Notice: Function wp_get_loading_optimization_attributes was called incorrectly. An image should not be lazy-loaded and marked as high priority at the same time. Please see Debugging in WordPress for more information. (This message was added in version 6.3.0.) in /home/admin/web/uplaza.net/public_html/wp-includes/functions.php on line 6085

Notice: Function get_loading_optimization_attributes was called incorrectly. An image should not be lazy-loaded and marked as high priority at the same time. Please see Debugging in WordPress for more information. in /home/admin/web/uplaza.net/public_html/wp-includes/functions.php on line 6085

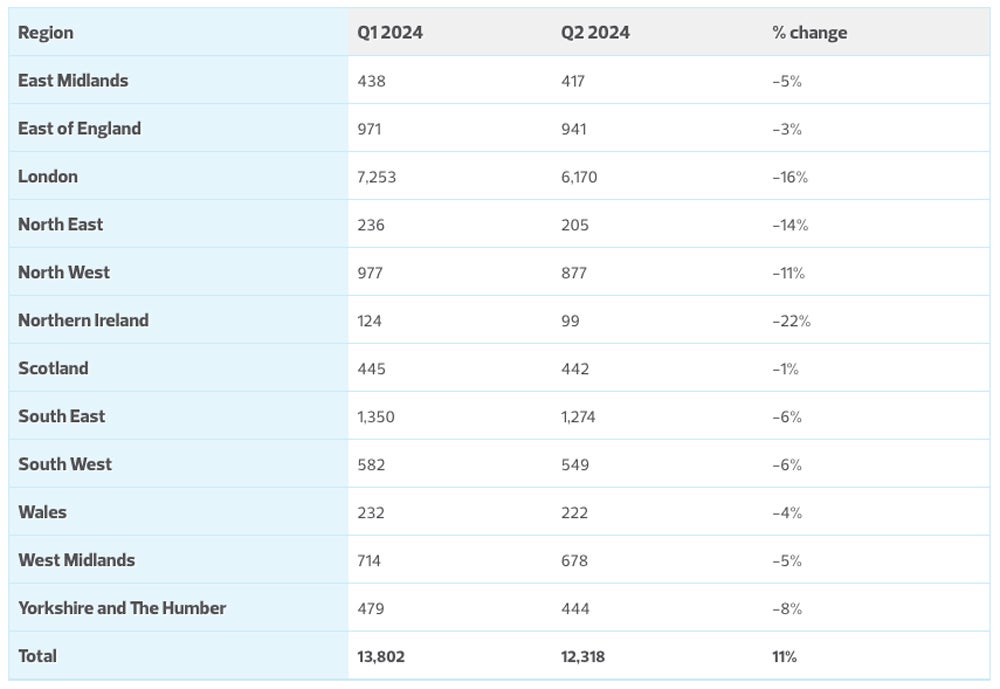

The variety of tech startups being based within the U.Okay. has suffered its first “marked decline” since 2022, based on accounting agency RSM UK. There have been solely 12,318 new tech incorporations within the second quarter of 2024 in contrast with 13,802 within the first quarter — an 11% decline.

The variety of tech incorporations is seen as a great indicator of business progress and, up till now, this determine has urged prosperity. Q1 2024 noticed the very best variety of tech incorporations in 5 years, whereas the whole variety of startups fashioned in 2023 jumped by 22% from 2022, representing the biggest share enhance on report.

Ben Bilsland, associate and head of expertise at RSM UK, stated in a press launch the newest figures counsel “the tide may be turning on tech growth.”

“Whilst on one hand the new government is grappling with a £22 billion budget shortfall, on the other, it can’t afford to take a strong tech sector, that contributes around £150 billion a year to the UK economy for granted,” he stated.

“With that in mind, and with high interest rates and sticky inflation continuing to present economic challenges, we would encourage government to do all it can to maintain growth in the sector.”

Final week, it was revealed that the brand new Labour authorities had scrapped £1.3 billion price of funding that had been earmarked for AI infrastructure by the Conservatives. The King’s Speech in July additionally made scant point out of the tech sector and didn’t formally announce any new laws surrounding it, together with the anticipated AI Invoice.

Bilsland stated, “We want a renewed deal with the larger image from authorities, supporting the sector to develop expertise which permits the UK to compete on the worldwide stage. Within the US, tech behemoths akin to Google and Amazon create large financial progress. This begs the query can the UK authorities afford to not spend money on the tech sector?

“The King’s Speech felt like a missed opportunity to address the tech skills gap with further training and tackle the AI landscape. Despite limited resources, we’d urge the new Labour government to consider helping the sector at the next Budget, with improved tax reliefs and access to deep computing to support AI advancement.”

