The vitality transition just isn’t on observe to mitigate the consequences of local weather change. Take the case of Shell, whose shareholders not too long ago voted to decelerate the UK-based oil big’s local weather targets. Shell had deliberate to chop its “net carbon intensity” by 20% by 2030 and 45% by 2035, however now seeks a 15%-to-20% discount by 2030 and not has a 2035 goal.

Shell CEO Wael Sawan advised shareholders this was motivated by “uncertainty around the pace of change in the transition.” BP can also be scaling again its local weather commitments, regardless of beforehand being one of many trade’s early movers in setting inexperienced priorities.

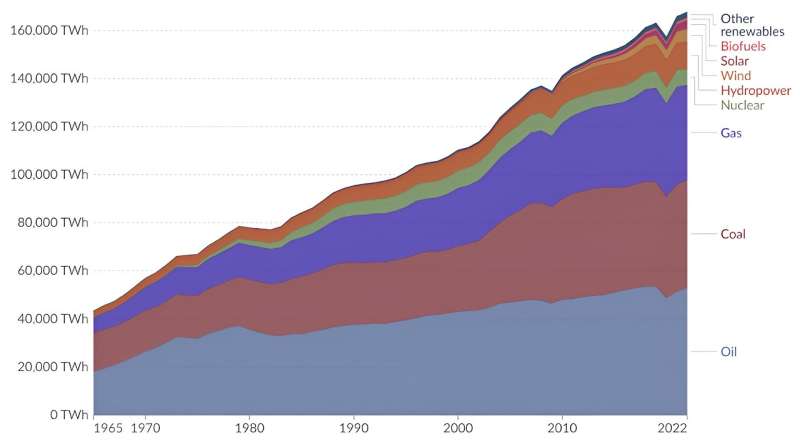

One vital clarification for these shifts is that world demand for fossil fuels retains rising, reflecting improvement wants and inhabitants development within the international south and likewise governments’ failure to maintain net-zero targets on observe. Oil demand is about to hit practically 103 million barrels per day in 2024, in contrast with 100 million in 2019 and 85 million a decade earlier. In 2025, it’s anticipated to cross 104 million barrels.

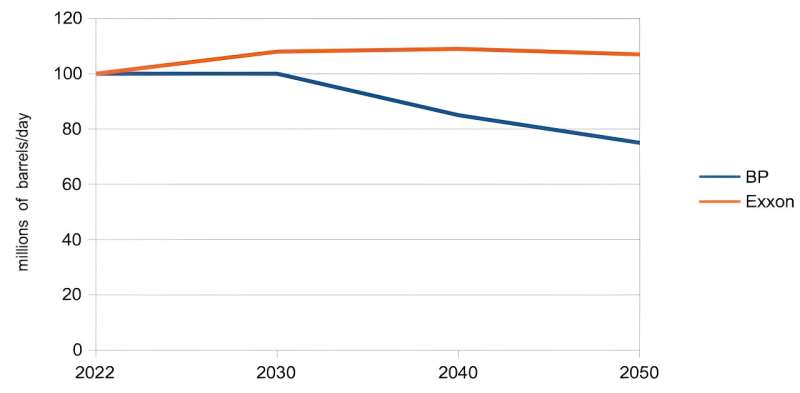

The US majors—Chevron, ConocoPhillips, ExxonMobil—have executed a greater job of foreseeing this than their European counterparts, Shell), BP and TotalEnergies. The US majors’ extra bullish forecasts have led them to take a distinct strategy to the vitality transition, prioritizing decarbonizing their merchandise relatively than diversifying into renewables and related cleantech, per the Europeans.

Environmental activists have handled the US majors as pariahs for refusing to reduce their core companies. Activists hardly embrace the European majors both, but it surely has appeared self-evident that their diversification efforts would contribute extra to the vitality transition than the US majors. This seems to be debatable, nonetheless.

Diversify or die?

For those who consider that demand for fossil fuels will probably be decreased by authorities local weather insurance policies, it follows that the oil majors are in a combat for survival. They threat being put out of enterprise by billions of dollars-worth of “stranded assets” on their stability sheets, similar to oil reserves and manufacturing infrastructure whose values might collapse.

Many policymakers and local weather advocates in Europe and North America have been arguing this for a while, utilizing metrics that rank these multinationals on their “readiness” for the transition. But regardless of spectacular will increase in photo voltaic and wind capability, 55% of worldwide vitality stays equipped by oil and gasoline (plus 27% from coal).

From a business perspective, the American majors’ extra decided deal with their core oil and gasoline enterprise has been rewarded. ExxonMobil’s earnings have been smashing estimates, as an example. As CEO Darren Woods put it in early 2023: “We leaned in when others leaned out, bucking conventional wisdom.”

