It doesn’t look like it from the patron’s finish, however there’s quite a bit that goes right into a card swipe throughout a purchase order. A colossal infrastructure underpins the monetary transactions folks make each day. And regardless of being invisible to most of the people, any enterprise that desires to just accept funds has to grapple with it in a method or one other.

However how are you alleged to sift by processor choices, particularly when the terminology and charges are so opaque?

Whereas we will’t essentially prescribe a selected choice to a broad, nameless viewers, we all know a factor or two about digital B2B answer suppliers and might help signpost essential particulars and factors of curiosity. So…let’s try this.

Primarily based on our analysis of 34 processors throughout 19 knowledge factors, one of the best fee processors are:

- Greatest general: Helcim

- Greatest for high-risk/higher approval odds: PaymentCloud

- Greatest direct processor: Chase

- Greatest for small companies: Sq.

- Greatest for transparency: Dharma

- Greatest for rising companies: Stax

High fee processors comparability

If we had been doing a side-by-side comparability of full function lists, we’d be right here till the subsequent fiscal 12 months. We determine you’re most likely a busy skilled, so the data right here up prime is abridged and summarized to keep away from added particulars the place they aren’t useful. We’ll dive into deeper particulars down beneath, however this desk might enable you to rule out choices instantly and prevent a while.

| Our ranking (out of 5) | Month-to-month charges | POS choices | Quickest deposit time | Lowest transaction charge | |

|---|---|---|---|---|---|

| Helcim | 4.66 | None | Sure; proprietary | Inside 2 enterprise days | Base interchange, plus 0.15% + $0.06 |

| PaymentCloud | 4.56 | By quote | Sure; Third-party | Inside 48 hours | 2.4% + $0.10 (charges negotiable) |

| Chase Cost Options | 4.51 | By quote (free choices out there) | Sure; proprietary | Similar-day | 2.6% + $0.10 |

| Sq. | 4.50 | Beginning at $0 | Sure, proprietary | Subsequent enterprise day | 2.6% + $0.10 |

| Dharma | 4.46 | As little as $20/month | Sure; Third-party | Subsequent-day | Varies |

| Stax | 4.42 | Beginning at $99/month | Sure; Third-party | Subsequent enterprise day | 0% + $0.08 |

Helcim: Greatest general

Our ranking: 4.66

Helcim is our choose for the highest all-around competitor on this class. With a price construction that always achieves the bottom costs within the {industry}, excessive buyer satisfaction charges and ample add-on choices (like POS {hardware} and fee gateway providers), Helcim affords fairly a little bit of worth for the value.

A comparative newcomer to the house, Helcim is a fee processor with the categorical purpose of pricing transparency, reducing limitations to entry for small companies and serving to them to develop and survive. Their value construction is designed to attenuate the charges handed on to their prospects, even when that makes the numbers a bit extra advanced at first look.

One space the place Helcim falls a bit behind its friends on this record is deposit instances: they don’t provide any same-day choices and even next-day choices. They do, nevertheless, assure “within two business days” throughout the board.

In brief, even when Helcim isn’t an ideal match for each enterprise, few SMBs could be ill-served by this processor.

Why we selected Helcim

Helcim is a dependable, clear and reasonably priced possibility for fee processing. For the overwhelming majority of companies, Helcim will present glorious service and pricing that don’t gouge into your earnings.

Sure particular outlier use circumstances might have trigger to look elsewhere (and we handle a number of of these beneath).

Pricing

Helcim doesn’t cost month-to-month subscription charges, and doesn’t have contracts. As a substitute, you solely pay the transaction charges.

For each transaction, they move alongside the bottom out there interchange charge, and add their margin on prime, with scaling reductions for increased volumes. This pricing mannequin is named “interchange plus.” On the highest volumes, you’ll be able to see charges as little as:

- In-person—base interchange charge, plus 0.15% + $0.06

- Keyed and on-line—base interchange charge, plus 0.15% + $0.15

Moderately than flattening the charge to be the identical whatever the interchange value, like processors akin to Sq. do, Helcim retains the identical margin on their finish for each charge, so decrease interchange charges result in decrease prices for you.

Options

- “Interchange Plus” pricing helps companies maintain extra of what they earn.

- Reductions on transaction charges for high-volume prospects.