London accounted for the very best variety of incorporations in Q2 of 6,170. Nonetheless, the determine was down 16% from Q1. In actual fact, all U.Okay. areas noticed decreases within the variety of tech incorporations from the earlier quarter, with the biggest being Northern Eire, which noticed a drop of twenty-two%.

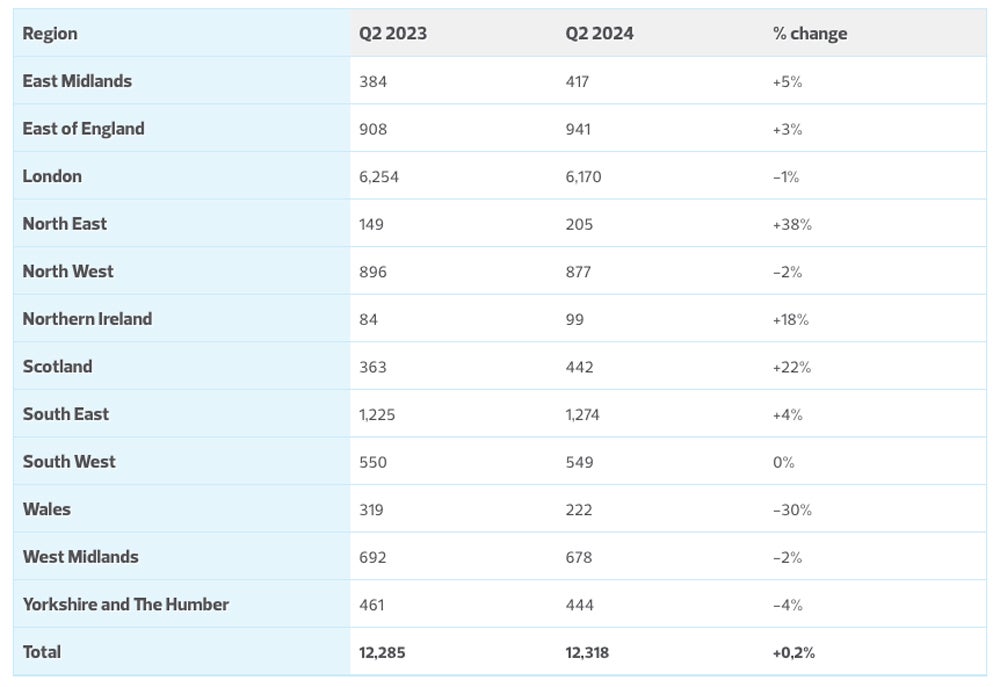

Regardless of the discount in new tech startups over the past six months, most areas did see extra tech incorporations in Q2 2024 than Q2 2023. That is notably true for the North East and Scotland, which noticed year-on-year will increase of 38% and 22%, respectively. The variety of tech incorporations in the entire of the U.Okay. for Q2 2024 was 0.2% increased than the identical determine for Q2 2023.

It’s not simply U.Okay. tech that’s struggling

On Monday, shares within the “Magnificent Seven” U.S. tech corporations — NVIDIA, Meta, Alphabet, Microsoft, Amazon, Tesla, and Apple — had all dropped dramatically, shedding a mixed $1.3 trillion over 5 days. The selloff is expounded to a number of elements, however a main one is that traders have gotten involved concerning the return on funding of AI.

Alphabet spent $13.2 billion within the second quarter on account of investments in AI infrastructure, 91% greater than Q2 2023, placing stress on revenue margins. Meta CEO Mark Zuckerberg additionally remarked on an earnings name that he expects will probably be “years” earlier than the corporate monetises its AI merchandise.

Goldman Sachs inventory analyst Jim Covello wrote in a latest report, “Despite its expensive price tag, the technology is nowhere near where it needs to be in order to be useful … Over-building things the world doesn’t have use for, or is not ready for, typically ends badly.”

Sequoia Capital associate David Cahn argued in a weblog publish that the AI business must generate $600 billion a yr to pay for its {hardware} spend.

Semiconductor corporations face their very own points, with shares in Intel, Samsung, TSMC, and SoftBank Group, the father or mother Arm Holdings, all diving on August 1.

Intel’s inventory fell 26%, its worst day in 50 years, after suspending its dividend and shedding 15% of its workforce. These strikes are the agency’s makes an attempt at clawing again to a dominant business place after being overtaken by quite a few opponents within the S&P 500, however they concurrently dragged down world semiconductor shares. Rumours that NVIDIA will delay the discharge of its new chip attributable to design flaws additionally contributed to its shares falling by 6.3%.

Traders are additionally getting ready for imminent U.S. rate of interest cuts, which means they’re prioritising small-cap shares, which have a tendency to learn extra from decrease charges.