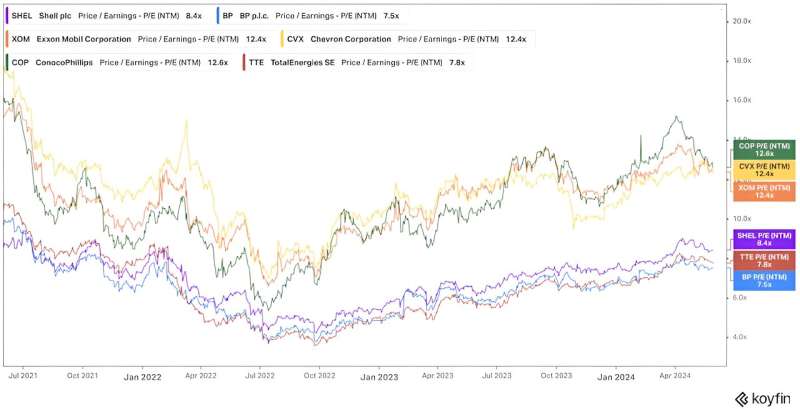

A considerable hole in US-European share value valuations exists, as proven within the chart beneath (click on to make it larger). Within the UK, decrease valuations are additionally on account of a common decline in London inventory market values—the CEOs of Shell and TotalEnergies have each overtly thought-about switching listings to the US. Shell and BP’s choices to average their local weather targets are to the same finish.

The strategic divide

Since 2021, BP has plowed 8%-to-12% of annual capital expenditure (capex) into renewables, primarily offshore wind and charging infrastructure for electrical autos (EV). Shell focuses totally on photo voltaic and wind, spending 12%-15% of capex over the identical interval. This quantities to annual spending of over US$1 billion (£784 million) for BP and round US$3 billion (£2.4 billion) for Shell.

The US majors are spending comparably on decarbonization. ExxonMobil has earmarked US$20 billion or 17% of capex from 2022 to 2027, together with carbon seize, lithium mining, hydrogen and biofuels. Chevron’s deliberate spend is US$10 billion or 12.5% of capex by 2028 on related actions.

To be clear, these efforts do not meet expectations. The Worldwide Vitality Company (IEA) thinks that to hit net-zero emissions, oil majors should spend 50% of capex by 2030 on clear vitality (be it renewables or decarbonization). A mere 2.5% was spent in 2022, partly as a result of the nationwide oil firms that produce a lot of the world’s oil and gasoline spend even lower than the US-European majors.

Decarbonization might be one of the best spending alternative, provided that oil demand is rising. Additionally, constructing wind and photo voltaic farms is arguably a poorer match for the majors’ core skillset—distinction, for instance, ExxonMobil’s transfer to change into a number one lithium producer for EV batteries, which inserts its drilling specialism.

At any charge, the majors will solely increase transition-spending in the event that they’re satisfied it is of their pursuits. A lot is dependent upon incentive buildings, which have not at all times been useful.

The US majors (and environmental activists) have complained prior to now that US incentives to decarbonize have been insufficient and authorities coverage unpredictable. The 2022 US Inflation Discount Act (IRA) has improved the scenario by incentivizing investments by means of tax credit.

EU efforts to provide a comparable package deal are lagging. It does not assist that the struggle in Ukraine and post-pandemic financial woes have intensified European considerations about vitality prices and safety.

As well as, Philippe Ducom, CEO of ExxonMobil Europe, not too long ago claimed that the array of various EU rules in numerous member states inhibits inexperienced funding. He mentioned this at present makes it troublesome to spend any of the agency’s US$20 billion decarbonization fund in Europe.

Clearly, the EU must each agree on IRA-style incentives and harmonize rules urgently. Equally, the US wants to make sure that the IRA incentives go far sufficient if the majors are to come back wherever near the IEA 50% capex goal.

However the majors’ willpower to maintain supplying extra oil, it is time for policymakers to view them as an important piece of the energy-transition puzzle. If these corporations may be incentivised to take a position extra of their appreciable money circulation—exactly what renewables firms lack—into decarbonization, the impression will probably be vital.

The US majors’ superior valuations and efficiency imply they’ve probably the most funding functionality. With the US political and financial surroundings additionally extra conducive to letting them do what they do greatest, mockingly they may effectively find yourself contributing extra to the inexperienced transition than their European counterparts.

The Dialog

This text is republished from The Dialog beneath a Inventive Commons license. Learn the unique article.![]()

Quotation:

Why the US oil majors could find yourself doing extra for the inexperienced transition than their extra progressive European rivals (2024, June 3)

retrieved 3 June 2024

from https://techxplore.com/information/2024-06-oil-majors-green-transition-european.html

This doc is topic to copyright. Other than any honest dealing for the aim of personal research or analysis, no

half could also be reproduced with out the written permission. The content material is supplied for data functions solely.