- Integrates with common monetary apps like QuickBooks and Xero.

- No contracts, no commitments, no hidden prices for strolling away.

- Optionally available surcharging options that can help you move transaction charges on to prospects.

Professionals and cons

| Professionals | Cons |

|---|---|

|

|

PaymentCloud: Greatest for high-risk/higher approval odds

Our ranking: 4.56

Simply as shoppers with decrease credit score scores might need to work tougher to get an auto mortgage, some companies additionally wrestle to get approval for issues like service provider accounts. It might even be for no motive aside from the character of the enterprise itself — akin to with high-risk classes like age-restricted merchandise.

With out a service provider account, although, there’s no solution to course of funds electronically, and also you’re caught having to take each transaction in money.

PaymentCloud is our main choose for companies that face points like this. A processor with extra favorable approval charges, they’ve choices to assist companies which have been turned down elsewhere. And their processing charges are negotiable.

Their much less clear public-facing pricing generally is a bit irritating, and approval timeframes are sometimes longer because of the nature of the underwriting being accomplished. However for companies that wrestle to get authorised by different processors, an extended wait time could also be a really tolerable worth of admission.

Why we selected PaymentCloud

PaymentCloud is among the many few fee processors that present choices to companies underserved by the majority of the market. Working example: our prime general choose — Helcim — flat out can’t approve sure enterprise sorts, making all of their different advantages moot.

Generally, what you want is a good, dependable accomplice that can truly offer you an opportunity.

Pricing

PaymentCloud doesn’t publicly record its subscription prices or transaction charges. You’ll should contact the gross sales workforce for any up-to-date or totally correct data there. That being stated, some person opinions have reported per-transaction charges as little as 2.4% + $0.10 in some circumstances, and they’re negotiable.

Options

- Higher approval odds for companies that may’t get service provider accounts with different processors.

- Appropriate with a wide range of Third-party {hardware}, together with the favored Clover methods, which may be bought instantly from PaymentCloud

- Integrates instantly into a number of digital purchasing carts, on-line shops and different ecommerce instruments.

- Negotiable processing charges.

- Surcharging instruments that can help you move processing charges on to prospects.

Professionals and cons

| Professionals | Cons |

|---|---|

|

|

Chase: Greatest direct processor

Our ranking: 4.56

This one is for all of you on the market pondering, “it’s all electronic; why isn’t it instant?”

There are a number of causes — some extra comprehensible than others — why so many processors don’t assure same-day deposits. If that’s a serious disadvantage for you, there are a number of methods you’ll be able to shut the hole, and make it simpler to get your cash sooner. The best is that this: use the identical group as your processor, and your banking establishment.

That’s the place Chase suits into this record. Well known as a number one nationwide financial institution, Chase additionally affords fee processing. Meaning you’ll be able to arrange a enterprise checking account with Chase and have them deal with the processing of your transactions. The key upside to that is Chase’s assure for same-day availability of funds when it’s going into an account they deal with.

Why we selected Chase Cost Options

Look, we will’t fault you for wanting your cash sooner. Nobody actually likes ready to receives a commission, in spite of everything. So when it occurs that Chase is a good financial institution, and a strong contender as a fee processor, it’s not an enormous leap to resolve to make use of them for each functions.

Along with quick funding, Chase additionally affords glorious account stability, safety and aggressive, negotiable charges.

Pricing

Chase breaks their charge construction into three sections:

- Faucet/dip/swipe—2.6% + $0.10 per transaction

- Keyed-in/fee hyperlinks—3.5% + $0.10 per transaction

- Ecommerce—2.9% + $0.25 per transaction

Personalized pricing, akin to interchange plus, can also be out there upon request.

Moreover, Chase affords some further advantages and perks in the event you’re utilizing their banking system. For instance, you’ll be able to profit from their same-day funding at no extra value, in the event you’re having them deposit incoming buyer funds right into a Chase enterprise account.

Options

- Few processors provide deposits as quick as Chase’s (not to mention sooner).

- Possibility to make use of Chase for enterprise banking in addition to fee processing.

- Extensively appropriate with quite a few ecommerce options.

- A number of POS {hardware} choices, lots of which combine instantly into your checking account.

- Proprietary enterprise analytics platform at no extra value that provides demographic, buying and competitor insights throughout all Chase card and financial institution transactions.

