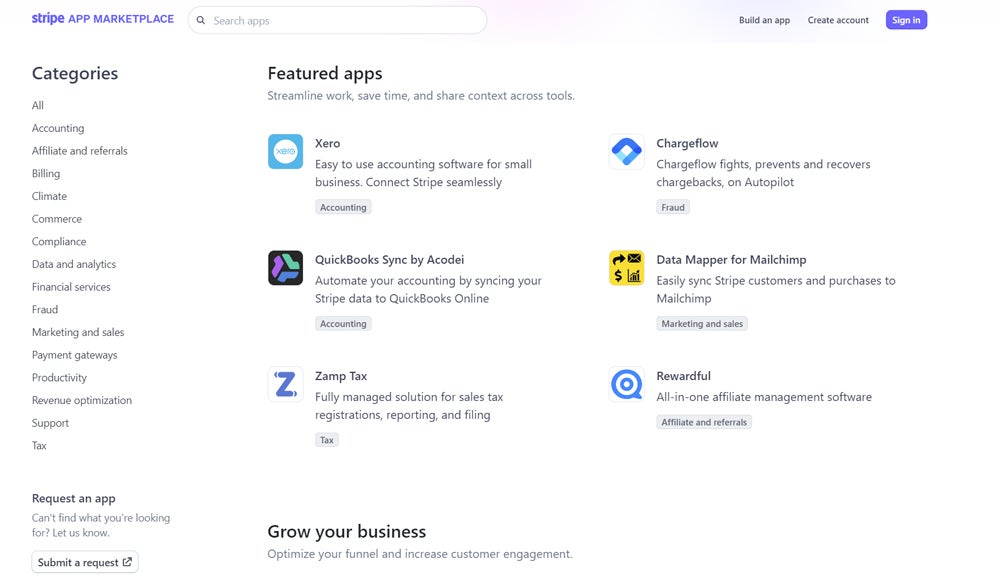

Whereas Stripe is thought for its developer-friendly instruments, it additionally provides seamless third-party integrations. I feel this makes Stripe a viable choice even for companies that would not have the technical know-how for full customized builds as a result of it permits them to seamlessly combine with fashionable platforms and companies with out the necessity for intensive coding or developer abilities. The Stripe App Market has integrations with ecommerce platforms, accounting instruments, and CRMs to assist streamline enterprise processes. With pre-built connectors and plugins, companies can simply add fee performance to their current methods, making Stripe accessible to non-technical customers as effectively.

Stripe execs

- Clear flat-rate pricing.

- Extremely customizable API.

- Accepts all kinds of fee strategies.

- Helps over 135 currencies and 46 international locations.

- Properly-structured and intensive documentation.

- Actual-time detailed reporting and analytics.

- Constructed-in PCI compliance, information encryption, and fraud detection.

- Fast setup with minimal friction.

Stripe cons

- Add-on charges for Stripe Billing and Stripe Invoicing.

- No high-risk service provider assist.

- No built-in POS system.

- Might be complicated for non-developers.

- Account holds or freezes.

Stripe options

If you happen to suppose Stripe doesn’t suit your wants, I like to recommend trying into the next fee processing options.

| Month-to-month price (begins at) |

||||

| On-line processing price | ||||

| Standout characteristic |

Sq.

Sq. is well-known for its omnichannel fee processing capabilities. It has a free web site builder and point-of-sale (POS) system, each of which aren’t natively obtainable in Stripe. This doesn’t imply you can not construct your individual web site or have a POS system with Stripe, however you have to to depend on APIs and third-party integrations.

Alternatively, Sq. provides out-of-the-box options for constructing your individual web site and utilizing a POS system. Sq. additionally doesn’t cost any additional charges for paid invoices or recurring billing. This makes Sq. a superb choice for small companies seeking to settle for fee in numerous channels with none additional coding or add-on charges.

Helcim

Whereas Stripe provides clear, flat-rate pricing, it is probably not essentially the most cost-effective, particularly for companies which have excessive month-to-month transaction volumes. Helcim, alternatively, provides not simply interchange-plus pricing but additionally computerized quantity reductions. Each are additionally obtainable via Stripe, however you have to to get in contact with Stripe’s gross sales staff, and it’s topic to approval.

Apart from this, Helcim additionally provides out-of-the-box fee options just like Sq.. It has a free and easy web site builder, in addition to a free POS software program. I feel that for companies prioritizing prices and options requiring much less coding, Helcim is a superb choice.

PayPal

Though Stripe is well-known within the funds house, PayPal is a extra acquainted model due to its presence in consumer-to-consumer transactions. Though Stripe nonetheless provides extra highly effective APIs for constructing customized options, I’d take into account PayPal to have probably the most intensive one-click integrations, particularly within the ecommerce discipline.

factor to notice with PayPal is you don’t want to make use of it as your unique fee processor — it’s typically obtainable as a further fee choice even if you’re already utilizing Stripe.

PaymentCloud

I feel an enormous hole with Stripe is its lack of assist for high-risk retailers. Companies thought of high-risk are prone to get rejected once they apply for a Stripe account, and it’s best to enroll with a high-risk service provider account supplier as an alternative, similar to PaymentCloud.

PaymentCloud provides versatile options, permitting companies to select from easy-to-use ones that require much less coding to totally customizable choices via their associate suppliers.

Evaluate methodology

This Stripe overview relies on an intensive analysis of its key options, pricing, and total efficiency. My evaluation included hands-on testing of Stripe’s API, fee processing instruments, and Stripe Market to know its real-world utility.

I additionally took under consideration Stripe’s price construction, together with its extra prices for options like Stripe Billing. To make sure a well-rounded analysis, I in contrast Stripe to different main fee processors available in the market, score it on standards similar to performance, scalability, and developer expertise.

This text and methodology had been reviewed by our retail professional, Meaghan Brophy.