Professionals and cons

| Professionals | Cons |

|---|---|

|

|

Sq.: Greatest for small companies

Our ranking: 4.50

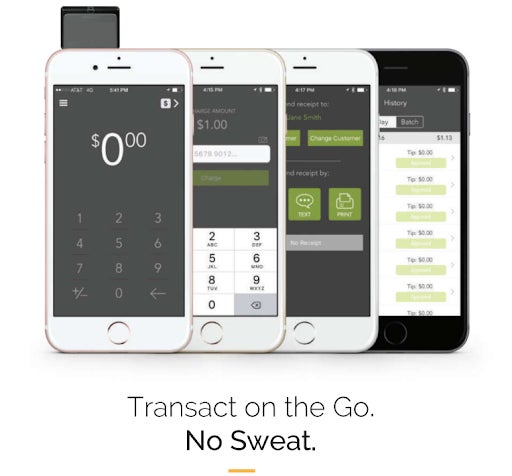

One other monetary model with a robust presence elsewhere within the digital ecosystem, Sq. initially made a reputation for itself with its flagship mobile-enabled card reader. That very same design philosophy and market focus information Sq. to today, with a lot of its choices prioritizing the wants of small companies, together with these with out a bodily location or on-line retailer.

And, like Chase, one of many large benefits of utilizing Sq. is the way it combines two totally different hyperlinks within the processing chain — on this case, the processor and the POS gear. As such, it’s simple to get began (you’ll be able to join free and solely pay processing charges), easy to implement and a breeze to make use of.

Associated: Level of Sale Deployment Guidelines

Why we selected Sq.

Sq. is our choose for small companies due to the way it dramatically lowers the barrier to entry, even for professionals simply beginning out. It’s extremely widespread for brand new companies to return to Sq. for his or her POS {hardware} and in the end resolve to remain for the fee processing. It’s arduous to argue with the acute comfort and the transparency of the pricing mannequin.

Pricing

You possibly can join Sq. free of charge, and lots of use it this manner, paying just for transaction charges. There are paid subscription choices, nevertheless:

- Free—$0 per 30 days; simply pay the processing charges.

- Plus—Beginning at $29 per 30 days, provides options tailor-made to the wants of meals service, retail and appointment-based companies.

- Premium—customized plans, with customized pricing.

As for the processing charges, Sq. breaks down transactions into 4 totally different classes, every with a special worth level:

- In-person—beginning at 2.6% + $0.10 per transaction

- On-line—beginning at 2.9% + $0.30 per transaction

- Invoices—beginning at 3.3% + $0.30 per transaction

- Manually entered—beginning at 3.5% + $0.15 per transaction

Customized charges are additionally out there for companies processing greater than $250,000 month-to-month.

Options

- POS supplier and fee processor in a single.

- Use free of charge, with out month-to-month subscription and pay just for the processing you even have them do.

- Handy know-how that integrates simply with nearly all of platforms, cell units and different instruments of the commerce.

Professionals and cons

| Professionals | Cons |

|---|---|

|

|

Dharma: Greatest for transparency

Our ranking: 4.46

A California-based firm targeted closely on giving again to the group through donations and supporting non-profits, Dharma is a company equally involved with its affect on the companies it serves and society at massive. All “about us” web page particulars apart, Dharma holds the celebrated place of getting each essentially the most advanced and essentially the most clear pricing on our record.

In all equity, there’s loads of complexity available with the numerous interlinking chains of digital funds and commerce. Meaning there’s loads of room to cover charges, upcharges and different nasty surprises in there below the guise of “simple” or “straightforward” pricing.

Dharma will get forward of that. It takes slightly studying to get a agency grasp of how their construction works, and it might be worthwhile to speak to their employees instantly. However for these prepared to do the maths and examine their numbers, you’ll discover all of it provides up appropriately.

Why we selected Dharma

In an financial setting just like the one we reside in right now, few betrayals really feel as full as when enterprise “partners” take our hard-earned earnings proper out of our digital wallets, so to talk.

Dharma makes our record each as a result of they’re a decent fee processor and since there are not any darkish patterns or opaque methods at play. It might take extra detailed calculations to examine their math, however they supply all of the figures needed to take action, and also you’ll be unlikely to ever must query prices on the invoice consequently.

Pricing

Dharma doesn’t have a quick-and-easy breakdown of its pricing on its web site. Nonetheless, they do clearly state that there are not any hidden charges, no contracts and that they virtually at all times come out to a worth level cheaper than different suppliers.

Moderately than depart that final level as an ambiguous brag that may’t be verified, they’ve value calculators on their website that can help you evaluate Dharma’s pricing to that of its rivals.

The charge construction breaks down into three sections:

- Month-to-month charges (starting from $20 to $25, with reductions for increased volumes).

- Quantity charges (starting from 0.10% of quantity to 0.15% of quantity, with reductions for increased volumes).

- Transaction charges (as little as $0.08 per transaction, relying on account/processing kind).

For a transparent, correct thought of what you’ll be paying, you’re higher served by testing the calculators your self. As a bonus, you’ll be capable of evaluate them in opposition to the associated fee constructions of its rivals, like they supposed.

Options

- Regardless of complexity, Dharma boasts the best pricing transparency of any supplier on our record.

- {Hardware}-agnostic, you should buy nearly any POS system and use it with Dharma.

- When you’ve totally understood the numbers, Dharma’s charges are among the many best and favorable.

Professionals and cons

| Professionals | Cons |

|---|---|

|

|

Stax: Greatest for rising companies

Our ranking: 4.42

A giant query on the minds of many bold entrepreneurs is, “will this support my business as it scales?”

Stax is our choose for a processor that solutions that query within the affirmative. With a flat month-to-month subscription mannequin, companies are closely incentivized and rewarded for processing at increased volumes.

Moderately than tack on a proportion charge as its revenue margin, Stax prices you the bottom interchange charges (that are obligatory), a flat markup of lower than 15 cents per transaction after which a month-to-month subscription charge primarily based on the processing quantity. Consequently, many companies wind up paying considerably much less, since Stax’s revenue margins are capped.

And as quantity goes up, the common value per transaction goes down, saving you much more the extra you utilize their service.

Why we selected Stax

A lot of minimizing processing prices comes all the way down to conserving the processor from taking greater than their justifiable share. Stax approaches this from an attention-grabbing angle by the use of a flat month-to-month charge. That charge goes up as quantity does, however typically works out to a decrease value per transaction.

In different phrases, in the event you’re already processing a good quantity, or count on to see intensive development within the close to future, you stand to save lots of fairly a bit through the use of Stax.

Pricing

Stax doesn’t cost per-transaction markups, as an alternative breaking their charges into brackets primarily based on quantity.

- Processing as much as $150,000 yearly—$99/month, plus interchange charges

- Processing as much as $250,000 yearly—$139/month, plus interchange charges

- Processing greater than $250,000 yearly—$199/month, plus interchange charges

For every transaction, Stax prices a flat-rate charge, usually starting from 5 – 15 cents, relying in your plan and whether or not the transaction is card-present or card-not-present.

Customized pricing is accessible for high-volume shoppers

Options

- Uniquely suited to facilitating development and high-volume shoppers stand to save lots of considerably extra by their pricing construction.

- Add-on options embody customized branding, automated billing and funds, and built-in SaaS platform funds.

- Boasts industry-leading compliance.

Professionals and cons

| Professionals | Cons |

|---|---|

|

|

How do I select one of the best fee processor for my enterprise?

We did our best possible, however clearly, there’s no solution to think about the total breadth of potential enterprise wants when doing an inventory like this. Each enterprise is totally different, and has totally different wants, so that you’ll in the end have to use some degree of discretion when contemplating our picks within the record.

That being stated, we checked out our candidates and regarded them by the lenses beneath, to make sure that we targeted on the elements mostly prioritized throughout the infinite variety of use circumstances out there.

Pricing, prices and transparency

Charge constructions can grow to be frustratingly advanced in some B2B eventualities, and fee processors aren’t an exception. Transaction charges are the inspiration of the associated fee matrix right here, and interchange charges make up the bulk in lots of circumstances. Moreover, there are added processing charges, in addition to potential prices like month-to-month subscriptions, {hardware} funds for POS terminals and extra.

Relying on the answer in query, you could possibly obtain decrease general prices by bundling choices from the supplier, prioritizing decrease interchange charge transactions, rising processing quantity and so forth.

Past that, some manufacturers are higher than others at being upfront with their pricing, advanced or in any other case. Even a convoluted charge construction may be made tolerable if there are not any surprises on the invoice on the finish. Conversely, manufacturers that attempt to obscure and conceal prices till you get the ultimate bill may be infuriating, particularly when it appeared so easy initially.

Oh, and don’t overlook that contracts can nonetheless gum up the works right here, like they do elsewhere in enterprise. Some manufacturers provide month-to-month service, permitting you to cancel anytime. Others would require you to commit your self to a contract (which may be as much as three years lengthy or extra).

There’s no “correct” reply in all of this; it comes all the way down to how the scales steadiness out. What serves as a dealbreaker for one group could also be a tolerable worth of admission for one more, relying on the “pros” in that state of affairs. Simply don’t go into any of this blind, and count on opaqueness by default till confirmed in any other case.

Safety, stability and reliability

You’re coping with digital financials. Every transaction entails delicate data and the transference of forex. The very last thing you want is to make use of a channel you consider to be safe, solely to leak priceless data and hard-won income out into the palms of dangerous actors.

Knowledge breaches are slightly like automobile accidents — they appear distant and borderline imaginary till they occur to us personally. However the previous decade has confirmed that no group, regardless of how massive or tech-savvy, is resistant to assaults and vulnerabilities. So don’t be afraid to play hardball and examine closely when vetting the main contenders in your record.

Equally essential is how reliable the system is. These are all internet-dependent interactions, so if the system is down, you successfully can’t receives a commission. Errors, failed batching and different points may also create issues, resulting in unwelcome surprises to your prospects and chaotic monetary cleanup for you.

Maintain an eye fixed out for issues like uptime ensures (and opinions that show or disprove them) to assist keep away from coping with extra of those points than strictly required. And bear in mind, 99.9% uptime might sound like quite a bit, however that also leaves over a full eight-hour workday’s value of downtime over the course of a 12 months.

Compatibility and suppleness

There are such a lot of transferring components within the processing chain. POS methods, fee gateways, banking networks, digital storefronts, internet hosts — the record goes on and on. When you have the liberty to easily bounce straight in with a fee processor’s all-in-one options, nice.

If, nevertheless, you’ve gotten instruments you might be at present utilizing or want to make use of, double and triple examine the compatibility earlier than you decide to something.

Pace, delays and turnaround time

No one likes ready to receives a commission. No one likes ready to get help after they have a problem. And, nobody likes having to pause gross sales as a result of the system is down and you may’t get ahold of a reside helpline.

From deposit pace, to customer support high quality, there are fairly a number of methods a fee processor can speed up issues in your finish, or sluggish them to a crawl. You received’t at all times discover concrete figures on issues like this, and generally you’ll should look elsewhere to seek out them (like opinions and Third events). However you’ll choose the legwork to the disagreeable surprises on the opposite finish.

Use case concerns

Cost processors aren’t vulnerable to the identical diploma of use case sensitivity as different components of this chain (like POS methods, for instance). Nonetheless, you might have particular concerns or particular wants you prioritize which may be nominal issues to different companies, akin to integrations with a selected software program, or dealing with a selected fee kind like textual content hyperlinks.

On this record alone, we level to issues like high-risk retail, processor/banking combos and scalability. You’re not being unreasonable by looking for particular options or performance. You’re being thorough and strategic.

Methodology

For this record of fee processing suppliers (say that ten instances quick), we constructed an inventory of the most well-liked candidates with constructive reputations and person opinions. Then, we reviewed candidates primarily based on plenty of vital core elements, together with value, pricing transparency, contract phrases, safety and stability, compatibility and integrations, and the way chargebacks had been dealt with.

To assemble data, we consulted the processors themselves, examined hands-on demos and free trials, and solicited suggestions/opinions from present and previous customers. We paid explicit consideration to areas of performance that had been non-standard, in the event that they had been talked about within the model’s advertising and marketing as an out there function, and whether or not or not opinions indicated it labored as described.

There’s no getting across the want for a fee processor, however we hope our efforts right here have been helpful in serving to you sidestep any pointless prices concerning which distributors you analysis or select to make use of.

This text and methodology was reviewed by our retail skilled Meaghan Brophy.